How much would a 40-year-old need to invest in an ISA to earn a £2k monthly passive income in retirement?

The Stocks and Shares ISA can significantly boost an investor’s chances of building wealth for retirement. Being shielded from capital gains tax and dividend tax — which over time can total tens of thousands of pounds — can eventually yield an impressive passive income.

Exactly how much an individual needs to invest for a decent second income depends on what they invest in. But with a balanced portfolio of FTSE 100 and S&P 500 shares, I’m optimistic that investors could enjoy a £2k passive income by the time they retire.

Let me show you why.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Buying UK and US shares

Diversification is an essential part of long-term investing, allowing individuals to spread risk and realise a spectrum of growth and income opportunities. By providing around 600 companies to choose from, a strategy focused on FTSE 100 and S&P 500 shares can help individuals effectively achieve this.

The S&P 500’s large weighting of growth shares can facilitate strong capital gains over time as share prices respond to rising earnings. And the UK blue-chip index is packed with dividend shares that provide a reliable and healthy passive income (the forward dividend yield is currently around 3.5%). So it’s a powerful combination, in my view.

Strong returns

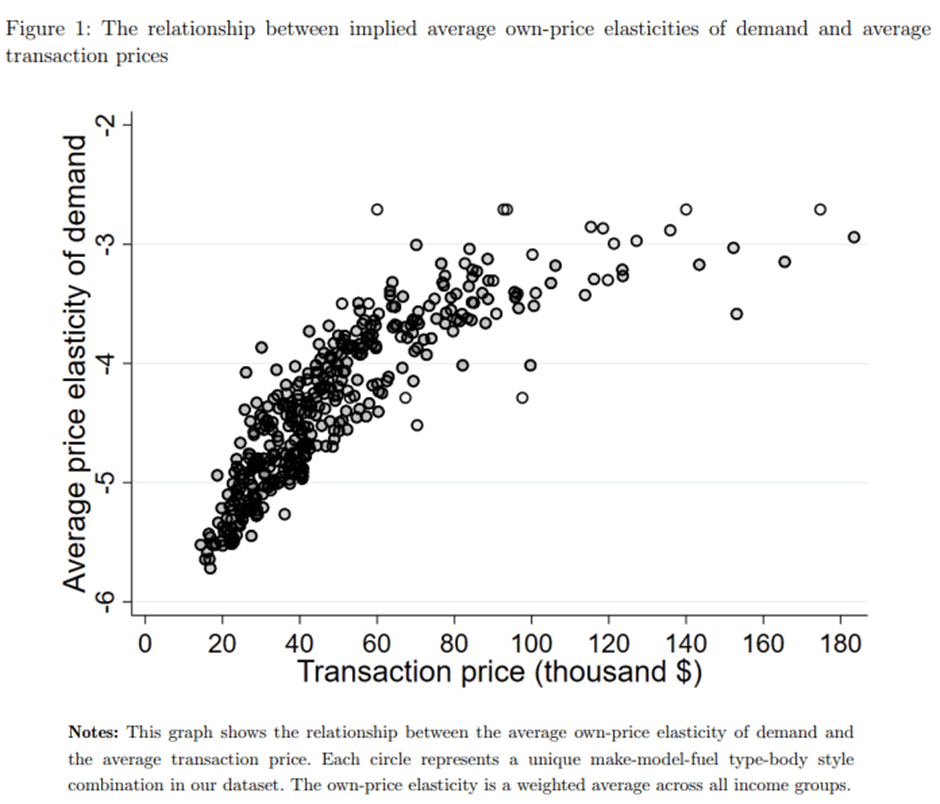

The earlier the investment journey begins — thus allowing more time to grow wealth — the better. But previous long-term returns of UK and US shares (shown below) suggests even those late to the party can build a big nest egg:

| Index | Average annual return (Feb 2015 – Feb 2025) |

|---|---|

| FTSE 100 | 6.3% |

| S&P 500 | 12.4% |

Let’s say a 40-year old’s looking to make a £2,000 monthly passive income in retirement at the State Pension age of 68. If they invested just under £250 equally across the Footsie and the S&P each month in that time (£246 to be exact), they could have an ISA worth roughly £400,000 to retire on. That’s based on a long-term average return of 9.4% across both indices.

There’s then multiple ways they can use this to generate income, like purchasing an annuity or drawing down a percentage of the fund each year. Another popular option is to buy dividend shares, which throw off cash while offering the potential for further growth.

If our middle-aged investor selected 6%-yielding dividend stocks, they would hit that magic £2k monthly income target.

A FTSE 100 hero

To build that £400k portfolio needed for such a passive income, they could invest in individual shares, tracker funds, investment trusts, or a mix of all three.

One share I think would be worth serious consideration is Legal & General (LSE:LGEN), which has the potential to deliver significant capital gains and dividends over time. As a major life insurance, wealth services and retirement product provider, it has multiple ways to capitalise on the world’s growing elderly population. It also stands to gain as rising uncertainty about the future of state benefits boosts the importance of financial planning.

While it may struggle to grow profits during economic downturns, its exceptional cash generation means Legal & General shares (which currently yield a huge 9%) should at the very least continue providing a solid dividend income. Payouts here have risen during 12 of the last 13 years.