Lloyds Banking Group (LSE: LLOY) has just released its annual results, and investors were able to cheer a 6% rise in its shares on the day.

However, the longer-term performance has been disappointing.

Is the ‘Black Horse’ destined for the knacker’s yard, or is it poised to sprout wings and fly?

Extraordinary

It’s remarkable to think that 15 years ago, in the months after the great financial crisis, Lloyds’ shares traded as high as 73p.

And that 10 years ago, at the time of the company’s 2013 results, they were up to 80p. And went on to reach a post-financial-crisis high of 88p in 2015.

The current price? 46p.

This strikes me as extraordinary, because Lloyds is a much stronger business now than it was 10 years ago.

Then and now

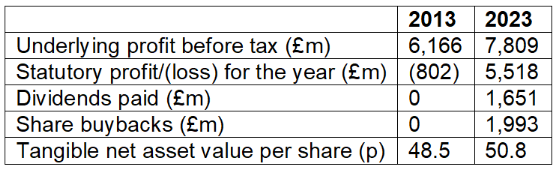

The table below shows some key numbers Lloyds reported in its 2013 and 2023 results.

Investors were paying 80p per share following the release of the above 2013 numbers. They’re paying only 46p per share on the back of the 2023 results.

If I had to pay 80p on the strength of one set of numbers and 46p for the other, I know which one I’d pay 80p for. Suffice to say, it’s not the 2013 set.

Cheap assets

Let me put the topsy-turvy world into even sharper relief by looking at the valuation metrics that can be drawn from the figures in the table.

I’ll begin with price/tangible net asset value (P/TNAV). At the 80p share price of 10 years ago, with TNAV per share standing at 48.5p, investors were buying at a P/TNAV of 1.65. Put another way, they were paying £1.65 for every £1 of Lloyds assets.

Today, at a 46p share price and with TNAV per share at 50.8p, the P/TNAV is 0.9. In other words, £1 of Lloyds assets can now be bought for just 90p — even though they’re generating higher profit, and infinitely superior shareholder returns through dividends and share buybacks.

Gulp, 112p per share

Turning to profit, let’s look at the underlying profit before tax, seeing as Lloyds was loss-making at the statutory bottom-line level in 2013.

10 years ago, the company had 71.4bn shares in issue. So, at the 80p share price, its market capitalisation was £57.1bn — valuing the stock at 9.2 times 2013’s £6.2bn underlying profit before tax.

Today, due to multiple share buybacks in recent years, Lloyds’ share count is down to 64.1bn. At the 46p share price, the market capitalisation is £29.5bn -valuing the stock at just 3.8 times 2023’s £7.8bn underlying profit before tax.

I don’t see any near-term prospect of it, because it would put the P/TNAV too far out of kilter, but if the market were to value Lloyds today at the same 9.2 times profit it was valuing it at a decade ago, the share price would be 112p.

Why? First, because of the higher profit than 10 years ago. And second, because billions of shares have been eliminated from existence through buybacks.

Dividends and buybacks

In 2023, Lloyds’ profitability was such that it generated sufficient surplus capital to distribute dividends of £1.65bn to shareholders (a trailing yield of 5.6% at the current share price) and spend £2bn on buybacks.

City analysts believe the bank can sustainably generate the surplus capital to support such returns. Lloyds has already announced a new £2bn buyback programme for 2024.

It’s important to note that if the annual dividend were to remain static at £1.65bn, the dividend per share would nevertheless increase. The £1.65bn would be distributed among fewer and fewer shares, because of the continual reduction in the share count through buybacks.

Cheap as chips

If Lloyds’ surplus capital generation is indeed sustainable, what would happen if the share price remained at 46p?

The dividend yield would get higher and higher, and the profit and asset valuation metrics cheaper and cheaper. If share buybacks at 46p went on long enough, it could reach the point where one lucky shareholder with one 46p share owned the entire bank!

You can’t even buy a bag of chips for 46p these days!

Sure, it’s a reductio ad absurdum argument, but it illustrates the point that if Lloyds is a sustainable generator of high levels of surplus cash, sooner or later the share price will have to rise to reflect its fundamental value.

This post was originally published on Motley Fool