Down 16% in a month, is this ultra-luxury stock now a no-brainer buy for my ISA and SIPP?

One share I have in both my Stocks and Shares ISA and SIPP portfolios is Ferrari (NYSE: RACE). While the iconic Italian sportscar company likely needs no introductions, it’s far from any old car stock.

No, Ferrari is valued as an ultra-luxury brand. This is why the stock is often ranked among peers like Hermès International and LVMH (Moet Hennessy Louis Vuitton) rather than grubby carmakers like Stellantis and Ford.

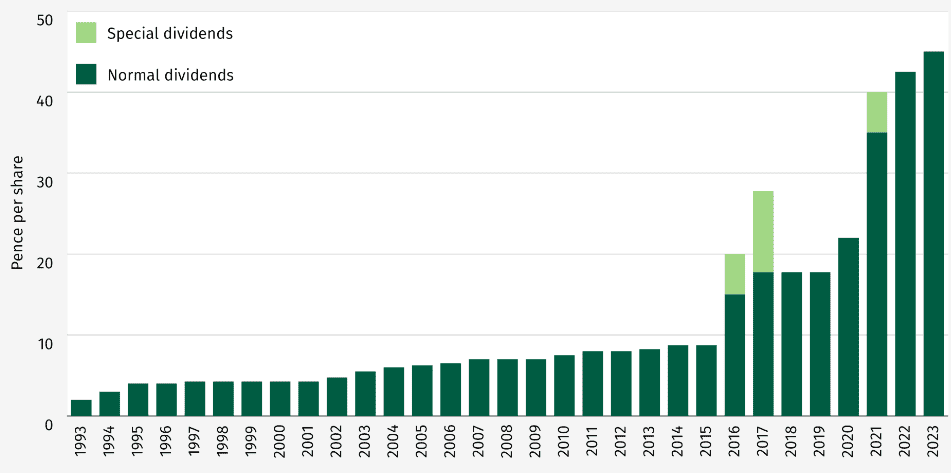

While the stock has raced 185% higher in five years, it’s fallen 16% in just over a month. This pullback has prompted analysts at both Barclays and Kepler Cheuvreux to upgrade Ferrari stock to Buy from Hold.

Barclays said the company retains relative “safe-haven” status compared to other European automakers hit by US tariffs. Starting on 2 April, Ferrari will hike prices by up to 10% on some models in the US. This demonstrates the company’s pricing power.

Meanwhile, Kepler said: “This is the pit stop we were long awaiting to turn more positive.”

But should I buy more shares on the dip?

Safe haven

For starters, I agree that Ferrari stock is somewhat of a safe haven. President Trump’s 25% tariffs on auto imports aims to encourage more US car manufacturing. But Ferrari exclusively manufactures its supercars in Maranello, northern Italy, and that won’t be changing.

Customers value the fact that the cars are largely hand-assembled in the same historic factory in Italy. This craftmanship and heritage is an important part of the brand’s appeal.

Meanwhile, the company limits production to maintain exclusivity. As a result, the order backlog extends into early 2027 due to incredible demand.

In other words, you can’t just go out and buy a new Ferrari, even if you have the money. And existing owners have a far better chance of securing limited-edition models than newbies.

The result is extraordinary earnings visibility, which investors value highly. As long as the order book extends two years into the future, I think the stock will carry a significant premium to the wider market.

Of course, we can grumble about how large that premium should be, but the fact the company deserves one is hardly in doubt. Right now, the forward price-to-earnings ratio is 43, which is lower than a few months ago (just over 50).

Marginal margin pressure

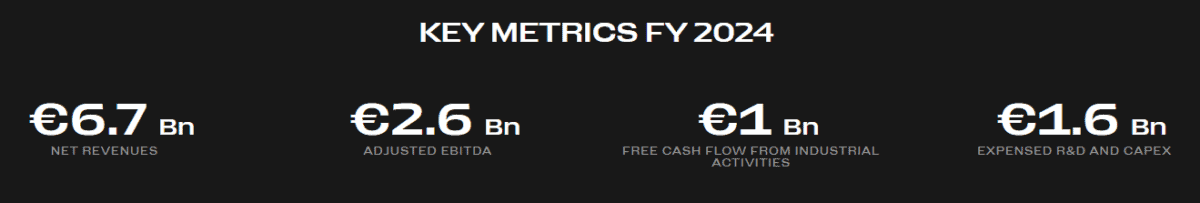

Last year, revenue rose 11.8% to €6.7bn. Shipments totalled 13,752 units, up just 1%, yet net profit jumped 21% to just over €1.5bn.

The main risk I see is some sort of damage to the brand. Ferrari takes incredible care of its reputation, but no brand is entirely immune.

It’s also worth noting that management sees a potential 50 basis point hit to margins this year due to tariffs. Then again, Ferrari’s operating margin was 28.3% last year, so it has a fair bit of flexibility.

My move

Whether we’re comfortable with it or not, the rich are getting richer around the world. And that is undoubtedly a very supportive trend for ultra-luxury brands like Ferrari.

I already have a somewhat large position across my ISA and SIPP. The 16% dip isn’t large enough to justify me making it even bigger.

But for investors wanting to invest in the rising global wealth theme, I think Ferrari stock is still worth considering as a long-term holding.