Stock market correction! 1 growth share down 53% to consider buying now

The tech-driven Nasdaq 100 index remains more than 10% down from a recent high, keeping it in correction territory. As a result, some tech shares now look more attractive for investors considering buying them than they did a few months ago.

Here’s one Nasdaq share that has lost half its value in a short space of time. I think it’s now worth a look for long-term growth investors.

The Trade Desk

The stock is The Trade Desk (NASDAQ: TTD). This is an advertising technology company that operates a programmatic platform allowing businesses to buy digital ads across various channels.

Programmatic advertising is the automated buying and selling of digital ads in real time. Basically, AI analyses data to place the right ad in front of the right audience at the right time.

This data-driven approach is meant to be much more efficient than the traditional spray-and-pray marketing methods (print newspaper ads, billboards, etc).

Capitalising on this digital advertising trend, particularly in connected TV, The Trade Desk has grown rapidly. Revenue has jumped from $836m in 2020 to $2.44bn last year. The company is also profitable, achieving a 16% net profit margin in 2024.

However, the stock has been smashed recently — down 53% in just over one month.

Why has it crashed?

There are two main reasons for this collapse. The first relates to this comment from CEO Jeff Green about Q4: “For the first time in 33 quarters as a public company we fell short of our own expectations.”

Specifically, the company reported revenue of $741m rather than the $756m it previously said it would. This unexpected miss spooked investors.

Second, there’s suddenly fear that the US economy is heading for a recession due to uncertainty around President Trump’s tariff policies. If so, companies could pull back on advertising spend, negatively impacting The Trade Desk’s growth. This is a risk here.

Perspective

Taking a long-term view however, I think the stock at $56 now looks attractive. The quarterly miss was clearly concerning, but management says it was self-inflicted and measures have been taken to address the problems.

I think after beating its own guidance for 32 out of 33 quarters, management deserves the benefit of the doubt here.

Moreover, the company puts its total addressable market at $935bn, and still appears to have a strong competitive position. Traditional TV advertising is shifting to streaming platforms, many of which have introduced ad-supported subscription tiers to supplement their traditional paid services.

More advertising slots available on streaming platforms is great news for The Trade desk, which has partnerships with Disney, Netflix, and Roku. So connected TV remains a huge long-term growth market for the company.

Moreover, Q4 revenue of $741m still represented 22% year-on-year growth, which isn’t exactly pedestrian. For this year and next, analysts are currently pencilling in revenue growth of about 20%.

My Foolish takeaway

I own shares of The Trade Desk, so it hasn’t been nice to see them nosedive like this. However, I have no intention of selling and think this may well prove to be a blip.

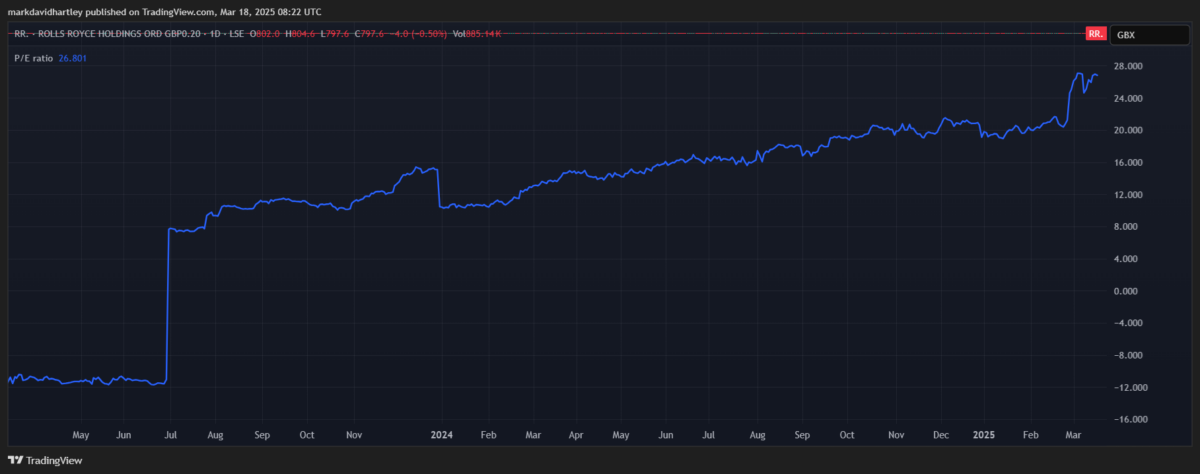

The stock still isn’t cheap, trading on a forward price-to-earnings (P/E) ratio of 51. However, that is a significant discount to its historical average.

After its 53% crash, I think this growth stock is worth considering.