Wow – I dodged a bullet with this FTSE 100 growth stock. I banked a 70% profit just before the 2008 financial crisis, then forgot all about it. I can’t remember why I sold, but I’m glad I did!

I’m talking about life insurer Prudential (LSE: PRU). Today, its shares trade at 720.8p. That’s the lowest level since November 2012, almost a dozen years ago.

Three years ago, the Prudential share price was flying high at 1,545p. It’s been falling ever since and can’t seem to stop. It’s down 30.91% over 12 months.

This was supposed to be one of the most exciting insurance stocks on the FTSE 100, taking advantage of a generational opportunity by shifting its operations to booming Asia, with headquarters in Hong Kong and operations all over China.

FTSE 100 straggler

This gave UK investors the confidence of a domestic listing and solid rules on corporate governance, combined with exposure to the world’s second-biggest economy. What could go wrong?

Quite a lot, actually: politics, property, shadow banking, youth unemployment, trade wars, authoritarianism, Taiwan… Chinese Premier Xi Jinping now faces a host of problems, many of his own making.

Yet the Prudential business seems fine. Full-year 2023 results showed business profits up 45% to $3.125bn. Adjusted operating profit rose 8% to $2.893bn. The board hiked the full-year dividend 9% to 20.47 US cents per share.

Last month, CEO Anil Wadhwani said Pru would return $2bn to investors via a share buyback between now and mid-2026. He also said the 2024 annual dividend to grow in the range of 7% to 9%.

That’s important, because the headline yield has been around the 2% mark for as long as I can remember. Today, it’s yielding 2.29%, well below FTSE 100 average of 3.7%. And for once, we can’t blame that on a rising share price!

Brilliant bargain?

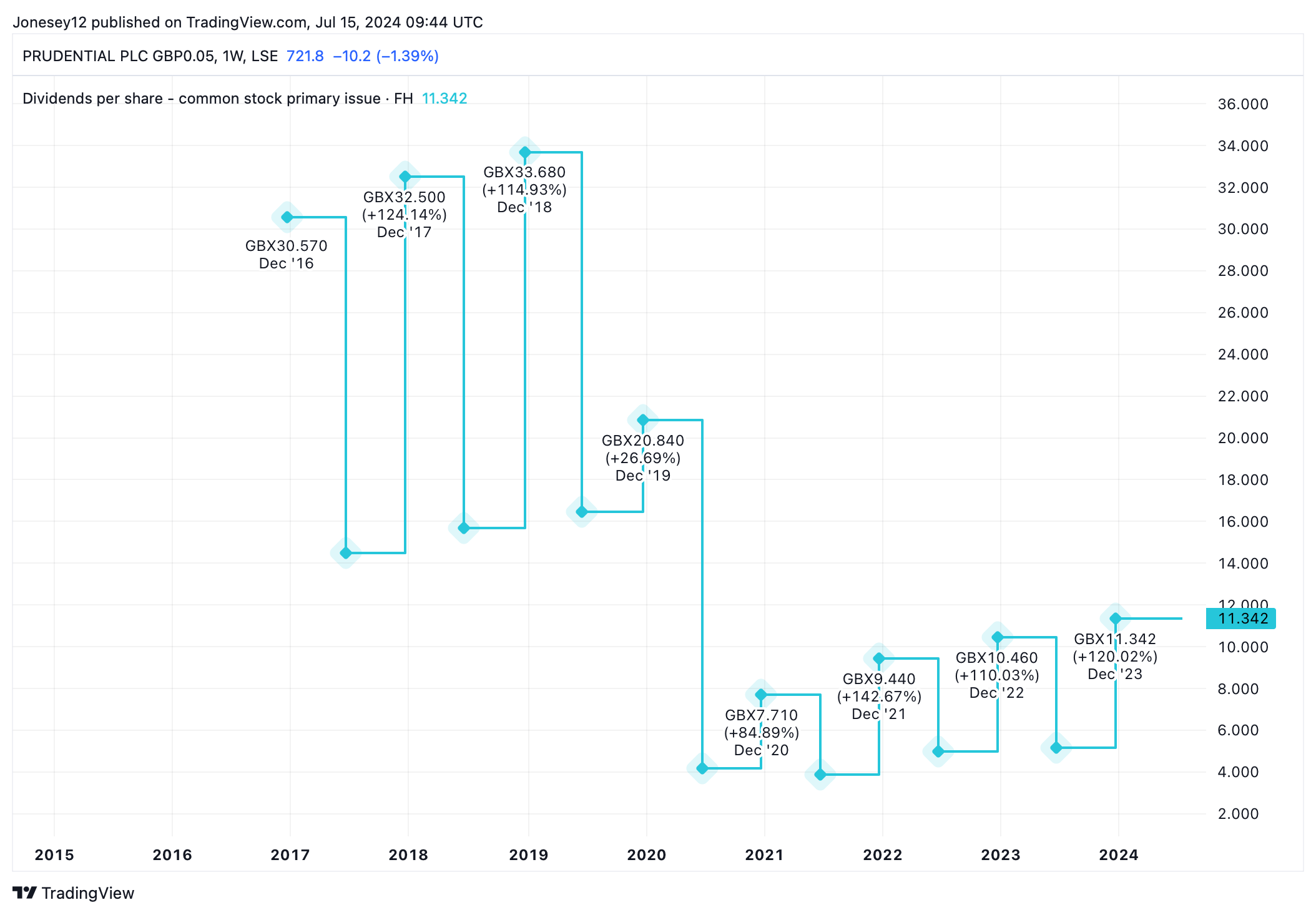

Its dividends took a beating during the pandemic, and are only now starting to recover. Let’s see what the charts say.

Chart by TradingView

It’s been a tough time for FTSE 100 insurers generally, with Legal & General Group, M&G, and Phoenix Group Holdings all struggling share-price wise. But at least those three offer whopping yields of 8% or 9%. Pru doesn’t.

The Chinese economy is picking up and could hit its 5% GDP growth target. That could persuade investors to take a second look at the Pru. They’ll be impressed by its low valuation. I was, anyway. Today, Prudential shares trade at just 10.76 times earnings, below the FTSE 100 average of 12.7 times.

Prudential isn’t a pure-play China stock — it’s doing nicely in Thailand and India, and has its sights set on Africa. It looks like a brilliant recovery opportunity, possibly one of the best on the entire FTSE 100.

The danger is that it’s looked like a brilliant opportunity for years, without coming good on its promise. It’s now on my watchlist, though. When I have cash to invest, I’ll give it a second shot.