At a price-to-earnings (P/E) ratio of 44, the Amazon (NASDAQ:AMZN) share price doesn’t obviously look like good value. But there’s more to this one than meets the eye.

There are several reasons why I don’t think the P/E ratio is a good way of evaluating this particular stock. And when I use what I see as a better multiple, it looks historically cheap.

P/E ratio

I don’t think Amazon’s earnings are a good reflection of the economic value of the underlying business. This is partly due to the way its costs are reflected in its income statement.

An example is the company’s investment in Rivian Automotive. In 2022, Amazon reported a net loss, mostly due to the effect of writing down the value of its stake in the electric van manufacturer.

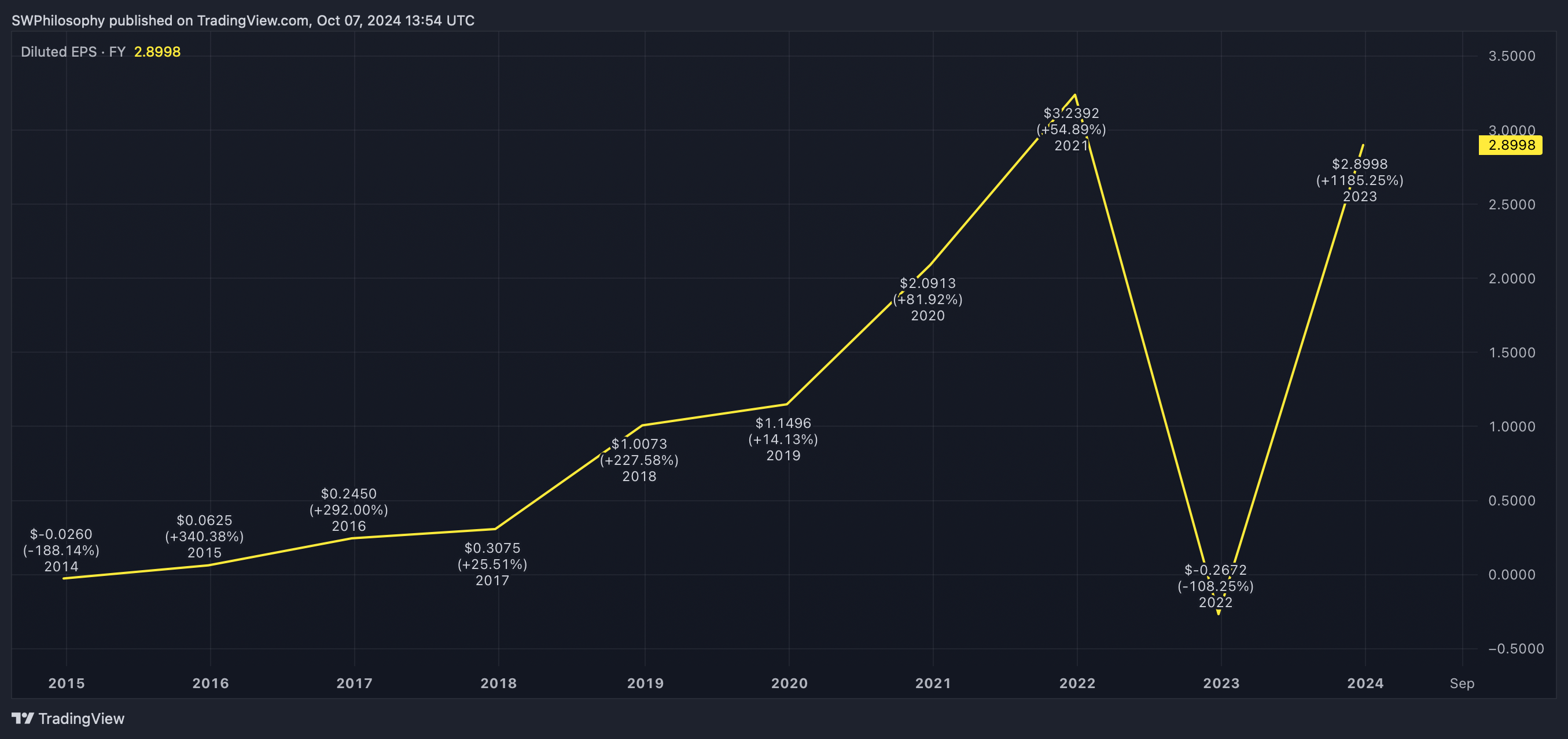

Amazon EPS 2014-24

Created at TradingView

This implies the business lost money. And while it did lose more on its Rivian investment than it made elsewhere, this is a one-off cost that isn’t likely to be repeated in the future.

As a result, Amazon’s P/E multiple has been extremely volatile. But I don’t think the value of the underlying business has fluctuated as much as this, making the ratio an unreliable guide.

Amazon P/E ratio 2014-24

Created at TradingView

More generally, Amazon spends a lot on customer relationships. But even though this shows up in the income statement as an expense, it’s more like an investment than an ongoing cost.

As a result, I think the firm’s earning power is much higher than its consolidated accounts indicate. And that’s why I’m sceptical of the P/E ratio as a way of valuing the stock.

P/B ratio

I think comparing Amazon’s price to its equity – the difference between its assets and liabilities – gives a better picture of where the stock is in value terms. This is the price-to-book (P/B) ratio.

Unlike its earnings, the company’s book value has been relatively stable over time. It has generally increased over time as the underlying business has grown, even in 2022.

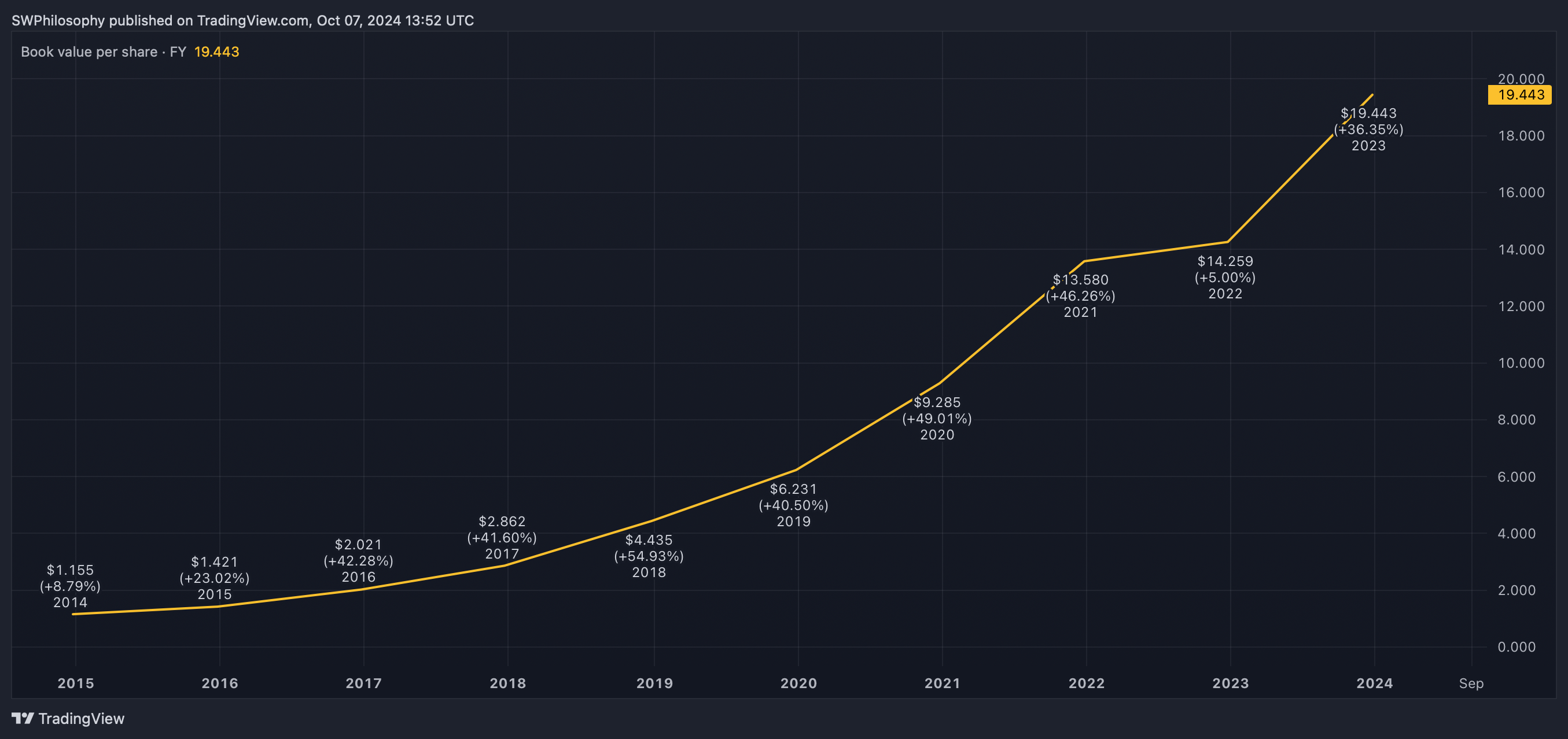

Amazon Book value per share 2014-24

Created at TradingView

Right now, Amazon trades at a P/B ratio of just over 8. By itself, that doesn’t mean much, but a look at where it has traded historically shows why I think there’s an opportunity here.

Over the last 10 years, the stock has generally traded at a much higher multiple. It’s only over the last couple of years that the P/B multiple has fallen below 10.

Amazon P/B ratio 2014-24

Created at TradingView

That implies investors have become less optimistic about Amazon’s ability to generate a return on its equity. But I don’t think the business has ever been in a better position.

The company’s size means it has never been more difficult to disrupt. And with AWS growing strongly and an emerging advertising division, I think Amazon looks like a real opportunity.

An investment opportunity?

With Amazon, I’m not too worried about competitive threats from other businesses. My biggest concern is the possibility of it being disrupted from elsewhere.

Last week, the company had some success in fending off an antitrust lawsuit from the US Federal Trade Commission (FTC). But I’d be surprised if investors have heard the last of this one.

That’s an ongoing risk for Amazon shareholders. But at historically low multiples, investors might wonder whether they’ve ever been better-placed to consider that risk in terms of valuation.