US shares have outperformed their UK counterparts over the last few years. But the threat of an economic slowdown has investors and analysts concerned about the S&P 500.

High valuations combined with signs of a possible recession make investing in US stocks a challenge at the moment. So could the FTSE 100 have some better opportunities?

Recession worries

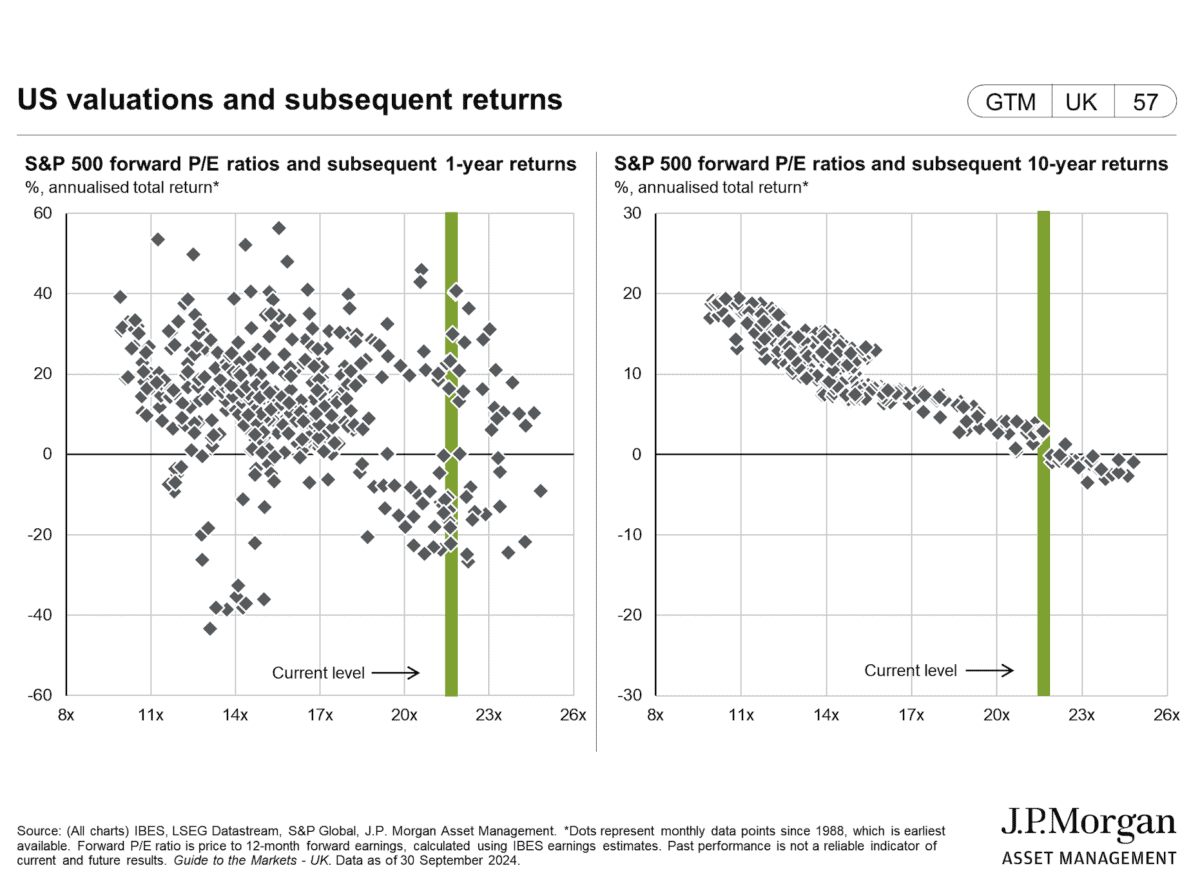

US stocks are trading at unusually high valuations at the moment. And as JP Morgan analysts have been pointing out, future returns haven’t been strong when this has happened before.

Source: J.P. Morgan Guide to the Markets Q4 2024

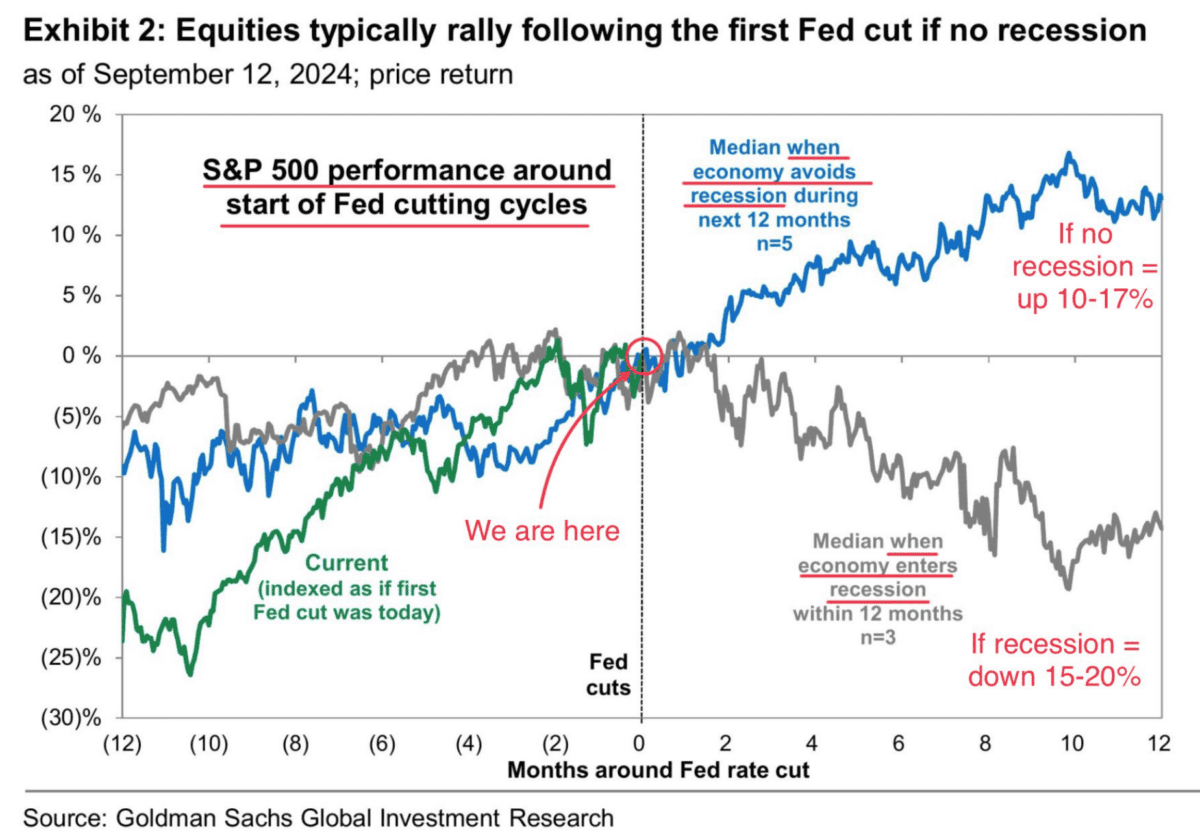

Furthermore, the Federal Reserve in the US has started cutting interest rates. And according to analysts at Goldman Sachs, this means the S&P 500 could go one of two ways.

If the US avoids a recession, the likely outcome is stocks to climb 10-17%. But if things do turn downwards, the market could fall somewhere in the region of 15-20%.

Source: Goldman Sachs Global Investment Research

Stock market historians have been pointing out signs of a potential recession – mostly to do with rising unemployment. So it’s easy to look for alternatives to US stocks at the moment.

Are UK shares any better?

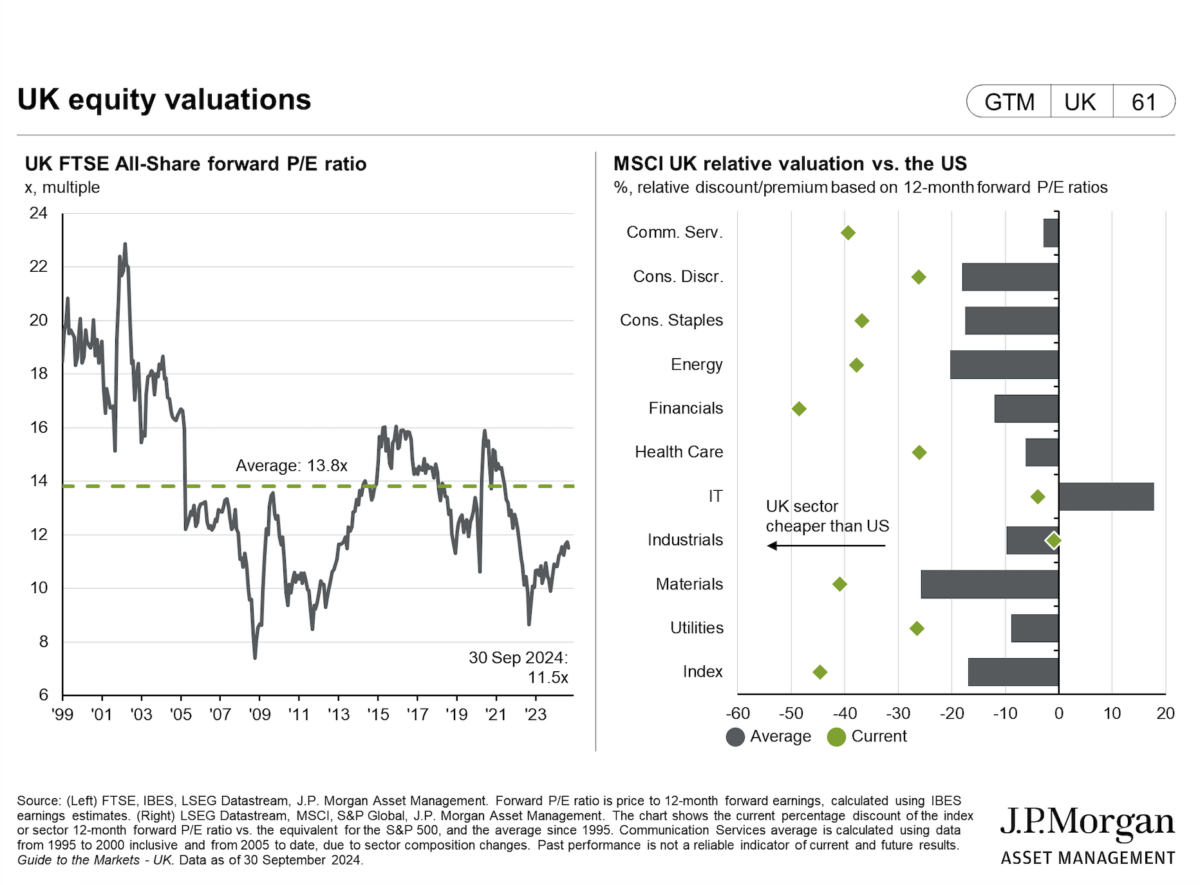

At a forward price-to-earnings (P/E) ratio of 11.5 UK shares are significantly cheaper than their S&P 500 counterparts, on average. So in terms of valuation, the risk looks lower.

Source: J.P. Morgan Guide to the Markets Q4 2024

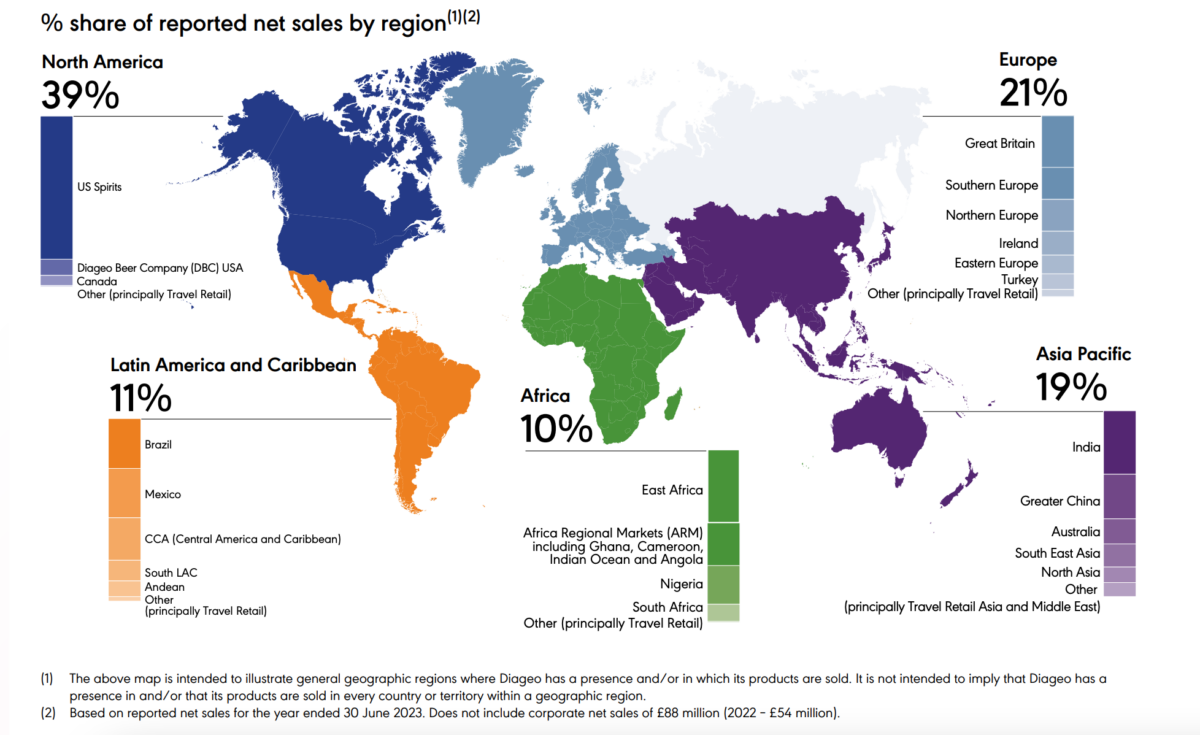

It’s worth noting though, that being listed in London doesn’t make a stock immune to the effects of a downturn in the US. Diageo‘s (LSE:DGE) a good example.

The firm might be a member of the FTSE 100, but last year 39% of its sales came from North America. That makes the US the company’s largest market by some distance.

Source: Diageo Annual Report 2023

As a result, a downturn in the world’s largest economy could weigh on Diageo’s earnings. It’s a UK stock, but this is a genuine risk with the business.

Where to find stocks to buy?

Despite the macroeconomic worries, I think there are opportunities on both sides of the Atlantic right now. But I’m looking at individual opportunities rather than an entire index.

While the S&P 500 as a whole might be up, not every stock’s expensive. Lithium miner Albemarle, for example, is trading at its lowest price-to-book (P/B) multiple in a decade.

Albemarle P/B ratio 2014-24

Created at TradingView

There are risks to consider – like the possibility of the business having to give away equity in its Chilean operations in order to renew its leases. But I think it’s well worth a look right now.

Something similar is true of Diageo. On a (P/E) basis, the stock’s unusually cheap, which is why I’m looking to add to my stake in the business despite the US risks.

Diageo P/E ratio 2014-24

Created at TradingView

Investing in a recession

I find the case for thinking the S&P 500 as a group might struggle over the next few years really interesting. Ultimately though, it doesn’t change how I think about my investments.

I’m awake to the possibility of a US recession creating buying opportunities by causing stocks to crash. But even if it doesn’t, I think there are plenty of options already.