Here’s how much an investor would need in an ISA to earn a £10,000 second income this year (and every year!)

One straightforward way to earn a second income is to build a portfolio of dividend shares.

Not only does that involve little real work, it can also be lucrative. Step by step, here is how an investor could use that strategy to target £10K in passive income each year.

A lump sum is one way – but it’s not necessary

The dividend income will depend on how much is invested and what the average dividend yield is.

For example, using a 5% dividend yield, £10K in second income annually would require a £200K investment.

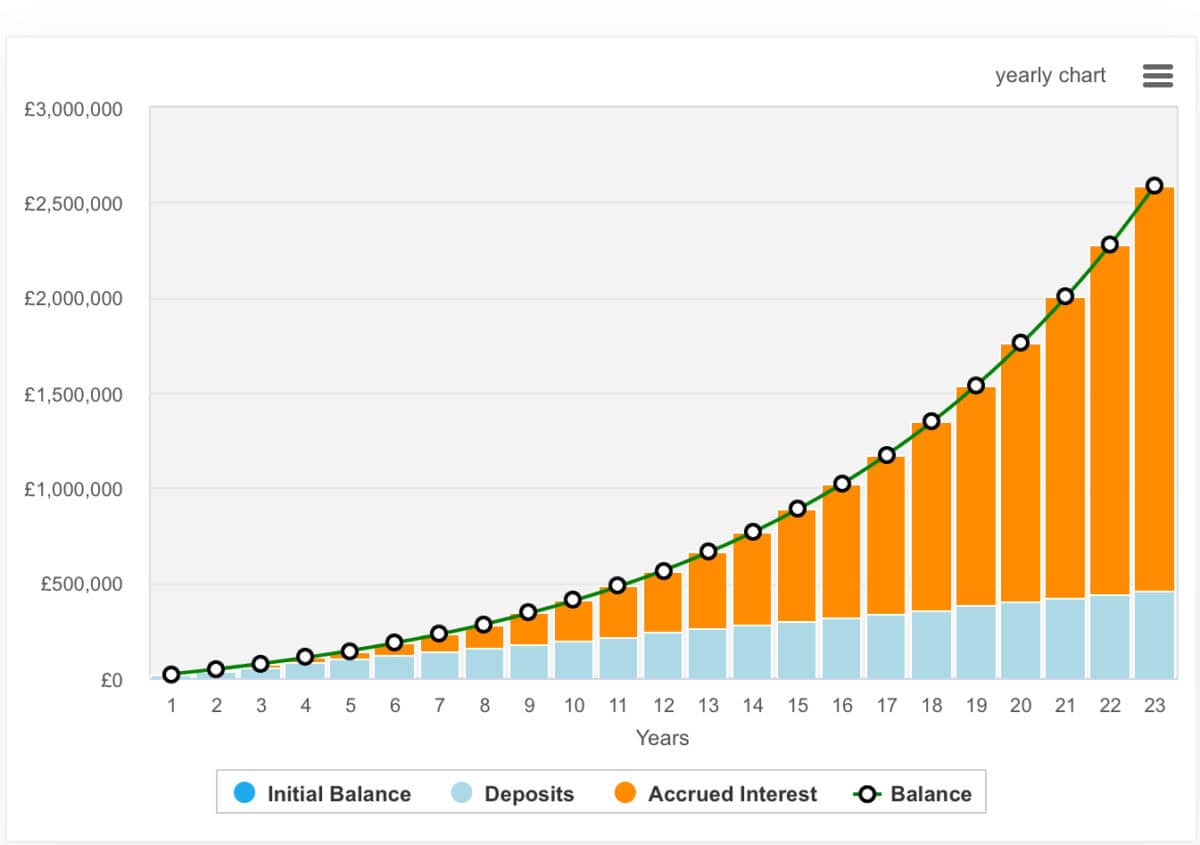

But an alternative method (and the one I use) is to try and build up to the income target over time by making regular contributions to an ISA.

Even £200 per week compounded at 5% annually could lead to a £200k portfolio. Sure, it would take 14 years. But as a long-term investor, that is music to my ears.

Finding shares to buy

An investor could also speed things up if the compound annual growth rate (i.e. share price movement plus any dividends) was higher than 5%. But dividends are never guaranteed – and share prices can go down as well as up.

So I never choose a share just because of its yield.

Rather, I try and find great companies I think have excellent long-term commercial prospects that in my opinion are not properly reflected in their current share price.

A short case study

That sounds well in theory, but what about the practice?

Let me illustrate with a share I own: footwear specialist Crocs (NASDAQ: CROX). Over the past five years, the Crocs share price has soared 149%: far, far above my 5% per year example.

I have missed that gain, as I am a fairly new shareholder. Fine. The thing is, even now, the company trades on a price-to-earnings ratio of just 7.

That seems almost absurdly cheap to me given the iconic brand and product, huge customer base, manufacturing management expertise and patented designs. I do not like Crocs — but I recognise a great business model when I see one.

Still, if the business is so good, why is it selling at that price – and why is it down 36% since June?

Its acquisition of the Hey Dude footwear brand has brought a host of problems and looks like increasingly bad value.

That is a risk to earnings. But I still think Crocs is a great business at a great price and plan to hold the shares.

Getting ready to invest

But wait. Crocs does not pay a dividend. So where would a second income come from in such a scenario?

Recall above I talked about a £200K portfolio invested at a 5% yield. If not starting with a lump sum, the investor does not need to invest in dividend shares immediately.

They can use a mixture of dividend and growth shares to build their portfolio value. Then, at the £200K mark, they could switch to just dividend shares.

If the investor diversifies and chooses the right shares, hopefully that £10K second income will keep coming (and maybe even growing) each year.

But they need a good way to buy and hold those shares, such as a Stocks and Shares ISA.