Assuming a 5% withdrawal rate, which could be achieved by investing in dividend stocks, an investor would need around £2.4m invested in a Stocks and Shares ISA to earn £120,000 of annual passive income. This equates to around £10,000 monthly.

These might sound like really big numbers. And they are. However, because most of these strategies for passive income take decades, it’s important to remember that £10,000 in 30 years will be worth a lot less than it is today.

In fact, assuming inflation does average 2% over the next 30 years — which may be an underestimate given broader challenges around scarcity of supply — £10,000 will feel like the equivalent of £5,520 in today’s money.

So in other words, this is a strategy to build a passive income stream for 30 years’ time that will feel like receiving £5,520 in today’s money, or a little less if inflation averages above 2%. Given that income from a Stocks and Shares ISA is totally tax free, that’s actually the equivalent a £97,000 salary after tax.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

The formula for success

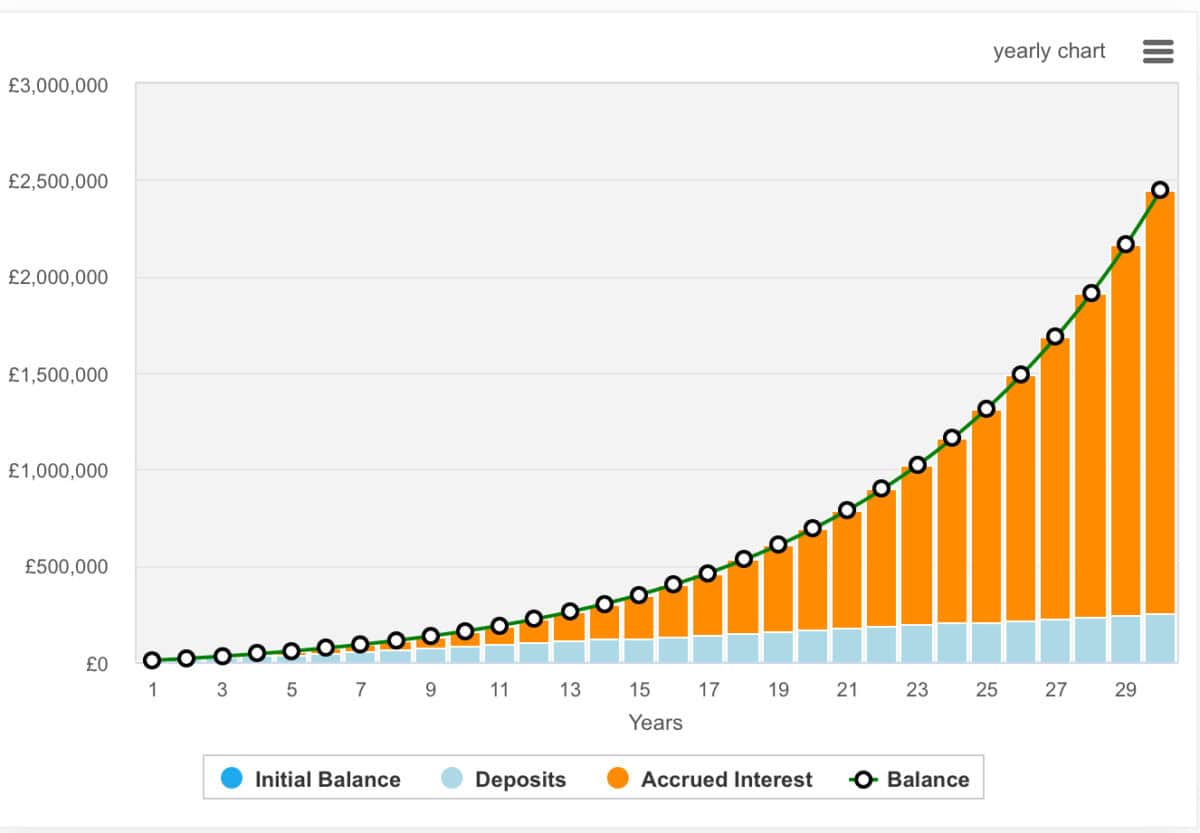

Ok, so how can a novice investor start with nothing and reach £2.4m. Well, it requires regular contributions, a sensible investing strategy, and time. Here’s one way to achieve it:

- A regular contribute of £700 a month. This would result in an annual contribution of £8,400, well below the cap of £20,000.

- A growth-oriented investment strategy that yields at least a 12% annual return. This may sound easier said than done, but many growth-focused funds have achieved this over the long run.

- A 30-year investment timeline, providing ample opportunity for the investments to compound.

This visualisation shows how the returns compound over time. Just look at the growth towards the end of the period compared to the beginning. It’s a stark contrast, and highlights the importance of time in the market.

One to consider

For long-term growth prospects with instant diversification, investors may want to consider Scottish Mortgage Investment Trust (LSE:SMT). This isn’t an uncommon choice, and I’ve previously highlighted sister trusts, Edinburgh Worldwide Investment Trust and The Monks Investment Trust.

However, it’s hard to look beyond Scottish Mortgage sometimes. The trust’s stock is up 74% over five years and continues to trade at an 8% discount to its net asset value. In turn, this suggests that I’m buying the companies that Scottish Mortgage invest in at a discount.

I appreciate that some investors will be put off by the unlisted holdings. For example, SpaceX, which represents 7.5% of the portfolio, doesn’t publish its financial information because it doesn’t have to. Moreover, its massive valuation‘s established by the stock market.

However, I’d point to the company’s excellent track record of picking the next big winner. It invested in Moderna before the pandemic — if only it sold more stock earlier — and owned Nvidia stock before the artificial intelligence (AI) revolution began.

Personally, I keep topping up on the trust when I can. It nicely complements the rest of my growth-focused portfolio.