How much would Tesla stock be worth if it was valued like Nvidia?

In mid-December, Tesla (NASDAQ: TSLA) stock was trading at over $470. As I write, the share price is around $240. That’s a drop of almost 50% in three months.

As an investor, it’s difficult to make sense of this. Are Tesla shares now too cheap? Were they too expensive before? Or has something else now changed?

I’ve been taking a closer look at this situation and considering how I might value Tesla.

Pressure on profits

On 13 March, the Financial Times published details of an anonymous letter from Tesla to the US government. In it, the electric vehicle (EV) company effectively warned that President Trump’s tariffs could hit profits for Tesla (and other US car makers).

Another problem that’s already putting pressure on Tesla’s earnings is that global consumers just aren’t buying as many new cars as they were. Profits have fallen at most of the big car manufacturers. Tesla’s operating profit fell by 20% last year.

Although forecasts suggest a return to growth this year, Wall Street analysts keep cutting their estimates. Broker forecasts for Tesla’s 2025 earnings have been cut by around 15% since the end of 2024. Forecasts for 2026 have also been trimmed.

How should I value the shares?

The funny thing is that Tesla shares are still trading on a 2025 forecast price-to-earnings (P/E) ratio of 88 even after falling by nearly 50%. Most of the other big car manufacturers are trading on single-digit price-to-earnings multiples at the moment.

However, comparing Tesla to regular car manufacturers seems pointless. Although I might think it’s just a large car company, the market seems to value the business more like a high-flying tech stock.

In addition, Tesla’s expected to continue delivering much stronger earnings growth than its legacy rivals. Broker forecasts suggest its earnings will rise by an average of 29% a year over the next two years.

I think Tesla does deserve some kind of premium valuation. The question is, how much? To get a different point of view, I decided to try comparing Tesla’s valuation with that of tech star Nvidia.

Tesla vs Nvidia: what’s a fair price?

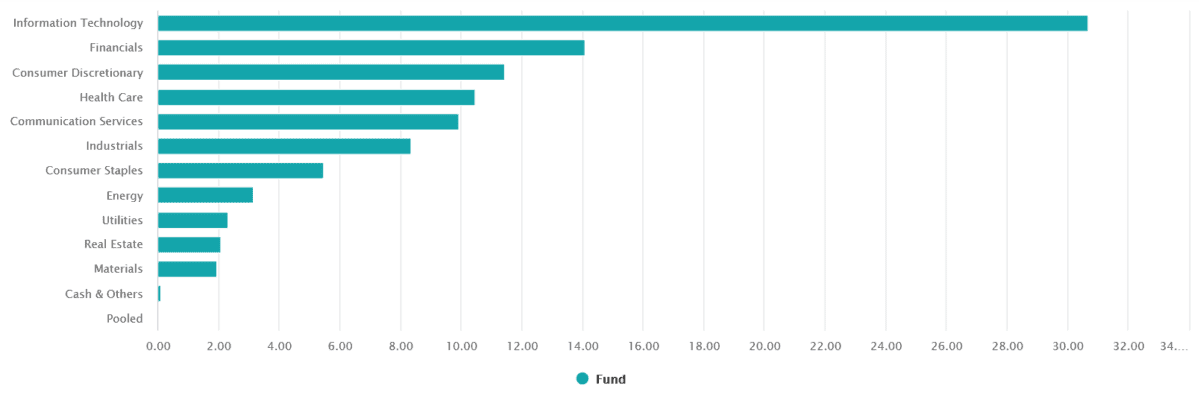

The AI boom has made chip giant Nvidia hugely profitable. Growth prospects for the next few years seem strong. Broker forecasts suggest its earnings could rise by an average of 40% over the next two years. Even so, Nvidia still looks a lot cheaper than Tesla:

| Broker forecasts | Tesla | Nvidia* |

| 2026 P/E | 66x | 20x |

*Nvidia’s financial year ends on 31 January, so I’ve used 2026/27 forecasts

If the market decided to value Tesla on the same P/E ratio as Nvidia, the former’s share price could fall by two-thirds to around $75. Ouch!

Am I missing the bigger picture?

Tesla’s valuation has always been about more than next year’s earnings. Founder Elon Musk has built a dedicated following and encouraged the view – rightly or wrongly – that Tesla’s much more than just a car company.

I won’t be buying Tesla stock, because the financials just don’t add up for me. But in unusual situations like this, it’s always worth doing the research and considering different viewpoints.