£1k in savings? Here’s how investors can aim to turn that into a £9,600-a-year second income

I’m aiming to build a high-and-rising second income from a portfolio of stocks and shares, and I don’t think I need to be an investment genius to do it. Which is pretty handy, because I don’t have the stock-picking skills of billionaire investor Warren Buffett. Hard experience has taught me that.

The truth is most of us don’t. But that’s okay because private investors have one weapon at their disposal. Time.

Over the years and decades, building a diversified spread of FTSE 100 stocks can be a great way to turn relatively small sums into a juicy passive income. And it’s possible to get started with as little as £1,000 (or even less).

Generating a second income through shares isn’t without risks. Stock markets rise and fall all the time but over the years, history shows the returns beat almost every other asset class.

FTSE 100 shares are a great source of income

Even big UK blue-chips can be volatile. A good way to get round this is to invest in a spread of around 15-20 different stocks, prioritising solid, established names with loyal customers and track records of steadily rising dividends.

Cigarette maker British American Tobacco‘s (LSE: BATS) a brilliant example of the type of dividend stock the FTSE 100 excels in that’s worth considering.

Although smoking’s under constant regulatory pressure, British American Tobacco still shifts 500 billion sticks a year. Plus it’s making a big push into what it calls ‘smokeless products’.

Personally, I don’t buy tobacco stocks but it means I miss out on a brilliant source of dividend income. British American Tobacco has a trailing yield of 7.95%. Any share price growth comes on top of that. Last year, the stock grew 25% to give a total return of almost 33%.

There are risks, of course. Cigarettes kill. Vapes will meet growing resistance. It’s a competitive sector. But British American Tobacco has survived these threats, thanks to its range of strong brands.

Over the past 20 years, the FTSE 100’s delivered an average return of 6.9% a year, with all dividends reinvested. Investors could potentially beat that by picking individual stocks. But even if they don’t, UK shares will still build wealth over time.

At 6.9% a year, if an investor put £1,000 into the FTSE 100 at age 30 and left it in the market until they turned 68, they’d have £12,623. If they drew 5% of their pot each year, that would give them £631 of passive income in retirement.

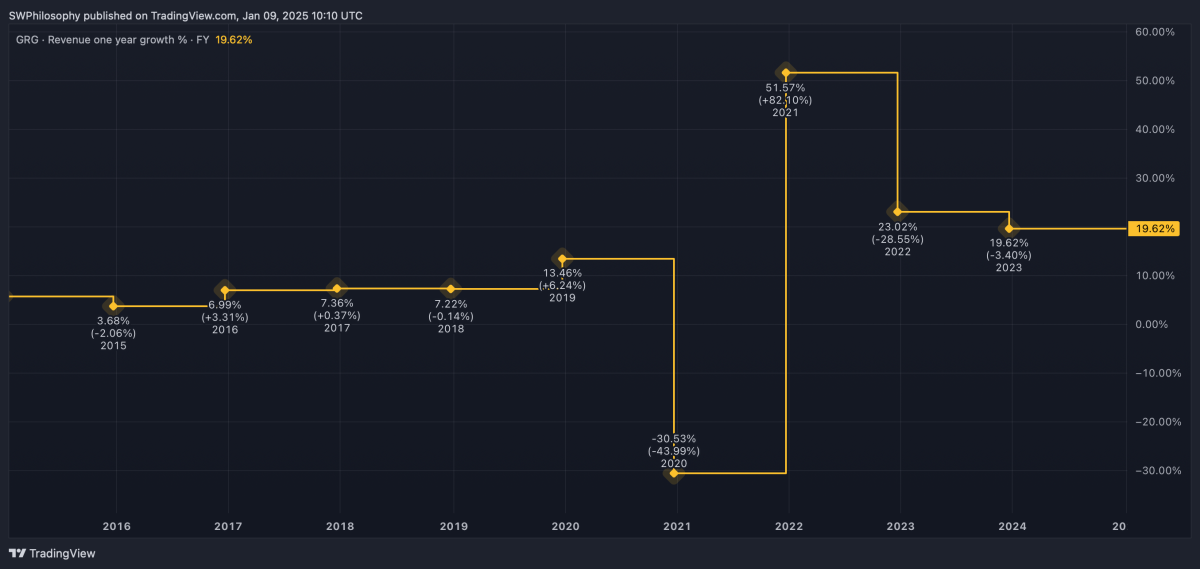

How stocks grow in value over time

That’s not riches, but it isn’t bad from an initial £1k. However, investing isn’t a case of just once-and-done. If they invested £1,000 a year for each of those 38 years, they’d have £192,691 by 68.

Again, this assumes average growth of 6.9% a year. Drawing 5% of that would give them a second annual income of £9,635.

There are no guarantees when investing. The investor could generate a lower return than 6.9% a year. On the other hand, they could get a higher one.

In practice, most of us should aim for more than £192,691 to secure a comfortable retirement so far into the future. That means investing more than £1k a year.

But it’s a start. And it isn’t necessary to be an investment genius to get cracking.