Over time, the London stock market’s proved a happy hunting ground for investors seeking dividend growth shares.

With an average dividend yield of around 3.5%, the FTSE 100 and FTSE 250 indexes provide larger dividends than most overseas bourses. This is thanks in part to the UK market’s long-established culture of paying cash rewards.

It’s also because many British companies are well-established in mature markets. They receive stable cash flows in industries like energy, banking, consumer goods and utilities. These can then be distributed in the form of dividends.

What’s more, with fewer growth opportunities to tap, UK shares in these sectors tend to return a larger portion of their profits to shareholders.

Taking care

Dividends are never guaranteed, of course. As we saw during the Covid-19 pandemic, even the most dependable dividend growth stock can suddenly reduce or axe payouts entirely.

Buy buying stocks with strong balance sheets, solid positions in defensive markets, and a proven commitment to paying dividends can greatly enhance an investor’s chance of receiving a healthy passive income.

Here’s one I’d buy if I had spare cash to invest. If analyst forecasts are correct, it could provide a £1k second income this year.

Power play

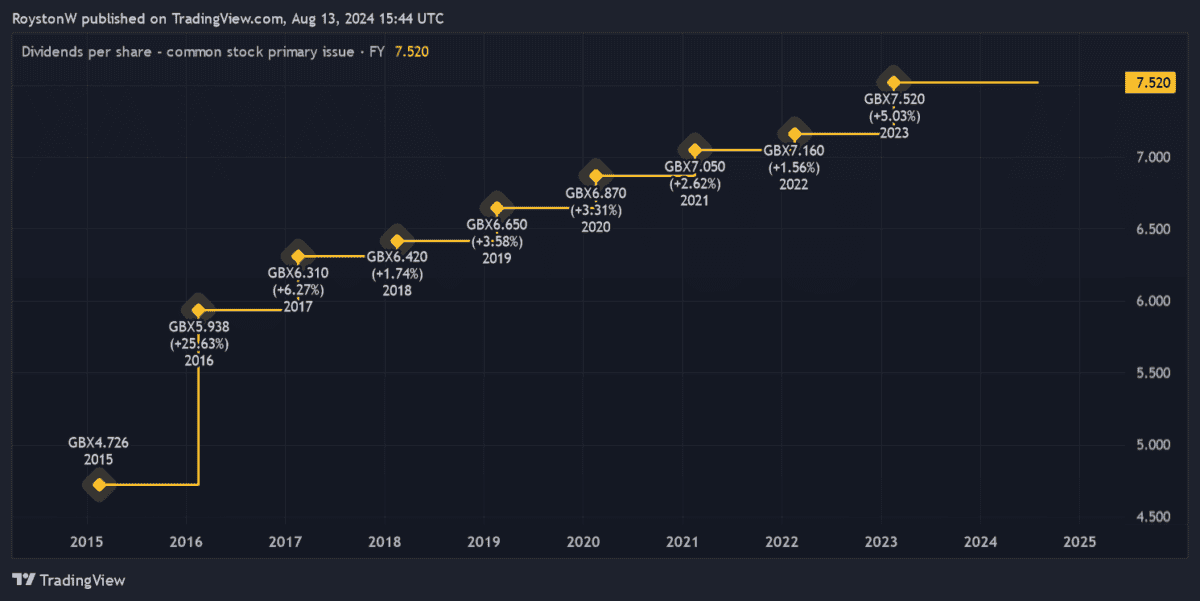

As the chart shows, NextEnergy Solar Fund (LSE:NESF) has a long history of raising the annual dividend. In fact, following its decision to raise fiscal 2024’s total payout to 8.35p per share, it’s increased cash rewards every year since its IPO back in 2014.

Being a renewable energy stock, the company benefits from stable cash flows at all points of the economic cycle. Electricity’s one of life’s essential commodities, so NextEnergy has the financial capacity as well as the confidence to pay a growing dividend.

What’s more, with a large proportion of its regulated revenues linked to the Retail Price Index (RPI), its ability to increase dividends remains strong, even during inflationary periods.

There are risks to buying NextEnergy Solar Fund. Energy generation dropped almost 7% last year, to 852GWh, which the firm attributed to “increased rainfall and humidity (which can affect the performance of certain components)”.

But weather-related issues to this extent are uncommon. Indeed, solar panels are well known for providing a consistent flow of electricity, thanks to average yearly irradiation and limited moving parts. This makes NextEnergy a much more reliable profits generator than many other renewable energy shares.

10.1% dividend yield!

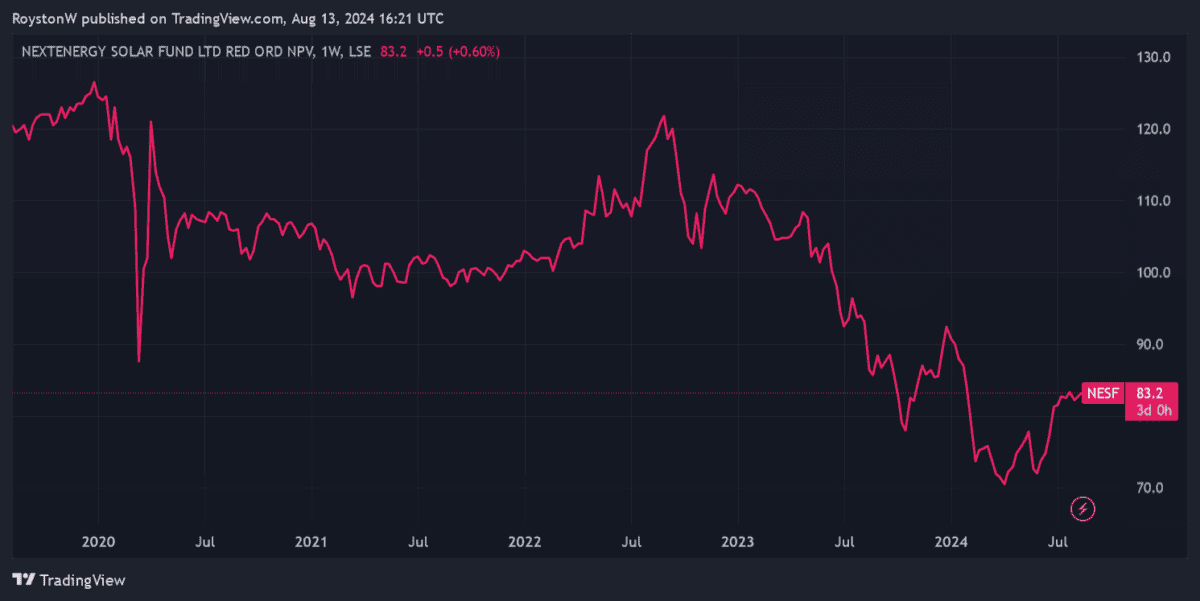

As the chart shows, the company’s share price has struggled more recently. Higher interest rates have squeezed its net asset values (NAVs) and pulled down earnings. This could remain a problem too, if inflationary pressures persist and central banks keep rates around current levels.

Yet the spectacular cheapness of NextEnergy’s share price still makes it worth serious consideration, in my opinion. The firm trades at a 22% discount to its estimated NAV per share of 105.7p.

With its forward dividend yield also sitting at 10.1%, I believe it could be one of the best value income stocks out there and worth considering.

If I invested just over £9,900 in NextEnergy shares, this would give me a juicy £1,000 in passive income this year alone. That’s assuming that broker forecasts are accurate.