The renewable energy stocks I’d buy right now

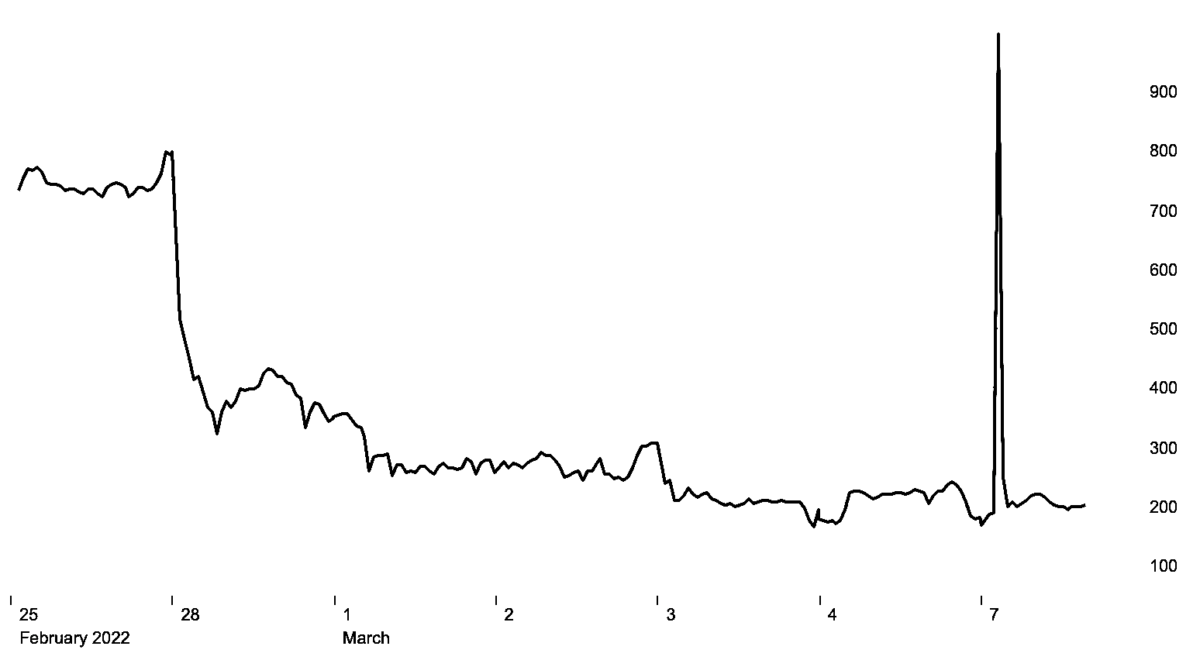

The rapidly deteriorating geopolitical environment in Eastern Europe is creating a challenge for investors. Hydrocarbon prices have exploded higher as talk of sanctions against Russian oil and gas exports is becoming more widespread.

The impact these higher prices will have on the global economy is impossible to predict. It will raise the cost of doing business for every single enterprise. Governments are planning to get around this issue by investing more in renewable energy.

I think this presents a fantastic opportunity for investors. The renewable energy industry was already booming before the crisis. Now it looks as if more money is going to flood the sector.

Against this backdrop, there are a couple of renewable energy stocks I would buy for my portfolio right now. I think these companies stand to benefit more than most from the current environment.

Renewable energy stocks to buy

At the top of the list is wind farm owner and operator Greencoat UK Wind. The company is the largest publicly traded wind farm operator in the UK, and it has a growing portfolio of wind assets. Rising energy prices could produce windfall profits for the corporation. This could free up more capital for management to invest in other deals and expand the portfolio further.

Still, as I noted above, this is a competitive sector. As money floods into the renewable energy industry, Greencoat might find it harder to deploy capital at attractive rates of return. This is something I will be keeping an eye on as we advance.

Another company I believe will benefit from the current situation is the Gore Street Energy Storage Fund. As the UK energy sector invests more in renewables, it will also require more batteries systems. Battery and energy storage systems meet an essential part of the renewable energy network as they help balance the network during periods of low solar or wind generation.

Gore Street Energy is one of the best ways to invest in this theme, in my view. It is run by an experienced management team, which is planning a substantial increase in capacity over the next few years.

One of the main challenges the company may face is competition. Additional regulatory constraints could also impact growth. Even after considering the challenges, I would buy the stock alongside Greencoat in my portfolio.

Long-term buy

A highly speculative area of the renewable energy market is hydrogen energy. I would like to have some exposure to this market in my portfolio, even though it is a high-risk investment.

Ceres Power is working with some of the world’s largest industrial companies to licence its hydrogen technology. It is already generating revenues from the sales, and 2022 could be an inflexion year for the group as revenues continue to grow.

Even though it could be years before the company is profitable, I would add this stock to my portfolio as a way to take part in the growth of this budding industry.

Rupert Hargreaves has no position in any of the shares mentioned. The Motley Fool UK has recommended Greencoat UK Wind. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.