This 10.6% yielding dividend share goes ex-dividend tomorrow (3 April)!

Ithaca Energy (LSE: ITH) is the fifth-highest yielding dividend share on the FTSE 250. With a huge 10.6% yield, it makes an attractive proposition for income investors.

What’s more, it goes ex-dividend tomorrow (3 April). That means any shares bought after that day won’t qualify for the next payout.

So should income investors consider sinking some cash into the stock before tomorrow?

Let’s have a look.

A promising energy stock

Ithaca Energy is a UK-based oil and gas company and subsidiary of the Israeli-owned Delek Group. It operates in the North Sea off the coast of Scotland, where it has headquarters in Aberdeen. It’s one of the largest energy firms on the FTSE 250 with a market cap of £2.63bn, slightly behind rival Harbour Energy at £3bn.

For a relatively new company, it financials look good. Although revenue slipped slightly in 2024, it still managed to post a pre-tax profit of $334.3m — up 11% from 2023.

This may have been boosted by the recent acquisition of assets from rival Eni UK. This helped ramp up production by 14.2% to 80,200 barrels of oil equivalent per day (boepd). It now expects to reach 115,000 boepd in its 2025 full-year results.

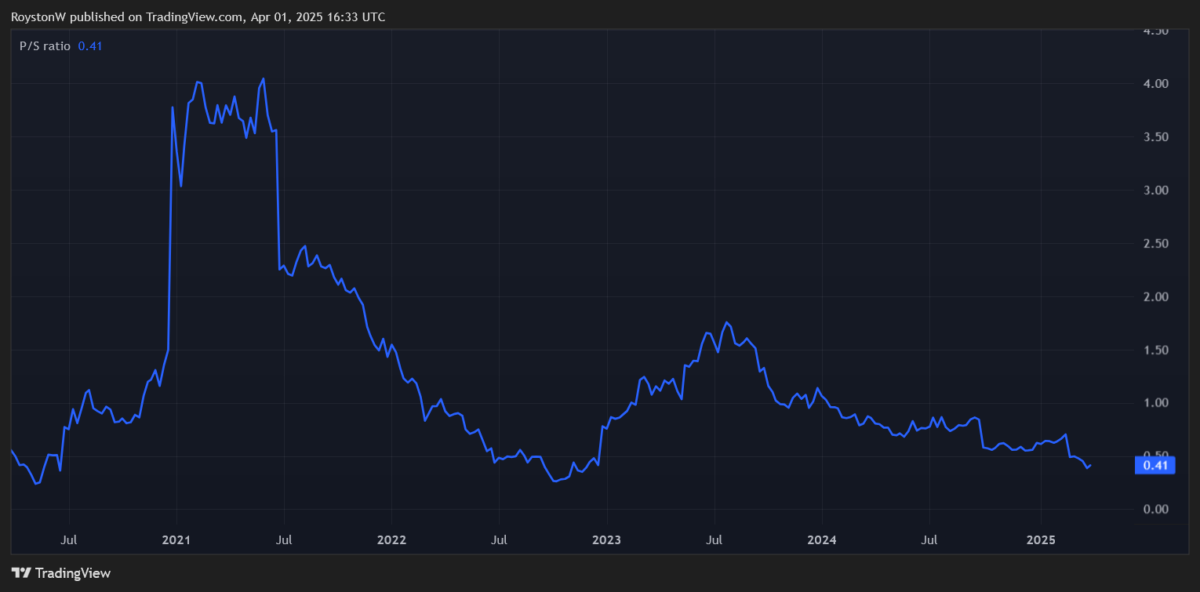

Although the stock is down 30% since listing two and half years ago, recent performance has been promising. Since hitting a low of approximately 96p per share in mid-November last year, it’s climbed 67% to 161p.

That’s an impressive recovery — but does that mean investors missed out on the best gains?

Maybe not.

Growth potential and risks

Oil and gas is a famously volatile industry, plagued by unpredictable supplies and a multitude of environmental risks. Revenues can be difficult to predict and consequently, share prices can fluctuate wildly.

But Ithaca seems on track to enjoy a good year. After posting its most recent results for 2024, the stock surged 9%, reflecting positive investor sentiment. This was likely attributed to confidence in its next development, the Rosebank project. Despite environmental challenges, it now feels certain the project will continue as planned.

But these plans could still be derailed by further regulatory hurdles. Plus, with a 10% streamlining reduction planned for its workforce, developments could be delayed.

It also continues to face profit risks from the UK government’s energy profits levy, with the company projecting cash tax payments between $235m and $265m for 2025.

The main point: dividends

Which brings us to the key point in question: dividends.

With the stock going ex-dividend tomorrow, it seems logical to consider investing in some today. It all but guarantees an immediate 10% return on the investment — barring any price changes between now and 25 April, when the payment is made.

But buying a stock purely for the next dividend doesn’t meet the Foolish ideology of investing for the long-term. Ithaca may have an attractive yield but its only been paying dividends for two years.

In the investment world, that’s no time at all — and it’s already made a 44% reduction in that short time.

That simply isn’t sufficient to confirm its reliability as a dividend stock. While I like its prospects and think it may eventually be a top dividend contender, I wouldn’t consider investing in it today.