Down 44% this year, could the Aston Martin share price bounce back?

Aston Martin (LSE: AML) seems to have a lot going for it. Its sleek cars sell for a high price thanks to a well-heeled customer base. The same however, cannot be said of its shares. The Aston Martin share price has tumbled 44% so far in 2025 and 88% over the past five years.

Selling for pennies, could this be a recovery play that deserves a place in my portfolio?

The problem with Aston Martin shares

For now, at least, my answer is a firm no. The share price fall reflects a number of problems faced by Aston Martin. As I see it though, one problem looms above all others. In short, the company has not yet demonstrated it can convert sales into profits.

I am also put off my the balance sheet. The luxury carmaker ended last year with net debt of £1.1bn, close to double its current market capitalisation of £563m.

But again, I see the problem as being the business model. If Aston Martin could figure out how to make money, it would be in a stronger position to pay down that debt.

For now though, the business remains heavily lossmaking. Last year saw the pre-tax loss rise to £289m.

The company has some possible fixes

In the past, the company has raised cash by issuing more shares. It could decide to do that again and use the proceeds to improve its balance sheet, although that would dilute existing shareholders. That could hurt not help the Aston Martin share price in the short term, although over the longer term I think a healthier balance sheet is in the company’s best interests.

But even setting aside the debt, Aston Martin’s business model is currently not working, in my view. Last year, the operating loss was £100m. That was a slight improvement on the previous year, but it still means the company is losing over £16k on average for every car it sold on a wholesale basis.

Maybe that is fixable. The business’s premium brand and loyal following gives it pricing power. It could increase the selling price of vehicles without necessarily hurting sales.

It also sells pricy special edition cars – by changing the mix of products sold, Aston Martin may be able to generate more revenue without necessarily needing to sell higher volumes.

Things may get worse from here

But that has been true for some years already and the company has not yet proven its business model can be consistently profitable. Meanwhile, economic uncertainty could now dent demand for high-end vehicles.

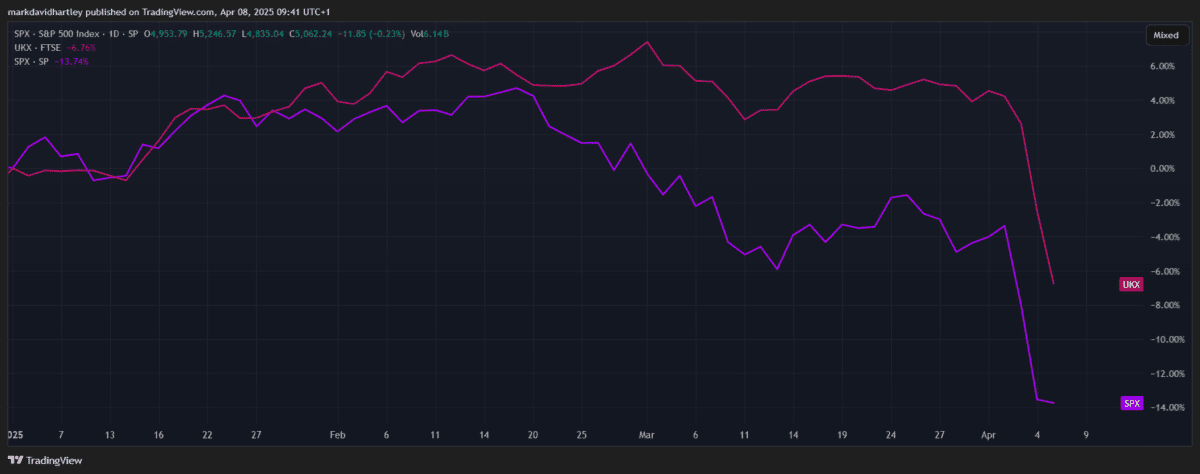

Tariffs are another risk. The Americas was the company’s key sales territory last year, representing 32% of wholesale volumes. Aston Martin makes its cars in England so the latest tariff disputes could hurt sales in the US.

Heading into a possible crisis from a position of strength can be challenging enough. But I reckon Aston Martin potentially faces serious short-term challenges to its sales while the base business is already failing to make money.

I would prefer to invest in a proven company that I think has higher chances of long-term success. Despite the price being in pennies, I will not be adding Aston Martin shares to my portfolio.