Excerpt: With a spectacular record of dividend growth and shares trading at an unusually low multiple, income investors should take note of this FTSE 100 stock.

Shares in businesses that have increased their dividend per share for 25 consecutive years can be great sources of passive income. Especially when they’re cheap.

Croda International (LSE:CRDA) is a FTSE 100 company that makes specialty chemicals. It has a strong dividend record and from a valuation perspective, it just became historically cheap.

Dividends

Stocks don’t get to be dividend aristocrats by accident. It doesn’t guarantee anything going forward, but it’s a sign of a strong business.

With Croda, there are two key advantages. The first is the number of patents that protect its products – over 1,600 across more than 275 families.

The second is the fact that its drug delivery systems are often specified as part of regulatory approval. That makes it impossible for pharmaceutical firms to switch to a different product.

That’s why Croda has been able to increase its dividend each year since 1991. Despite ups and downs in the company’s earnings, the firm has distributed more and more to investors.

The P/E ratio

At first sight, Croda doesn’t look like much of a bargain at the moment. A price-to-earnings (P/E) multiple of 30 is high relative to both the company’s history and the FTSE 100 average.

Croda International P/E ratio 2005-24

Created at TradingView

The trouble is, the P/E ratio can be highly misleading with this type of business. That’s because earnings can be quite volatile, causing the multiple to shift dramatically.

In 2022, for example, the stock traded at a P/E multiple of around 13. But that’s because profits were being boosted by unusually high demand for vaccines during the Covid-19 pandemic.

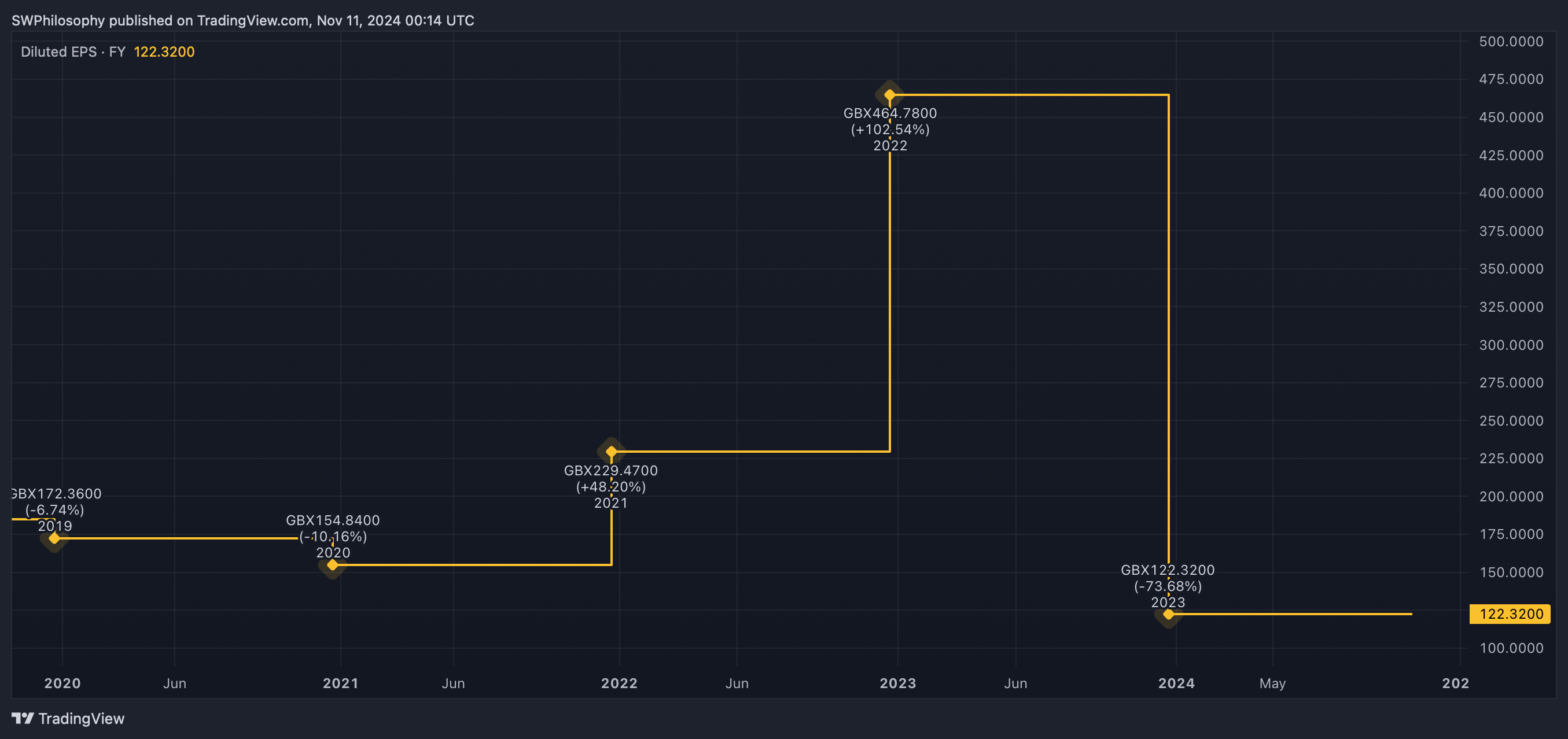

Croda International earnings per share 2019-24

Created at TradingView

As that has subsided, earnings have fallen away sharply. As a result, the P/E multiple has more than doubled even though the share price is down around 50%.

Valuation

With Croda, I think the price-to-book (P/B) ratio is a much more useful valuation metric. The value of the company’s assets minus its liabilities is much less volatile than its net income.

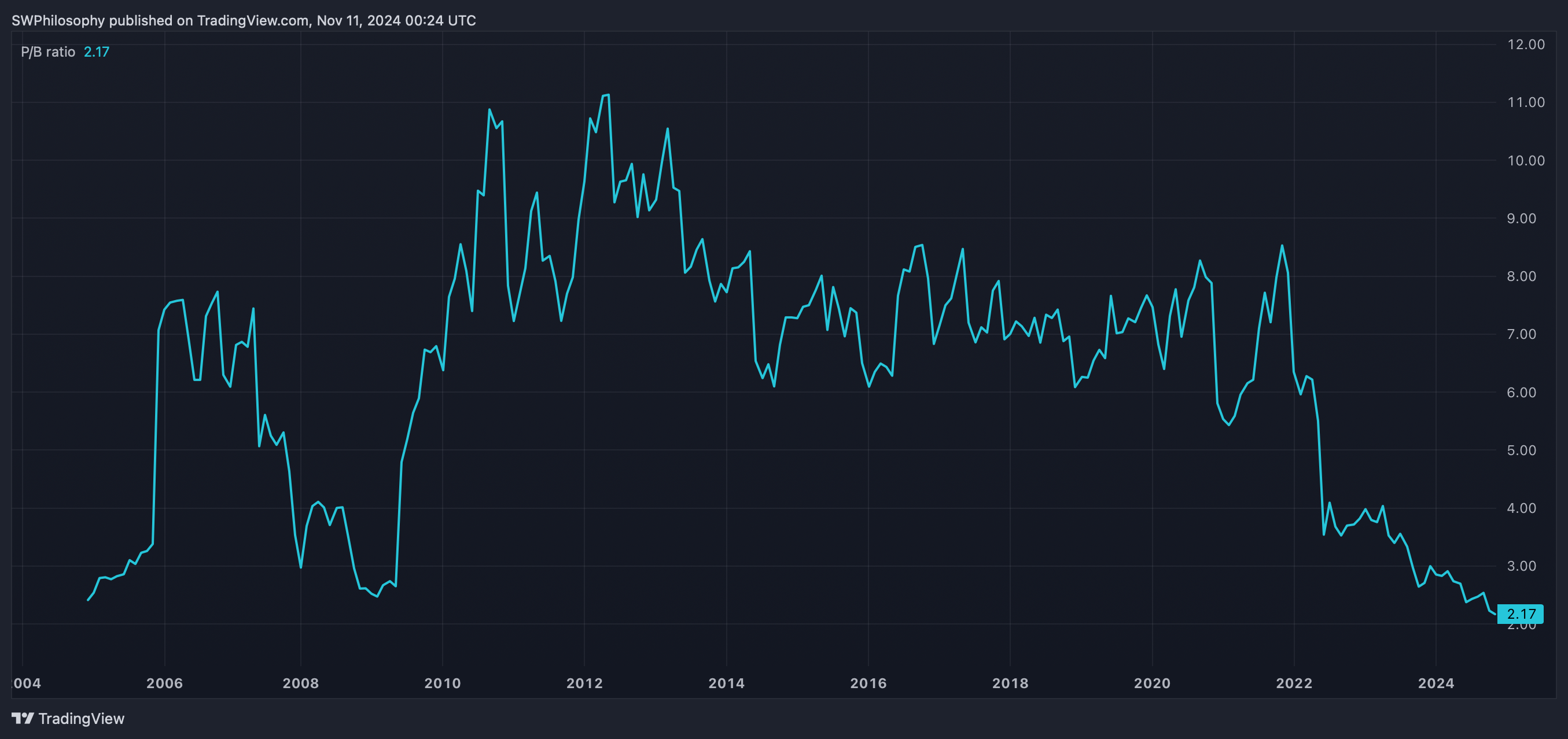

Croda International P/B ratio 2005-24

Created at TradingView

From this perspective, the stock is historically cheap. At a P/B multiple of close to 2, Croda shares are better value – from this perspective – than they have been at any point since 2005.

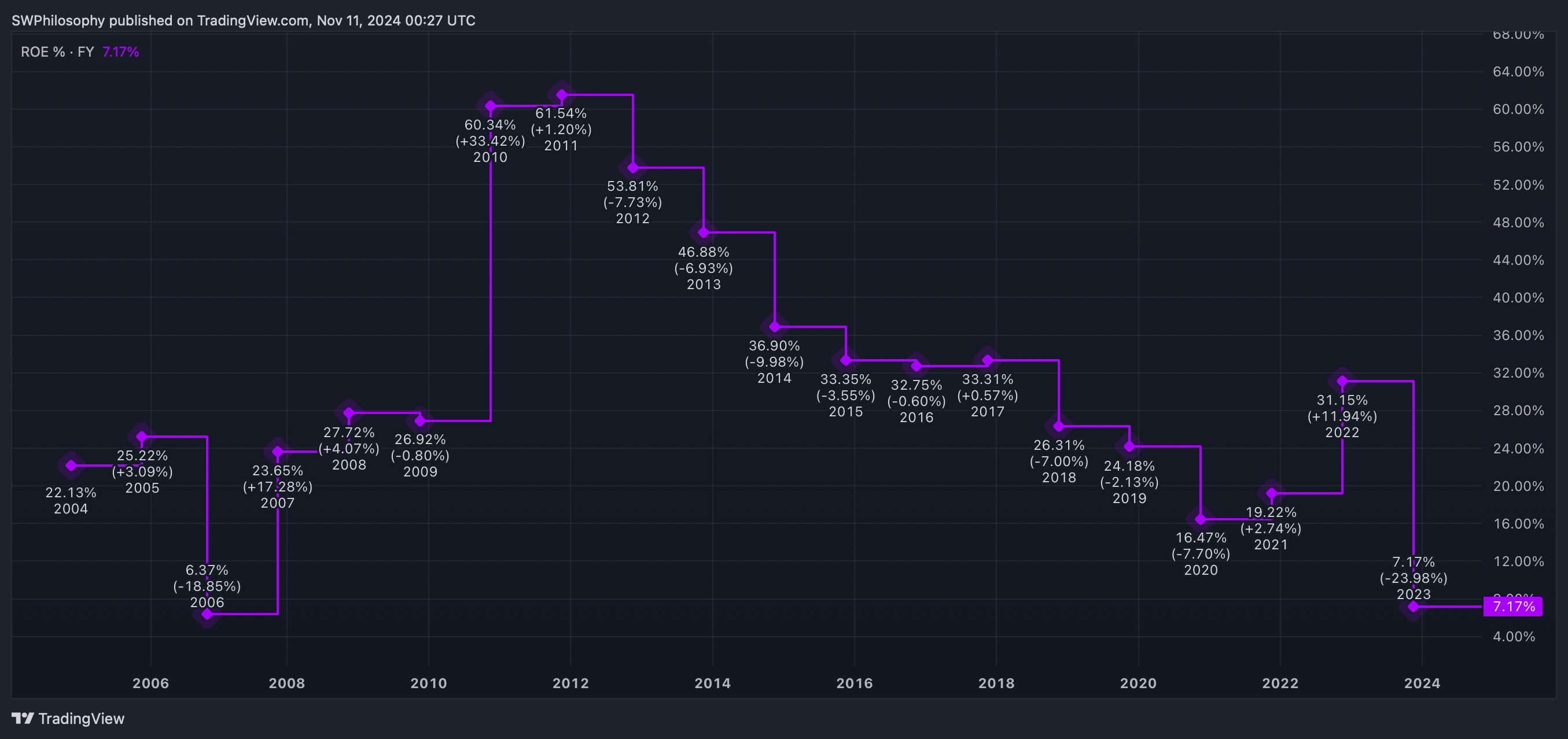

I think this is a good indication of how cheap the stock is, but there is a catch. Outside the pandemic, the return the company earns on its equity has been falling consistently since 2010.

Croda International return on equity 2005-24

Created at TradingView

Part of this is due to earnings volatility, but a 15-year trend can’t just be put down to cyclical fluctuations. The possibility of this continuing is the biggest risk investors currently face.

A buying opportunity?

The falling return on equity goes some way towards explaining why the stock has been trading at an increasingly low P/B multiple. Croda doesn’t earn the return on its assets it once did.

Equally, though, this hasn’t stopped the company increasing its dividend with spectacular consistency. And for that reason alone I think passive income investors should pay attention.

All of this leaves me undecided on what to do. But I am clear that the current valuation is the best opportunity I’ve seen when it comes to buying Croda shares.