Up another 35% in 2025 – can the Rolls-Royce share price keep climbing forever?

The Rolls-Royce (LSE: RR) share price just won’t stop. The FTSE 100 aerospace stock has rocketed 772% in just three years. Over the past year, it’s soared 102%.

Many investors assumed it would run out of puff. Some held back from buying. Others took profits too soon. Either way, they’ll be kicking themselves, as Rolls-Royce has risen another 35% so far in 2025.

Of course, my headline is rhetorical – no share price climbs forever. But once momentum sets in, a stock can soar for much longer than seems feasible. The big question is: does Rolls-Royce still have fuel in the tank, or is a correction on the way?

Number one FTSE 100 flyer

2025 has brought plenty of good news. In January, Rolls-Royce landed the biggest Ministry of Defence contract in its history, a £9bn deal for nuclear submarine engines.

February results showed 2024 operating profits jumped 49% to £2.9bn, while the group hiked mid-term targets, reinstated its dividend, and announced a £1bn share buyback for good measure.

Civil aviation remains a big profit driver, with Rolls-Royce engines in high demand as long-haul air travel continues to recover post-pandemic. Now defence is getting in on the act. The shares spiked again earlier this month, as European nations ramp up military spending to deter Vladimir Putin.

Rolls-Royce’s move into small modular nuclear reactors (SMRs) could further drive growth. These so-called ‘mini nukes’ are still in development, but if they take off, Rolls-Royce has a big opportunity.

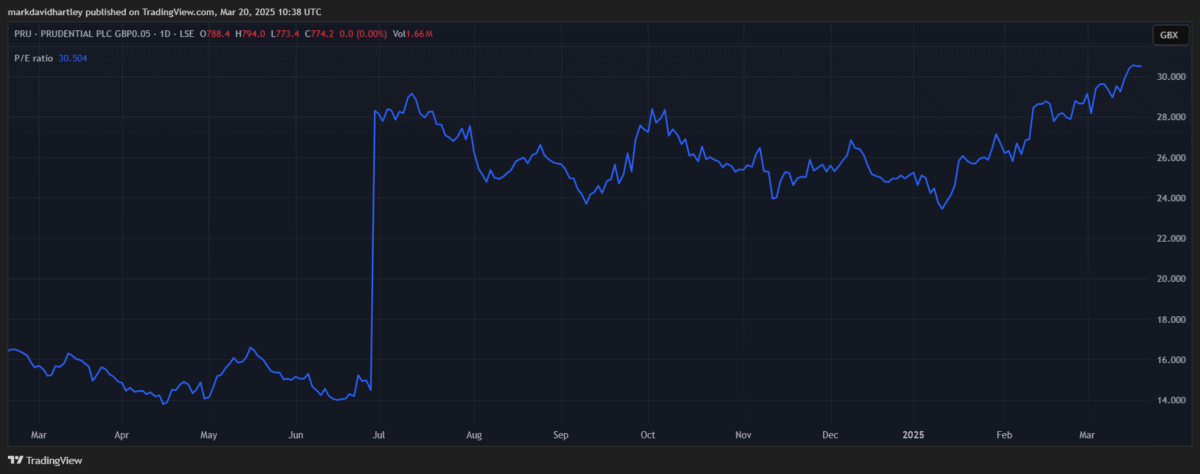

Despite all that optimism, there are plenty of risks. With a price-to-earnings ratio of 40, it trades at a massive premium compared to the FTSE 100 average of 15. That’s justified if earnings keep climbing, but if growth stumbles at any point, the share price could take a big hit.

There’s also the risk that European nations could cool on buying US defence equipment due to Trump’s perceived unreliability as an ally. While that could benefit Rolls-Royce in Europe, it could also hurt its US defence trade if America retaliates.

Growth, dividends, and a buyback

And what about Trump’s trade war? If tariffs increase, Rolls-Royce’s engines and power systems could become more expensive for American buyers, denting sales.

If the US falls into recession, long-haul air travel may slow. That’s a worry because Rolls-Royce’s engine maintenance contracts are based on miles flown.

If those mini-nukes fail to live up to expectations or get a thumbs down from governments, disappointed investors could start bailing out.

The 16 analysts covering Rolls-Royce have produced a median one-year target of 780p. If correct, that suggests a small drop of around 2% from today.

Forecasts are slippery things, but it’s easy to see the stock slowing from here. Then again, I’ve been saying that for the last 18 months.

I eventually stopped worrying and joined in the fun, buying Rolls-Royce shares on 6 August for 455p during a brief summer dip. At today’s price of 795p, I’m up around 75%. But at some point, someone will get burned. I’ve got a nice safety net now. New buyers won’t have that.

Rolls-Royce is now a £66bn company. It’s a lot bigger than it was, but could be bigger still. I think it still has bags of potential and long-sighted investors should still consider buying it, especially on a dip.