Here’s my Stocks and Shares ISA plan for 2025-26

By the time Monday (7 April) comes around, the Stocks and Shares ISA contribution limit will have reset. And I’ve been figuring out my plan for how I want to approach the new financial year.

As usual, my ambition is to invest as much as possible in my ISA – the tax benefits make it clearly worth it, in my view. But this year I’m in a slightly unusual situation.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Investing strategies

Normally, I’d be in a position of choosing between investing as much as I can as soon as possible, or focusing on investing regularly over the year. There are merits to both.

The advantage of investing earlier is dividends. Other things being equal, owning a company’s shares for longer means there’s more time to collect cash returns from the business.

The benefit of investing regularly is it eliminates the need to work out when stocks are cheap. As long as share prices go up over time, buying at every time should yield good results.

There is however, a third option that’s available to me this year. And it involves moving some of the investments I have in other accounts into my ISA.

Transferring

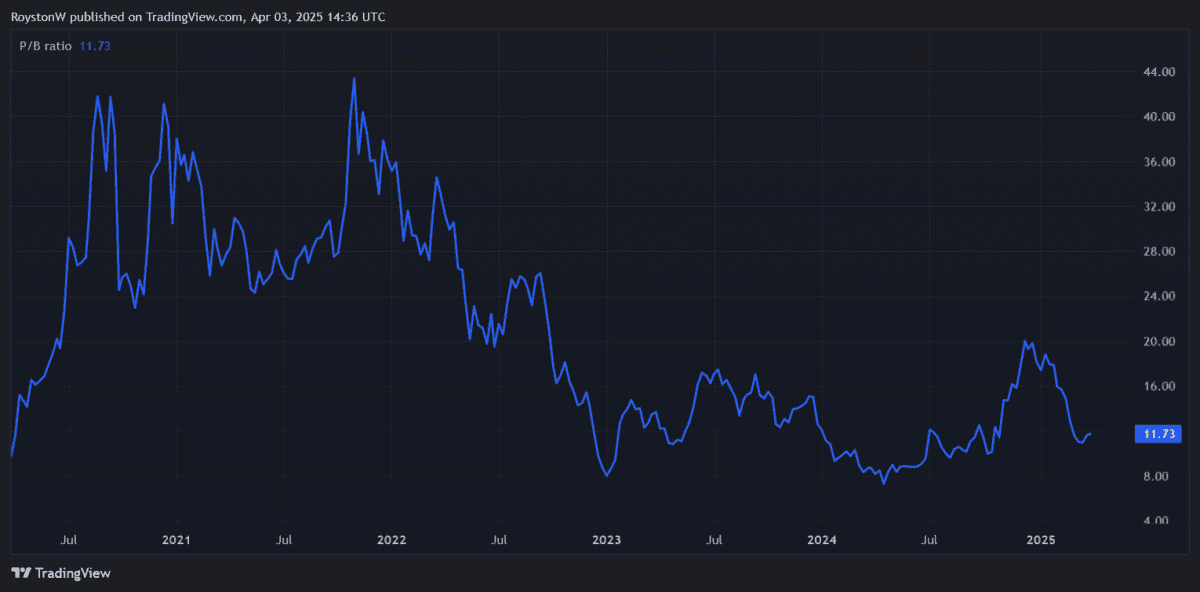

I have a few investments that I own in taxable accounts and transferring them into my ISA could be beneficial. A good example is Diageo (LSE:DGE).

Moving my Diageo shares to my ISA would obviously help me avoid dividend tax. But there’s another reason I think this could be an attractive strategy. Like a lot of investors, I’m down on my investment in Diageo. But that means I could sell the stock and record an ‘allowable loss’, which I could use to offset gains I’ve made elsewhere.

Doing this would bring down the amount I owe in capital gains tax for this year. And while I’d have to pay stamp duty to buy the shares in my ISA, I think this could be a good plan.

Do I even want Diageo shares?

Of course, I don’t have to keep Diageo shares at all – I could just sell them and buy something else. And it’s easy to see why I might do this given the company’s recent struggles.

The ongoing tariff issues in the US are a particularly annoying challenge. But over the long term, I think a strong competitive position across the Atlantic is likely to be a big advantage.

Alcohol distribution in the US is somewhat unique, mostly as a result of Prohibition. Rather than negotiating prices directly with producers, retailers go through wholesale distributors. This tends to result in higher margins for the likes of Diageo. This means a strong position in the US is a big advantage for the company – and it’s one that’s still very much intact.

Silver linings

My Diageo investment hasn’t exactly gone to plan, so far. But the chance to sell it at a loss and offset my capital gains liabilities might just be a silver lining to this particular cloud.

That’s my plan for my Stocks and Shares ISA. It offers investors protection from taxes on dividends and capital gains and I’m hoping to get as much as I can from it.