The International Consolidated Airline Group (LSE:IAG) share price has been soaring in 2024. Up over 37%, it’s been one of the FTSE 100’s best-performing stocks.

Investors might feel like they’ve been here before, though, and things can come undone in a hurry in the airline industry. So the big question is, what does the future looks like?

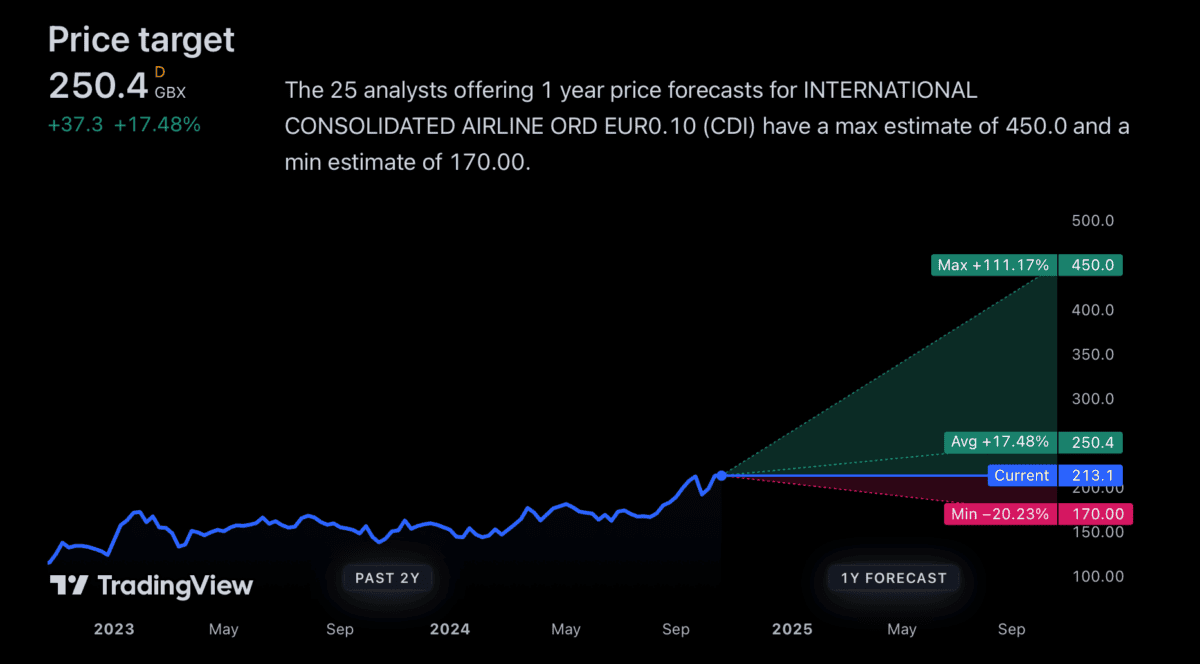

Analyst estimates

It’s fair to say that analysts are somewhat divided on this one, but the general view is positive. From what I can see, the average price target is around 18% higher than the current level.

Source: TradingView

The most optimistic estimate is £4.50 – more than double the current level. That’s from Liberum, who think the market is forgetting how well the company was doing before Covid-19.

At the other end, HSBC analysts have a price target of £1.70, which is 20% below where the stock is currently. That’s from July, where Liberum’s estimate was in April.

There’s not much consensus here, which means investors really need to think for themselves about what the outlook for the business looks like. But that’s something I’d look to do anyway.

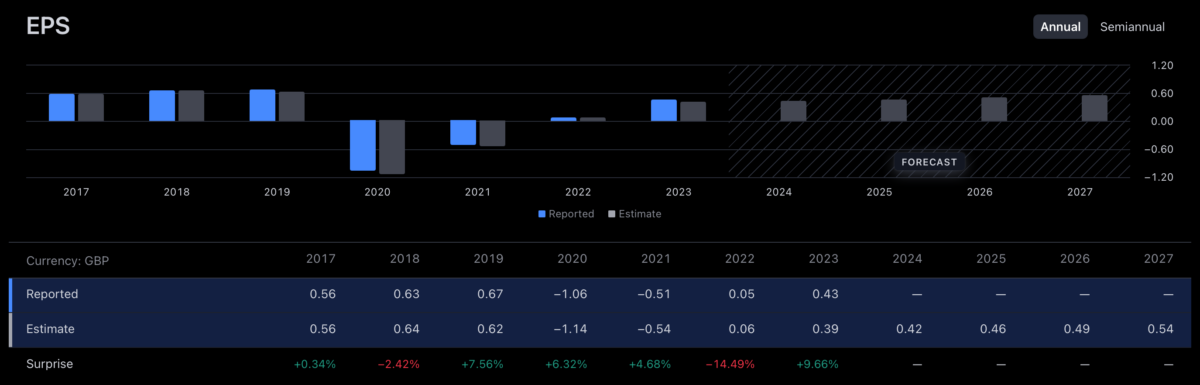

Earnings

Over the long term, where the IAG share price goes will depend on how much money the business makes. And I think the earnings expectations for the company are interesting.

Source: TradingView

On balance, analysts have a pretty positive outlook for the firm’s profits. Earnings per share are expected to rise steadily, reaching 54p by 2027.

At the risk of sounding like a bit of a misery, I’m sceptical. IAG’s income has been choppy over the last 20 years, with some relatively smooth periods interrupted by sharp declines.

IAG earnings per share 2005-2024

Created at TradingView

I’m not saying investors should expect another pandemic, financial crisis, or Icelandic ash cloud. But these things have a way of showing up unexpectedly and wreaking havoc on airline profits.

Competition

The trouble with these exogenous events is that airlines have high fixed costs. In other words, they still have fuel, staff, and airport expenses to pay for whether they are generating passenger revenue or not.

I have another worry about IAG, though, and that’s competition. Until recently, its long-haul business has been largely immune to the threat of budget airlines – but that’s changing.

Wizz has announced its intention to offer low-cost air travel connecting Europe and the Middle East. I have big concerns about this for the company, but I don’t love it for IAG.

Whether or not Wizz figures out a way to make money on these routes, increased competition can only be a bad thing for IAG. Especially if that competition is undercutting them on prices.

Not for me

Liberum’s point is well-made – I agree that the years before the pandemic were good ones for IAG. But that’s not enough to convince me the stock is a bargain at today’s prices.

The reason is that I strongly dislike the firm’s business model. While high fixed costs make for rapid growth when things go well, they also leave it vulnerable in a downturn.

I’m looking to buy shares in companies that are a bit more resilient and able to hold up better when the unexpected happens. While there is one airline that I think is attractive, it isn’t IAG.