The Lindsell Train Global Equity fund is a popular investment in the UK and it’s easy to see why. Over the long term, it has delivered great returns for investors.

But is it still a good choice for ISA or SIPP investors going forward? Let’s take a look.

Investment strategy

Lindsell Train Global Equity is a concentrated fund (it only holds 20-35 stocks) that typically invests in high-quality companies or ‘compounders’ as they’re sometimes called. These are companies that consistently generate high returns on capital and can reinvest these returns for future growth.

I like the investment strategy here. It’s quite similar to Warren Buffett’s approach to investing. It’s not going to work all of the time, of course. But over the long term, I’d expect it to deliver solid results thanks to the power of compounding.

Portfolio holdings

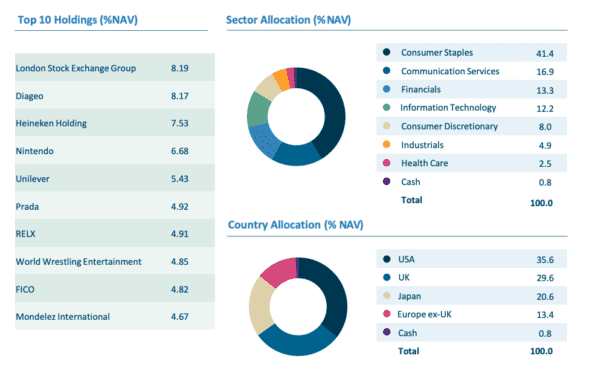

Looking at the fund’s investments, it contains an interesting mix of stocks. Here’s a look at the latest holdings data (from the end of February).

There are some great businesses in the top 10 holdings, including the likes of London Stock Exchange, Diageo, and Unilever.

However, there are a few things to note here. First, the fund has a lot of exposure to the Consumer Staples sector (41.4%).

Second, it doesn’t have a lot of exposure to Healthcare (2.5%). And third, there’s no exposure to Big Tech in the top 10.

Putting this all together, I’d expect the fund to behave very differently from the broader stock market.

In volatile conditions, I’d expect it to outperform due to that significant exposure to Consumer Staples and the absence of Big Tech.

The sting in the tail, however, is that in a raging bull market, it may underperform.

Performance

We can see this out/underperformance in the most recent performance table.

Over the year to the end of February (which was volatile), the fund returned 4.4%, outperforming its benchmark (the MSCI World index), which returned 2.7%.

However, over the five-year period to the end of February (in which we saw a strong bull market that was powered by Big Tech), the fund lagged the benchmark. Note that in 2021, when tech stocks really surged, the fund was behind its benchmark by a wide margin.

It’s still beating that benchmark since its inception, but not by as much as it was previously.

Fees

Finally, turning to fees, they’re relatively low for an actively-managed fund. Currently, the ongoing fee through Hargreaves Lansdown is just 0.51%. I see that as attractive.

My view

Putting this all together, my view is that Lindsell Train Global Equity is still a good choice for an ISA or SIPP.

I see it as a good ‘defensive’ holding. In other words, I think it could help add balance to a portfolio that has a lot of growth investments.

I wouldn’t invest a large percentage of my portfolio in the fund though.

Given the lack of exposure to some areas of the market, I’d want to own plenty of other funds/stocks for diversification.