On 12 March, the Persimmon (LSE:PSN) share price fell sharply after the company released its results for the year ended 31 December 2023. It’s now down 5% from its pre-announcement level.

Results

In 2023, completions were 9,922 — slightly higher than the company’s previous guidance of 9,750. But revenue was £2.54bn — lower than the consensus forecast of £2.6bn.

Of more concern was a significant decline in the operating margin. Despite seeing a 2.9% increase in its average selling price (ASP) to £255,752, it fell from 27.2% in 2022, to 14%, in 2023. Rampant build cost inflation and additional sales incentives were to blame.

Not surprisingly, diluted earnings per share were 67% lower, at 82.4p (2022: 247.3p).

However, despite the fall in profits, the directors recommended a final dividend of 40p for the year. If approved, the total payout for 2023 will be 60p, implying a current yield of 4.6%.

This is a very different picture to 2019 when the company was able to return 235p to shareholders after reporting an operating profit of £1.037bn (2023: £355m).

| Measure | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Completions | 15,855 | 13,575 | 14,551 | 14,868 | 9,922 |

| Housing revenue (£m) | 3,420 | 3,130 | 3,450 | 3,696 | 2,538 |

| Underlying operating profit (£m) | 1,037 | 863 | 967 | 1,007 | 355 |

| Operating margin (%) | 30.3 | 27.6 | 28.0 | 27.2 | 14.0 |

| Earnings per share (pence) | 269.1 | 220.7 | 248.7 | 247.3 | 82.4 |

The key question

Given the economic backdrop, I expected the results to be disappointing. But as a shareholder, I want to know whether the collapse in the margin is a temporary blip, or likely to be more permanent?

The answer to this question has implications for future earnings and, therefore, the company’s dividend, which is my primary reason for owning the stock.

The company says it expects its 2024 operating margin to be “in line” with 2023.

It also reported that its ASP on private homes was £280k during the first few weeks of 2024. In 2023, the ASP of social housing, which accounted for 22.6% of completions, was 46.5% lower.

If these figures are maintained throughout 2024, and the company builds at the top end of its forecast of 10,500 houses, Persimmon’s operating profit’s likely to be £369m — only marginally higher than in 2023.

Of course, there’s no guarantee the housing market will recover. But history suggests it will.

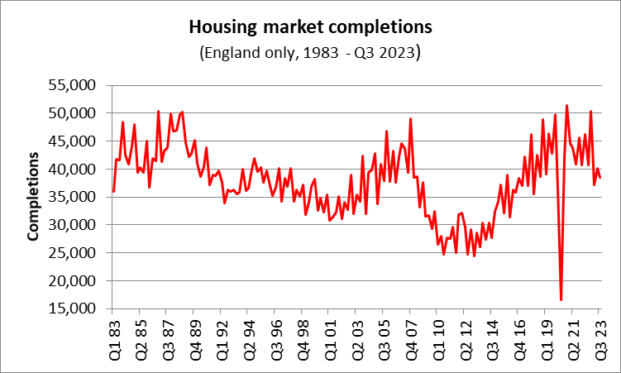

The chart below, using data from the Office of National Statistics, shows quarterly completions since 1983 and illustrates the cyclical nature of the market.

I believe the company will sell more houses when mortgages become cheaper. And most economists appear to be in agreement that UK interest rates have now peaked.

And the domestic economy’s expected to start growing again soon. This should enable Persimmon to raise its prices and help restore its margin. Its properties are 20% cheaper than the UK average, suggesting there’s significant scope to do this.

Final thoughts

Despite the risks of an uncertain housing market and inflation causing a further deterioration in the margin, I don’t plan to sell my shares. That’s because sales reservation rates are rising, cancellations are unchanged, and the company has 82,235 plots on which to build.

I’m also hoping for an increase in the dividend. In good times, the company returns nearly all its profits to shareholders. The current payout is equal to 73% of earnings. Later this year, if it becomes clearer that the housing market is recovering, I believe there’ll be headroom to increase this further.

Maybe that’s why Persimmon’s chief executive spent £100,216 on ‘results day’ buying more of the company’s shares.