Shares in FTSE 100 housebuilder Taylor Wimpey (LSE:TW) currently come with a 7% dividend yield. At that level, investing £14,708 could return £1,000 per year in passive income.

There are risks with both the company and the wider sector. But with house prices remaining resilient and interest rates likely to go lower this year, there could be a buying opportunity.

Risks

Let’s start with the big risk. Along with a number of other UK housebuilders, Taylor Wimpey is currently under investigation from the Competition and Markets Authority (CMA).

The question is whether any of the companies have engaged in anti-competitive behaviour by sharing information that ought to have been kept private. If so, there could be a big problem.

Exactly what the outcome of the investigation will be is almost impossible to predict for investors. And that’s a significant risk with the stock at the moment.

That’s why the stock has been falling over the last month. But I think this could well be a stock to keep an eye on with a view to taking another look when things become clearer.

Passive income

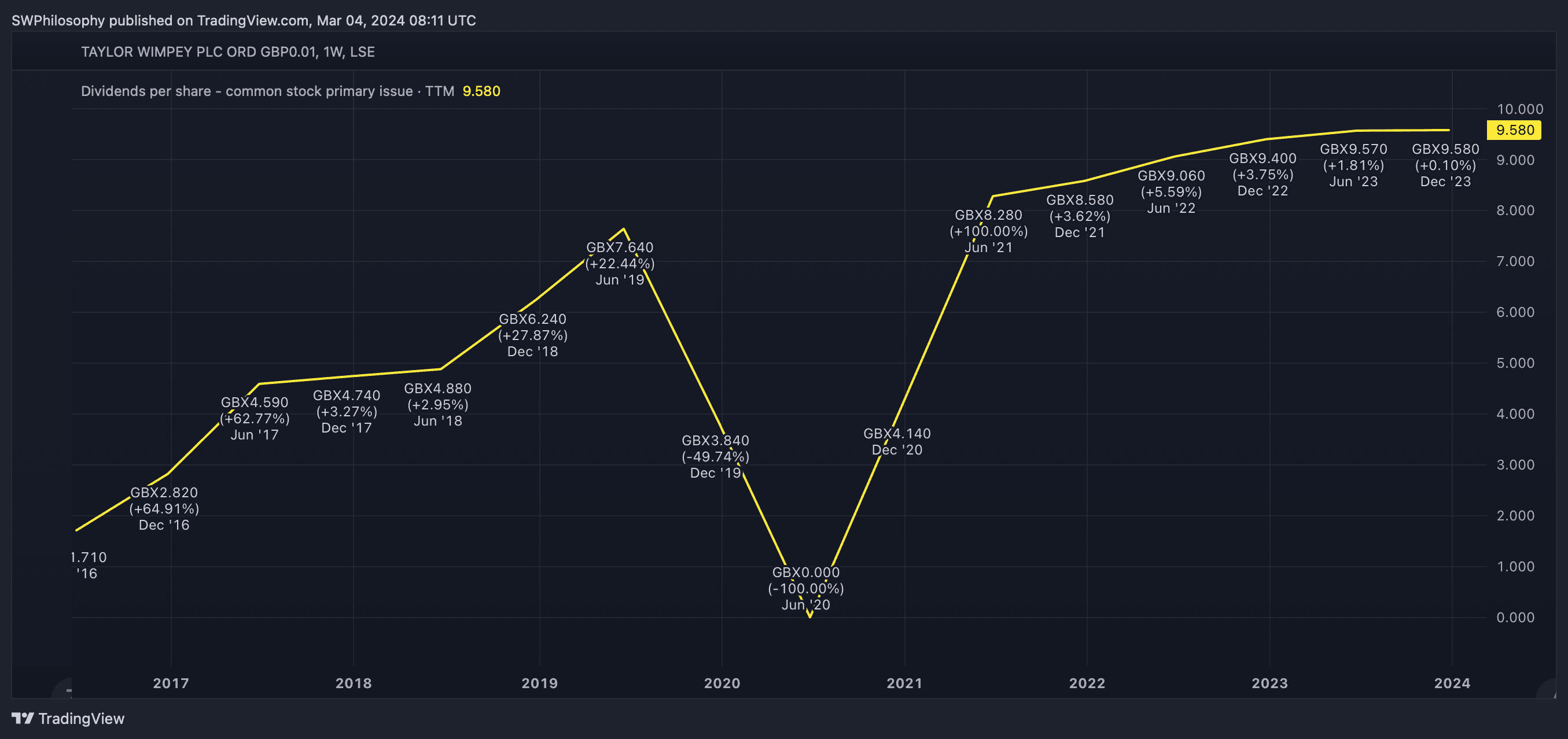

From a passive income perspective, Taylor Wimpey is impressively consistent. Aside from the pandemic in 2020, the company has steadily increased its dividend.

Taylor Wimpey Dividends 2016-24

Created at TradingView

Even in 2023, with profits falling, the firm continued increasing its dividend. That’s because Taylor Wimpey pays its dividend as a proportion of its assets, rather than its earnings.

This makes for more consistent cash flows to shareholders, but there is a risk. For any business, paying out more than it generates is unsustainable over the long term. Plus, of course, companies can choose to cut their dividend payments at any time.

Taylor Wimpey Earnings vs. Dividends

Created at TradingView

For Taylor Wimpey, the gap between earnings and dividends is narrowing. So investors should hope for an upturn in the property market soon – and there are some positive signs.

Outlook

Despite interest rates remaining steady, this has provided enough security for mortgage rates in the UK have been falling. That’s a significant positive for the housing market.

Taylor Wimpey’s strategy in a subdued market has been to cut back on volumes to maintain prices. As a result, the firm is in a decent position for when things recover.

A large land bank consisting of 80,000 plots means the company should have some ability to identify the best opportunities when the time comes to kick into gear. And I think it’s ‘when’ not ‘if’.

Further ahead, the UK looks to have a structural shortage of housing. Exactly what the solution is, I don’t know, but I’m convinced there’s opportunities for housebuilders across the board.

Time to buy?

At today’s prices, £14,708 could buy me 10,438 shares in Taylor Wimpey. If the dividend stays where it is, I’d receive £1,000 in passive income this year.

I think the company’s approach to its dividend means there’s a good chance of this happening. The biggest risk, in my view, is the uncertainty around the CMA investigation.

Exactly what that will bring is impossible to know. But I’m going to keep a close eye on how that unfolds and if the stock doesn’t move up significantly, it could well be on my buy list afterwards.