Here’s the FTSE 100 stock UK investors have been buying and selling this week

Volatile share prices have created a lot of stock market interest this week. But while the big moves have come from the US, UK investors have been focusing on the FTSE 100.

Data from AJ Bell and Hargreaves Lansdown indicates that UK retail investors have been focusing on a handful of names. And one in particular stands out.

Buying and selling

In terms of what investors have been buying, the lists are identical. Barclays and Rolls-Royce (LSE:RR) appear in opposite orders, but the five FTSE 100 names are the same.

Most popular shares bought by number of deals

| AJ Bell | Hargreaves Lansdown | |

| 1 | Barclays | Nvidia |

| 2 | Nvidia | Rolls-Royce |

| 3 | Legal & General | Legal & General |

| 4 | Rolls-Royce | Barclays |

| 5 | BP | BP |

Where things get really interesting though, is in terms of what investors have been selling. Rolls-Royce also appears to be the stock with the most sell orders from customers this week.

Most popular shares sold by number of deals

| AJ Bell | Hargreaves Lansdown | |

| 1 | Rolls-Royce | Rolls-Royce |

| 2 | Nvidia | Nvidia |

| 3 | BAE Systems | Lloyds Banking Group |

| 4 | Lloyds Banking Group | International Consolidated Airlines Group |

| 5 | Amazon | Scottish Mortgage Investment Trust |

It’s been an interesting week for the Rolls-Royce share price. The stock fell 21% before staging a 35% comeback, so investors have had chances to make – or lose – money in the short term.

For those with a long-term outlook though, I think it’s a reminder of the risks with the business. The stock’s been outstanding recently, but things can turn around quickly.

Recession risk

The possibility of a recession in the US is a significant risk for Rolls-Royce. Demand for air travel’s likely to drop in an economic slowdown and this is the company’s largest division.

In terms of tariffs, the picture’s a bit less clear. The company does have a significant manufacturing base in the US, which should help reduce the effect of tariffs.

Despite this, it’s probably worth noting that its largest competitor – GE Aerospace – has a bigger presence. So tariffs might tilt things in favour of the FTSE 100 firm’s rival.

Most importantly, none of this is under Rolls-Royce’s control. While all businesses face risks, it’s worth noting the extent to which the company depends on something it can’t influence.

Long-term investing

Investors with a long-term perspective however, might take a different view. When I buy shares, I intend to hold them for decades and I think a recession’s likely at some point.

That’s not to say the issue can be ignored entirely. If the company’s going to make less money because of a difficult macroeconomic environment, that’s relevant to what the stock’s worth.

My view with Rolls-Royce is that things are rarely as good or as bad as they seem. The firm operates in an industry where demand is naturally cyclical and investors have to factor this in.

Even with the big drop earlier this week, the stock still traded at a price-to-earnings (P/E) ratio of around 20. Given that things have been going well for the firm recently, I think that’s high.

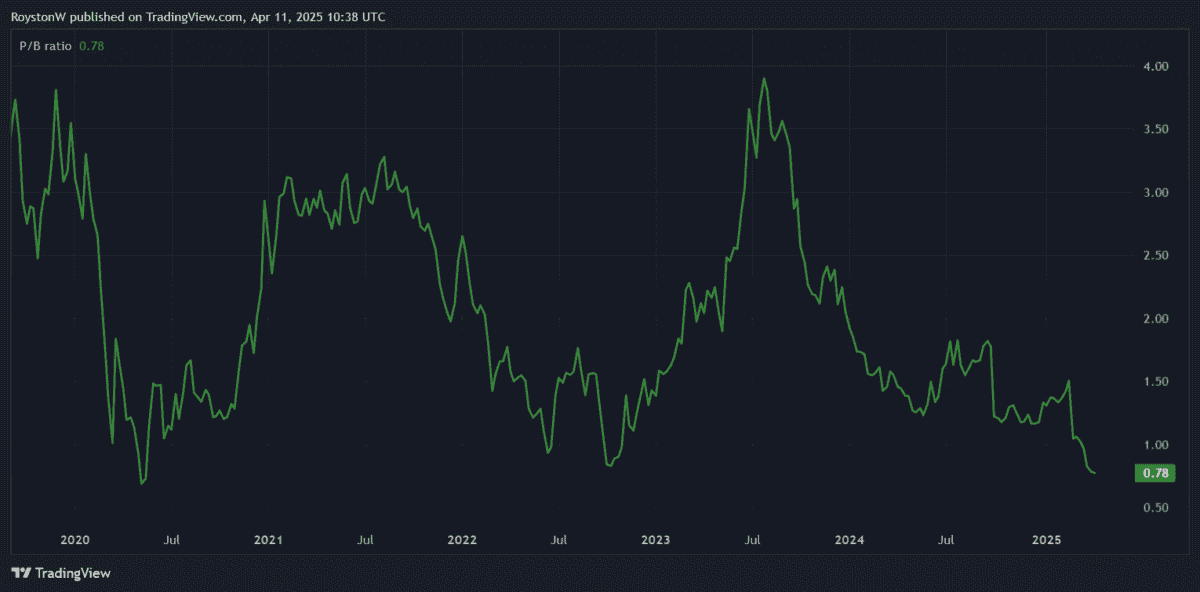

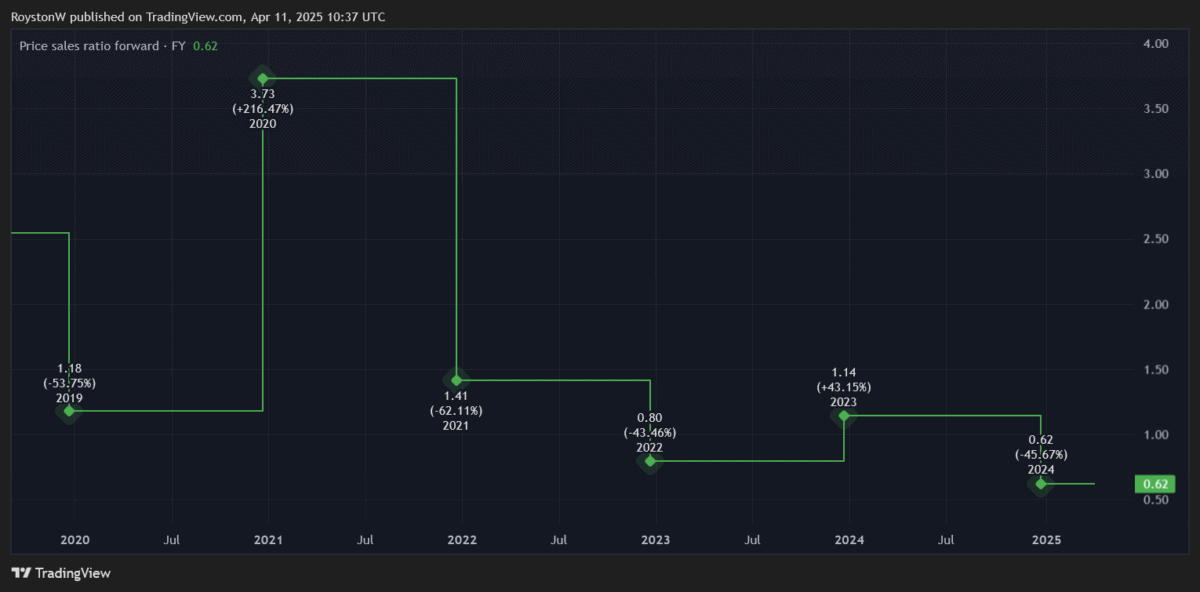

Independent thinking

I’ve been taking the opportunity to buy a FTSE 100 stock for my portfolio this week — but it isn’t Rolls-Royce. I can understand the recent interest, but I think there are better options available for me.