Legendary investor Warren Buffett has an interest in Diageo (LSE:DGE) shares via a subsidiary of Berkshire Hathaway, the investment vehicle of which he is chairman, chief executive and the largest shareholder.

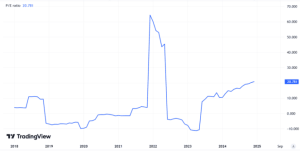

But I think it’s fair to say that the decision to buy stock in the drinks manufacturer hasn’t been one of his best moves. After buying into the company during the first quarter of 2023, the share price has been in steady decline.

Since the start of 2023, it’s fallen by a third. In November 2023, investors reacted badly to a profits warning following a slump in sales in Latin America and the Caribbean.

Compared to the year ended 30 June 2023 (FY23), revenue in FY24 fell by 1.4%. However, earnings per share was 11.8% lower. Unsurprisingly, this appears to have led to a loss of confidence in the company’s prospects.

Don’t panic!

But I suspect Buffett won’t be too bothered by these events. The American billionaire’s philosophy is all about long-term investing. He once described his favourite holding period as being “forever“. And advises to “only buy something that you’d be perfectly happy to hold if the market shut down for 10 years”.

Buffett’s approach is to identify well-managed companies that are undervalued. This sounds perfectly sensible to me. So should I also buy Diageo shares?

Reasons for me to buy

The first thing to note is that sales of its most famous brand, Guinness, have taken off in recent weeks. Influencers Lewis Capaldi and Jason Momoa, and a series of high-profile international rugby fixtures that were sponsored by the stout, have helped boost demand. Unfortunately, it means supplies to pubs in Great Britain have been restricted.

But the company has many other famous brands in its portfolio. In fact, it prides itself on offering something for everyone. For example, its six whiskeys range in value from $15 a bottle (Black and White) to $250+ (Johnnie Walker Blue Label).

The company has identified a trend where consumers are “drinking better, not more”. And with 62% of its FY24 sales coming from so-called premium brands, it should be well placed to capitalise.

And the fall in its share price has helped lower the historical price-to-earnings (P/E) ratio of the stock to 17.9. It was well over 20 when Berkshire Hathaway took its stake.

Risks

But the company’s carrying a lot of debt. At 30 June, its balance sheet disclosed borrowings of $21.5bn. This is over five times its FY24 cash inflow from its operating activities.

And its dividend isn’t high enough to compensate me for the additional risk that would come from holding shares in a highly-geared company. Based on its FY24 payout, the stock’s presently yielding 3.3%. This is below the FTSE 100 average of 3.8%.

I’m also concerned that 43 days before the November 2023 profits warning, the company’s directors said the group was on course to meet its current forecast. This highlights the potential volatility of the drinks market. Less charitably, it could also suggest that Diageo’s management team has limited forward visibility about the performance of the business.

At the moment, I can’t find enough reasons to make me want to buy the stock. Personally, I think there are better opportunities elsewhere.

This post was originally published on Motley Fool