The FTSE 100‘s risen a healthy 7% in 2024 as enthusiasm for UK shares has improved. But not all British blue-chips have had an enjoyable ride since the turn of the year.

B&M European Value Retail‘s (LSE:BME) fallen more than a quarter in value so far this year.

I wouldn’t rule out further share price weakness for the rest of the year or even during 2025 either. But as a long-term investor, I’ll consider buying it when I next have spare cash to invest.

Here’s why.

Fallen angel

A 29% share price decline in 2024 has seen B&M’s forward price-to-earnings (P/E) ratio topple to 10.5 times. This is well below the FTSE 100 average of 15 times. And it’s a multiple I believe is far too low.

Investors were spooked in June by the retailer’s failure to offer guidance for this financial year (to March 2025). And it’s failed to recover ground since then, with latest results showing a 3.5% decline in like-for-like sales from April to June.

I believe the scale of the sell-off’s impact hard to justify. B&M hit the top end of forecasts for the last fiscal period. And it’s looking good to continue delivering robust growth as its hugely profitable expansion programme rolls on.

Growth plan

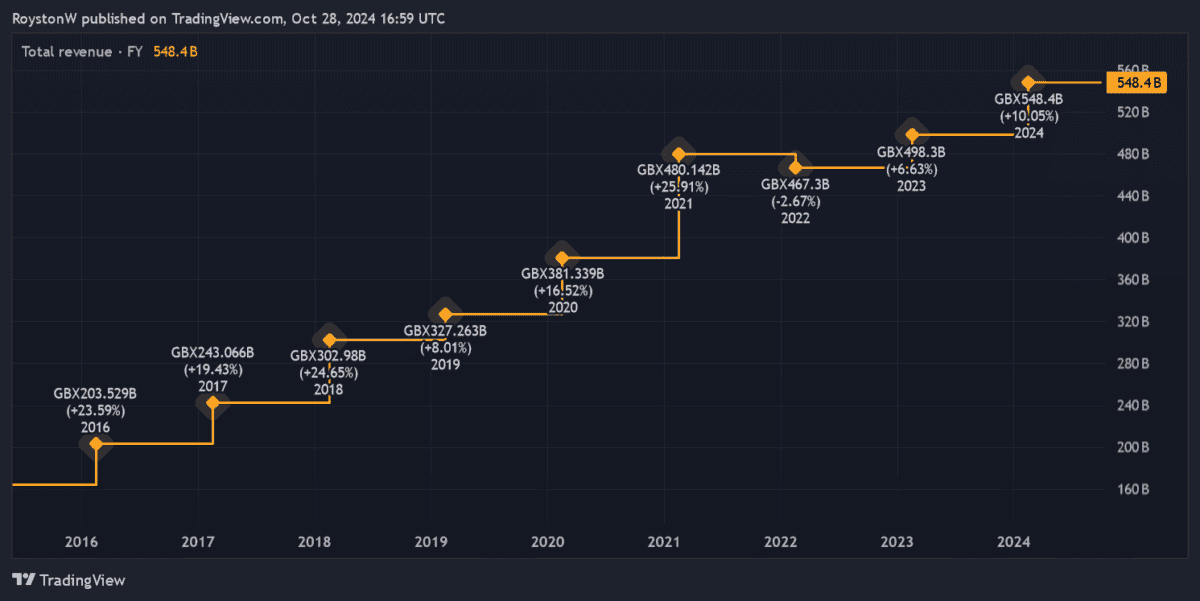

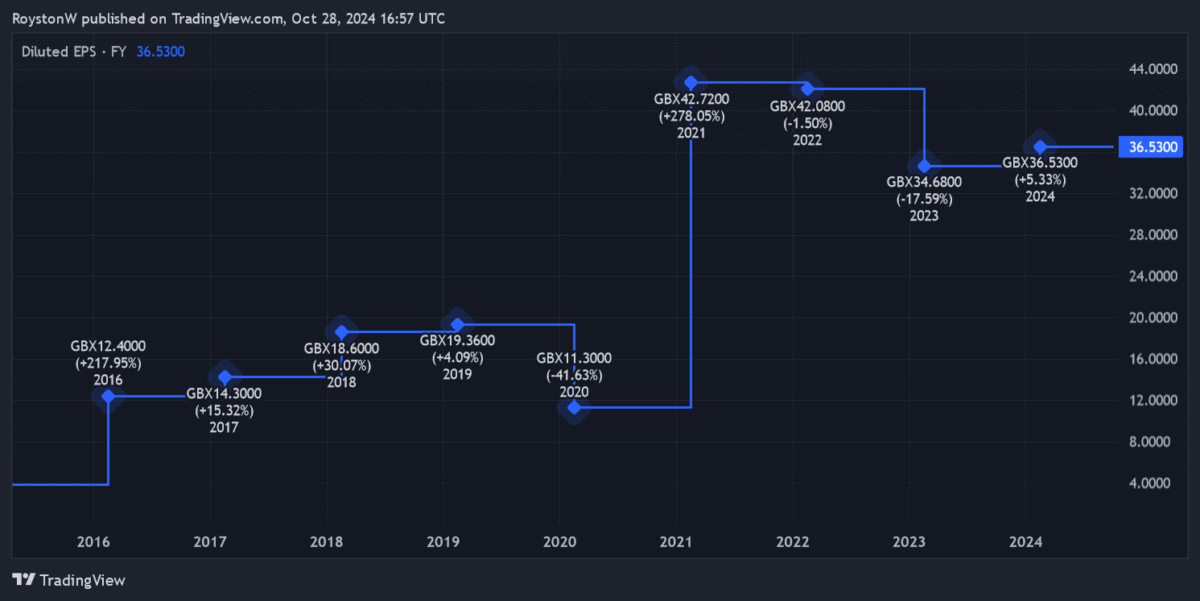

Today, B&M sells its cut-price product ranges from 755 stores. That’s up from 499 back in 2016. Over this period, both sales and earnings have soared, as the charts below show.

Given this success, it’s perhaps no surprise that B&M’s accelerating its growth programme.

Earlier this year it announced “a new, long-term store target of not less than 1,200 B&M UK stores, a significant increase from the 950 we had guided to previously“.

It plans to cut the ribbon on another 90 stores in the next two financial years alone. This could take group earnings growth to the next level.

There’s always the risk that the company expands too quickly, eroding shareholder value in the process. But encouragingly, B&M has a great track record of execution that continues to this day.

It said in July that “all stores opened since last year are performing ahead of expectations“.

More to come

I can see why investors are more nervous about B&M looking ahead. Competition’s intensifying, and especially as inflation fades and shoppers move towards more expensive operators.

These have certainly impacted the retailer’s trading performance more recently. However, the firm’s 3.5% like-for-like sales decline in the first quarter should also be seen in the context of strong comparatives a year earlier. Back then, corresponding revenues leapt 9.2% year on year.

It’ll have to paddle extremely hard to keep growing profits looking ahead. But I’m confident B&M — whose share price has risen 67% since 2016 — can keep delivering excellent shareholder returns as expansion revs up.