2 super-value FTSE 100 shares to consider right now!

Despite worries over the global economy and stubborn inflation, the FTSE 100 continues to make tracks at the start of 2025. In fact, the UK’s leading share index is now within a whisker of last May’s record highs above 8,400 points.

It’s been a strong couple of years for the Footsie. Yet long periods of underperformance mean that many top blue-chips are still trading at dirt cheap prices.

Here are two of my favourite FTSE 100 value shares today. Not only do they trade on rock-bottom price-to-earnings (P/E) ratios, they also carry tremendous market-beating dividend yields.

| FTSE 100 share | P/E ratio | Dividend yield |

|---|---|---|

| HSBC (LSE:HSBA) | 7.7 times | 6.5% |

| Rio Tinto (LSE:RIO) | 8.5 times | 6.6% |

Let me explain why I think they’re worth serious consideration.

Top bank

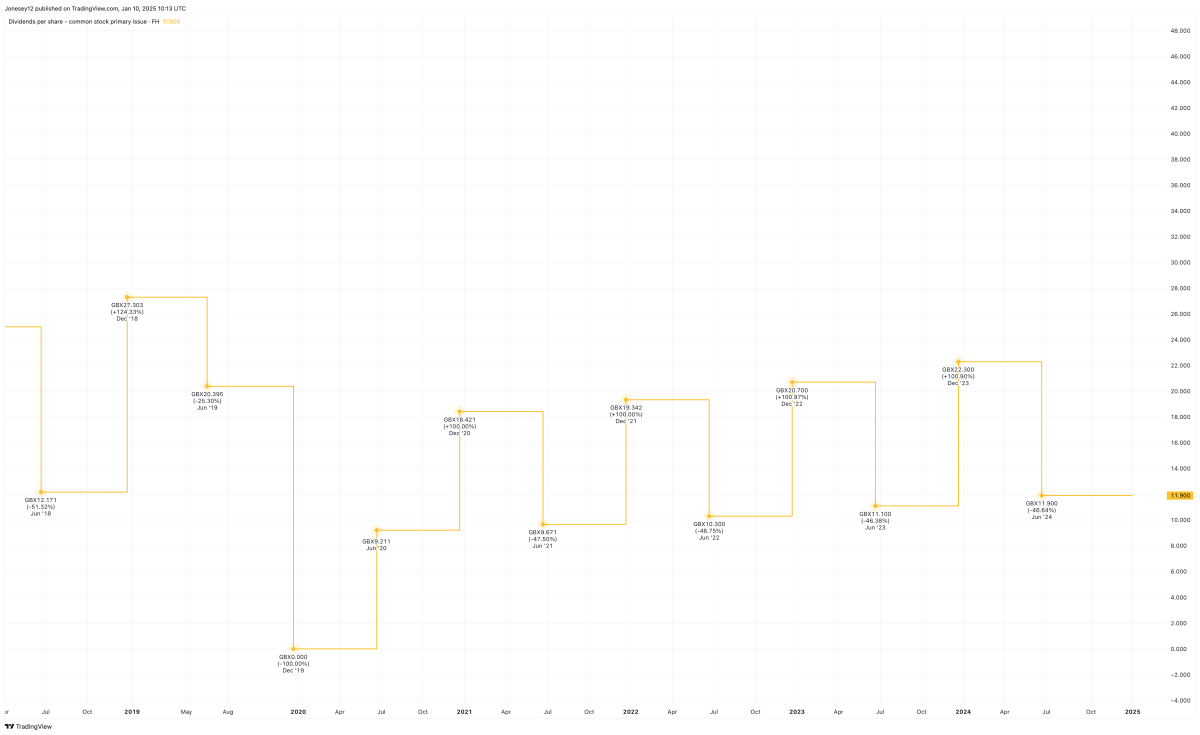

Asia-focused HSBC’s tipped to endure a slight earnings drop in 2025. This reflects in part the ongoing threat posed by China’s weak economy, and more specifically its slumping property sector.

But encouragingly, the bank’s so far managed to effectively navigate the tough trading environment. In the third quarter of 2024, it beat broker forecasts to post revenues and profits growth of 5% and 10% respectively.

I wouldn’t bet against HSBC beating full-year estimates for this year either, helped by ongoing efforts to accelerate cost cutting. According to Bloomberg, the bank’s targeting £3bn of savings through restructuring efforts that it aims to complete by June.

I think HSBC shares could deliver great long-term returns as financial product demand surges across its emerging markets. It has the scale and the brand power to supercharge its earnings growth, and plans to split its operations between ‘East’ and ‘West’ should help meet its goals.

Great miner

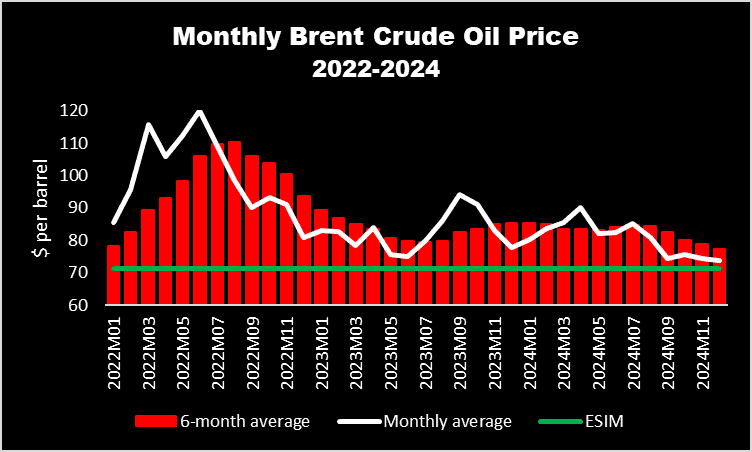

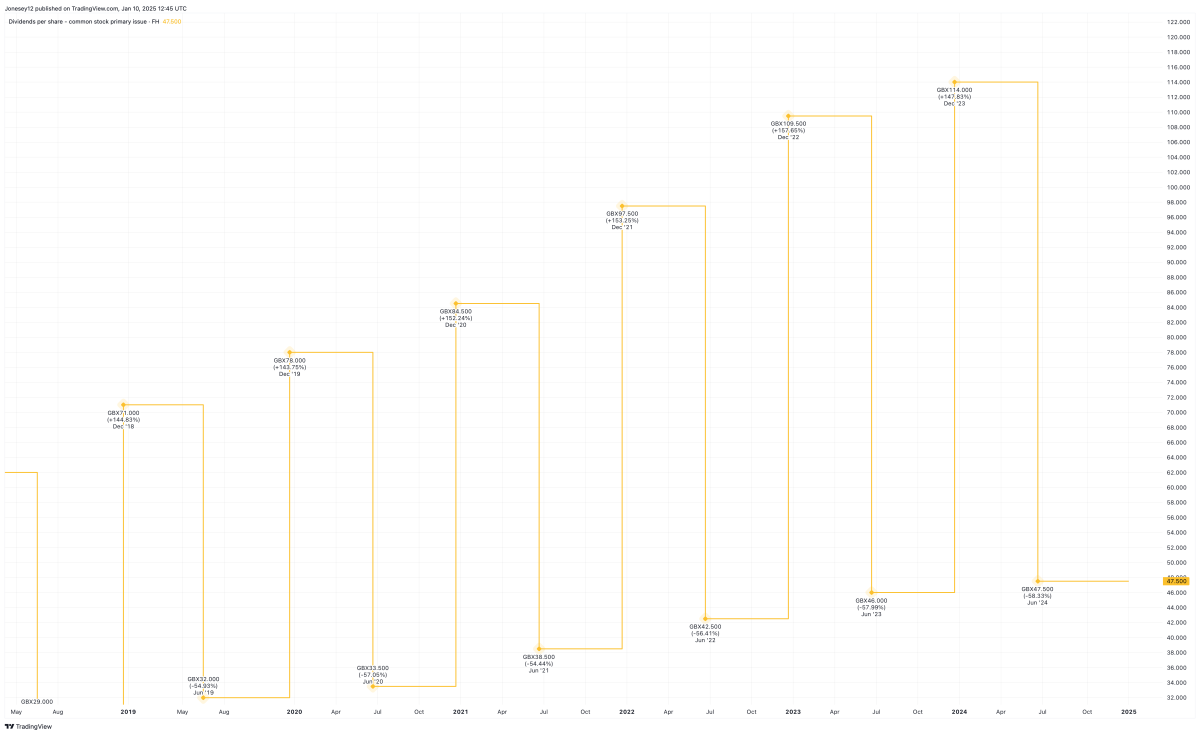

Rio Tinto’s another Footsie share expected to post a slight earnings dip in 2025. This also reflects problems in China’s commodities-hungry economy, allied with a broader slowdown of global growth.

Yet I believe it’s a value stock for patient investors to consider. I hold it in my own Stocks and Shares ISA and plan to increase my holdings when I next have spare cash to invest.

Over a longer time horizon, the outlook for major mining stocks like this remains compelling. Rio Tinto — which has a market-cap of £59bn — has the strength to weather temporary weakness in metal prices.

Expertise across a range of commodities including copper, iron ore and lithium means it’s well-positioned to capitalise on demand growth when the market upturn eventually comes. Factors like global decarbonisation, emerging market urbanisation and the growing digital economy should all lift industrial metals consumption substantially from current levels.

What’s more, a strong balance sheet gives Rio room to boost earnings growth through acquisitions and organic investment. Latest financials showed its net debt to underlying EBITDA ratio at just 0.4 times.