As stocks dive, is this a rare chance for ISA investors to build generational wealth?

The last couple of weeks have been a whirlwind. And despite preparing for a downturn, I’m among the millions of investors who have seen their ISAs hit. There’s almost nowhere to hide in the current market.

Investors looking at general market trends may be tempted to suggest that global stocks will recover in the coming years. However, I’d add a word of caution. If Donald Trump’s tariffs remain in place as they are (as we understand them to be), stocks still look overvalued. There’s also a lot of uncertainty.

However, I expect to most tariffs rolled back. Simply put, the cost of leaving tariffs in place is staggering. Economists estimated that the 2 April tariffs alone will raise consumer prices by 2.3%, equating to an average household loss of $3,800 annually. Lower-income households face losses of $1,700, exacerbating inequality.

The US economy is projected to shrink by 0.6% in the long run due to these tariffs, representing a $160bn annual reduction in GDP. These figures underscore the likelihood that Trump will roll back tariffs to mitigate long-term damage.

Investing during dips

History suggests that market dips can provide generational opportunities for wealth creation. For example, hypothetical investments during major market sell-offs since 1980 have consistently outperformed over the long term.

The broader market trends also offer reassurance. Despite intra-year declines averaging 16% since 2001, full-year losses occurred in only five of the past 24 years. Over time, markets have grown substantially, proving resilient through volatility. This historical resilience suggests that patient investors who weather downturns — and strategically invest during dips — may benefit from significant long-term gains.

Of course, many novice investors will be advised to maximise ‘time in the market’ rather than trying to ‘time the market’. While that’s certainly true, I prefer to try to find the best entry points for my favourite stocks.

One of my favourite stocks

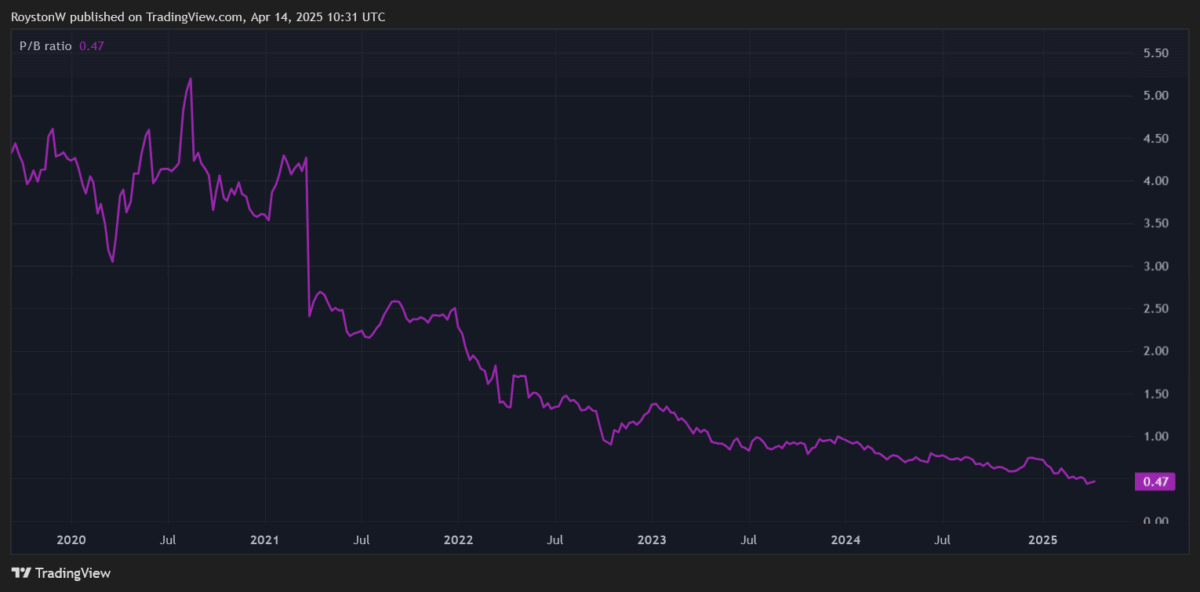

One stock I’ve been strategically buying is Jet2 (LSE:JET2). In fact, it’s the only UK stock I’ve topped up on since Trump’s tariffs were introduced. The AIM-listed airline is vastly undervalued in my opinion, trading with a market cap of £2.7bn. That’s only marginally ahead of its net cash position of £2.3bn. In other words, the market is pricing the UK’s no.1 tour operator at just one times net income when adjusted for net cash.

Of course, it’s not all rosy. The firm’s margins are thinner than the likes of IAG, and its fleet a little older. This does mean it’s more exposed to downward pressure on demand and has less capacity to absorb costs. In fact, the October Budget could add £25m in costs.

However, for me, it all comes down to the valuation. At such a huge EV-to-EBITDA discount to its peers, it’s clearly overlooked. What’s more, the company’s fleet replacement plan appears to be financially prudent and there appear to be supportive trends in fuel prices, which typically account for 25%-30% of operational costs.

Could buying today create generational wealth? Well, it may put an investor on the right track, and potentially beat the market. This could be a great start for someone looking to create generational wealth.