Investing £200 a month in a Stocks and Shares ISA can be a transformative strategy for building wealth over the long term. With a 20-year horizon and assuming a 10% annualised return, the power of compounding can turn modest monthly contributions into a substantial portfolio capable of generating significant passive income. Let’s examine how this works.

Starting with the maths

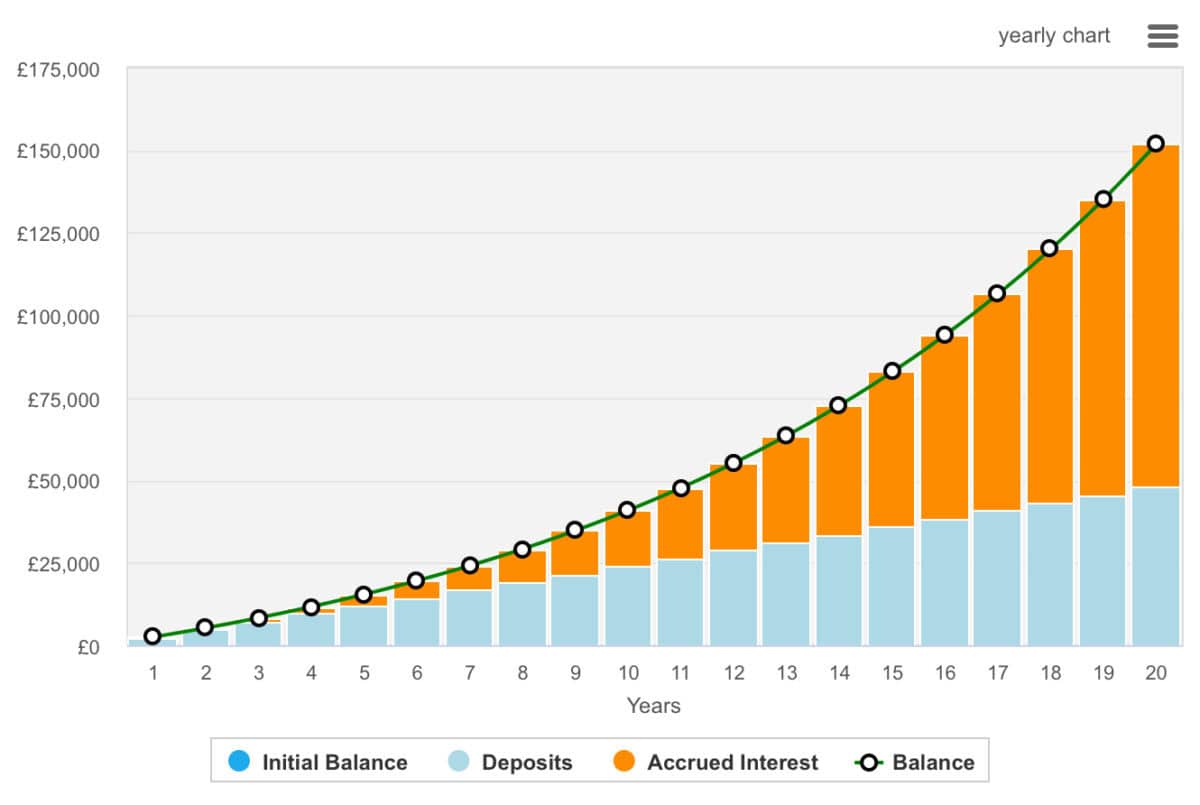

Over 20 years, monthly contributions of £200 would total £48,000. However, with a 10% annualised return, the portfolio could grow to around £151,874 by the end of the period. This includes £103,874 in interest earned through compounding. The formula for compound growth demonstrates how reinvesting returns amplify portfolio growth over time.

At this point, assuming a 5% dividend yield, the portfolio could generate an annual passive income of £7,594 a year — or £633 a month — providing a steady stream of cash flow that far exceeds the initial monthly investment.

Of course, there are several things to note here. Firstly, the investor might not achieve a 10% return. Some get more, but many others get less. Then, £633 won’t go as far in 20 years as it does today. In fact, in two decades tat would feel like around £386.34 in today’s money, assuming a steady annual inflation rate of 2.5%.

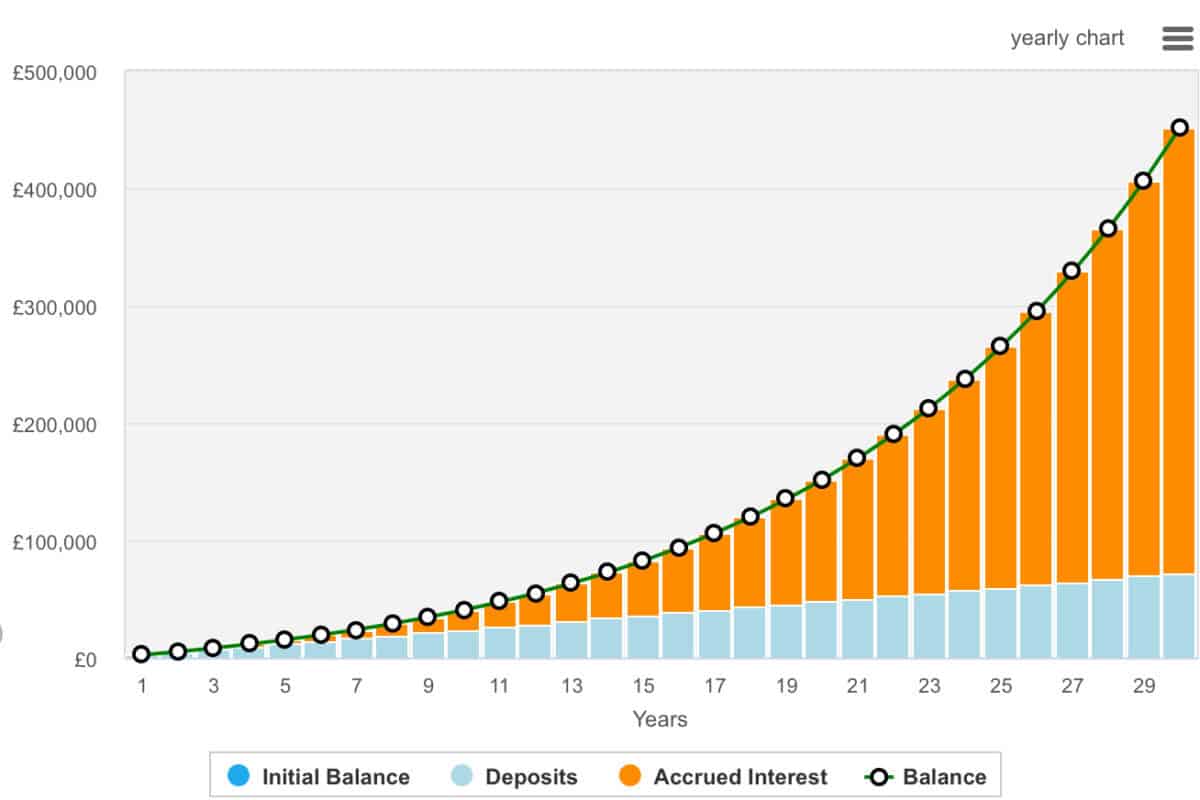

And this is why investors typically take a very long-term approach. And that’s because the portfolio will start earning interest on interest. This is something of a snowball effect. After a further 10 years of investing, that £200 a month would be worth more than £450,000.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

One for consideration

One standout option for consideration is Scottish Mortgage Investment Trust (LSE:SMT). Managed by Baillie Gifford, this trust offers exposure to some of the world’s most innovative and disruptive companies. Its portfolio spans both public and private firms, providing access to opportunities that are often unavailable to retail investors.

Current holdings include high-growth businesses like Amazon, Nvidia, and SpaceX, alongside emerging market leaders such as MercadoLibre and Meituan. This global diversification makes Scottish Mortgage an attractive choice for long-term investors seeking exposure to technological change and future market leaders.

Scottish Mortgage’s high-conviction approach is central to its appeal. Managers Tom Slater and Lawrence Burns focus on identifying companies capable of creating new markets or disrupting existing ones. This thematic strategy has delivered outsized returns in the past, with notable successes like Nvidia and Moderna.

However, it’s not without risks. The trust’s significant allocation to private companies introduces liquidity risks. These assets can be harder to sell during market downturns. Another key risk is gearing, or borrowing to invest. This is a strategy employed by Scottish Mortgage to enhance long-term returns.

While gearing can amplify gains in rising markets, it also exacerbates losses during downturns. The trust’s net gearing currently stands at 11%. This means its exposure to equities exceeds its shareholders’ funds by this proportion.

Despite these risks, Scottish Mortgage remains an appealing option for adventurous investors with a long-term perspective to consider. It’s a stock I’ll top up on with the market pulling back.