How much would an investor need in dividend shares to make £1,000 a month?

Dividend shares are a popular way for investors to build a second income. It’s true that there’s no guarantee of future dividends, but with a diversified mix of stocks in a portfolio, it can be possible to bank regular income over time. Based on the end goal of making a grand a month, here’s how I worked backwards to figure out the strategy and numbers.

Getting the ducks in line

Before we get to the figures, the most crucial element is getting the strategy right. After all, it’s pointless to be putting more and more money into something that isn’t fundamentally working.

From my experience, an investor would be best placed to regularly put some money aside for income stocks. Of course, a large lump sum injection is never a bad thing. But in reality, personal cash flow needs often mean it’s easier to invest a smaller amount on a monthly basis.

The advantage of this method is that it allows an investor to take advantage of opportunities as they arise. One month, a stock might bump up the dividend per share, making it attractive to consider buying. Another month, a positive trading update might put a company on track for higher-than-expected earnings. Again, this could make it a good option to add to the portfolio.

Over a couple of years, this should allow the person to have a broad portfolio of stocks with varying yields. As a result, if one company has a problem and cuts the dividend, it shouldn’t have a material impact overall that would throw off the progress for the end goal.

Generous yield and dividend cover

If an investor is already in the process of building a portfolio, an opportunistic stock to consider buying could be ZIGUP (LSE:ZIG). The share price is down 16% over the last year, with a current dividend yield of 8.53%.

The lower stock price makes it a potentially attractive option, especially when I consider the reasons behind the fall. Part of it has come from the drop in reported underlying profit before tax for the half-year ended October. It fell by 17.2% versus the same period last year. Yet some of this was due to lower profit made from the disposal of assets, which was unusually high last year. So this doesn’t really relate to normal business operations.

Further, the business is still profitable, with a dividend cover of 2.9. This means that current earnings can cover the dividend several times over. Therefore, I see this as a sustainable income share to consider going forward.

Looking forward, the report mentioned that “we have seen a good supply of new vehicles coming through since the year-end, reducing the fleet age and strengthening our asset base.” This should help to retain existing clients. The main risk I see is if profitability keeps moving lower due to higher costs of adding new vehicles.

The numbers

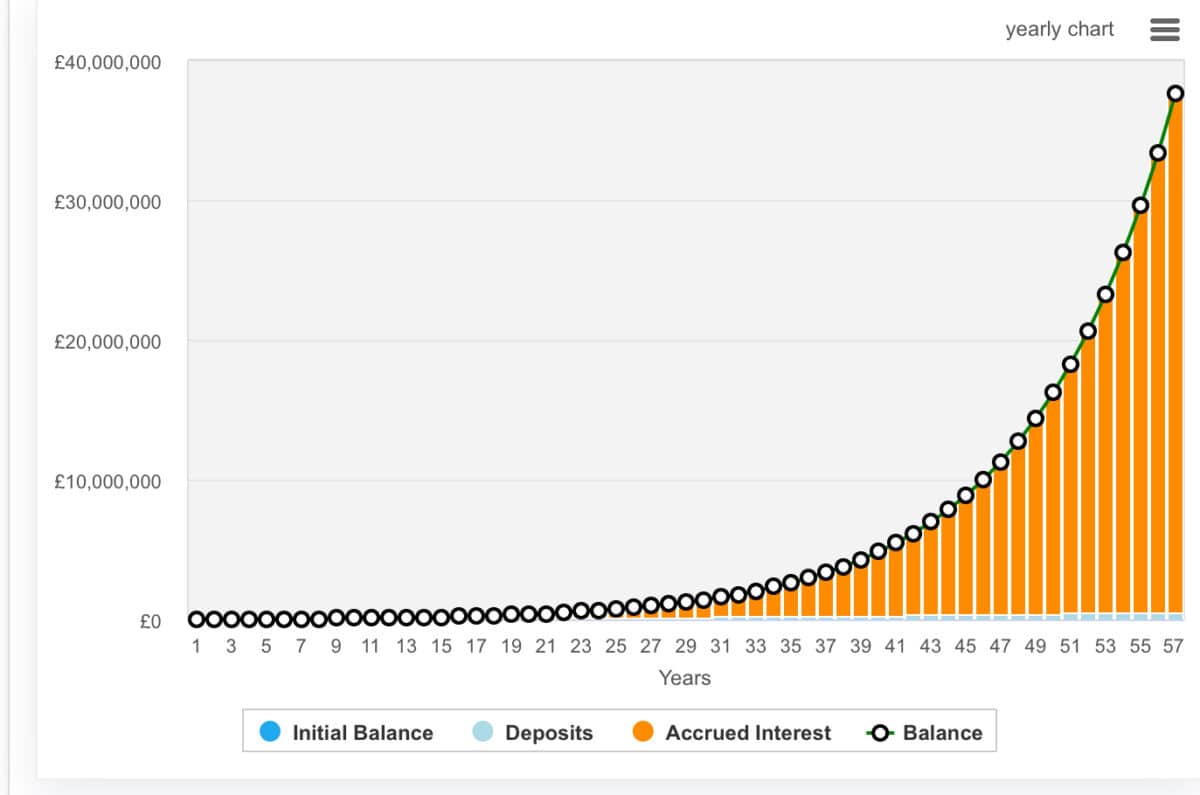

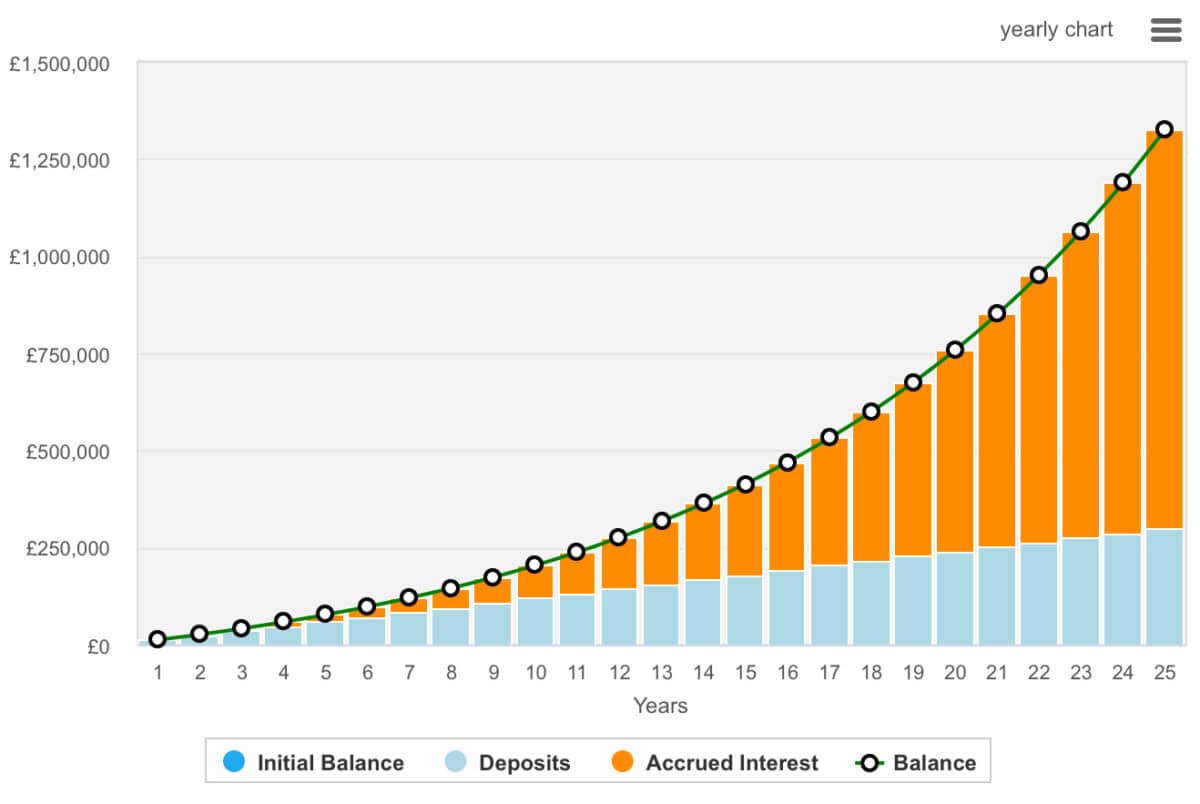

Let’s say an investor can put £500 a month towards buying dividend stocks with an average yield of 8%. After 14 years, the pot size could be at £155,538. This means that in the following year, it could pay out £1,036 a month, even without adding in any fresh cash.