8.1x earnings & 0.67 PEG: this growth-focus FTSE bank could skyrocket

Banks were the best performing sector on the FTSE 100 last year, with Barclays and NatWest nearly doubling in value. Standard Chartered (LSE:STAN), a bank with a focus on growth markets in Asia, Africa, and the Middle East, also surged. In fact, the stock is up 78% over the past 12 months. Despite this elevated share price, I’m starting to wonder if Standard Chartered is a bargain hiding in plain sight. After all, the company’s valuation metrics scream ‘Buy’.

These valuation metrics are very appealing

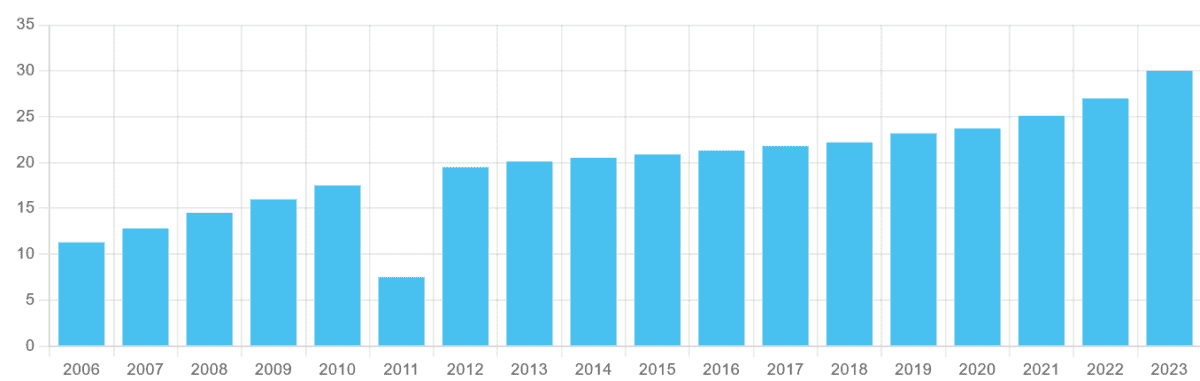

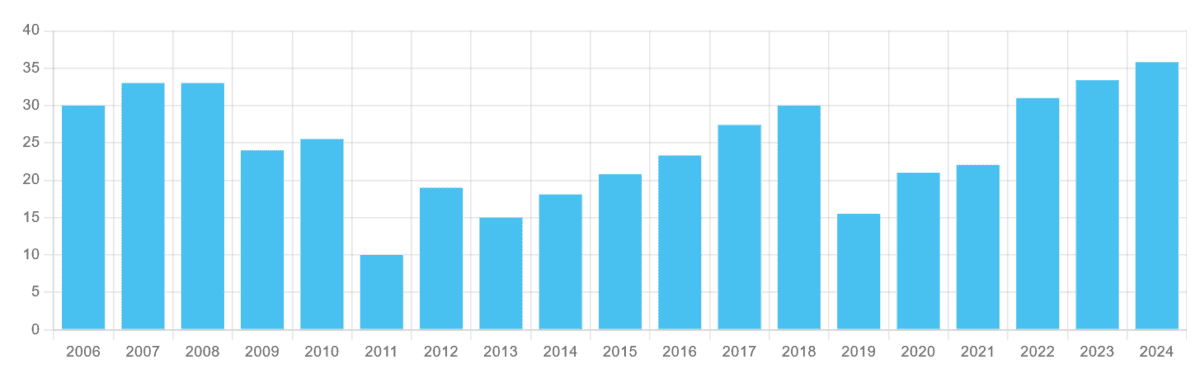

Standard Chartered’s valuation appears attractive, trading at a forward price-to-earnings (P/E) ratio of 8.1 times, representing a 35% discount to global financial peers. This is particularly noteworthy given the projected 12.1% annual earnings growth over the next three to five years, resulting in a highly appealing price-to-earnings-to-growth (PEG) ratio of 0.67. This is a near 50% discount to the global financial sector average.

Interestingly, UK-focused banks like Lloyds have typically traded with lower P/E ratios given the slow growth nature of the economy. However, Standard Chartered is even trading at a discount to Lloyds, which has a forward P/E of 9.6 times. This also suggests that Standard Chartered might be significantly undervalued, especially considering its exposure to high-growth emerging markets.

What’s more, Standard Chartered has a price-to-book (P/B) ratio of 0.76, representing a 40% discount versus the sector average. And for further context, JPMorgan — one of the most expensive banking stocks — has a P/B ratio of 2.3. In other words, investors are willing to pay a 130% premium for JPMorgan’s book, while discounting Standard Chartered.

This attractive valuation has not gone unnoticed, with CEO Bill Winters facing questions about it at Davos recently. “We’re still trading below book value, which doesn’t make any sense to me given the returns that we’re generating”, Winters told Bloomberg TV, adding that he thought the rallying share price had further to go.

The USP is also a risk

Standard Chartered’s unique selling proposition (USP) lies in its focus on leveraging the value of fast-growing economies. However, this strategy brings inherent risks for investors. Exposure to politically unstable regions, fluctuating currencies, and weaker regulatory frameworks can increase volatility. Additionally, unstable economic growth or systemic challenges in these markets may impact profitability. While its growth-focused approach offers significant potential rewards, investors must weigh these risks against the bank’s strategic positioning and broader market diversification.

All eyes on 21 February

Standard Chartered is set to report its Q4 and full-year earnings on 21 February. Interestingly, the banks that have reported to date have performed very well. This is typically a good sign for the sector. As such, I’m exploring buying the stock before the earnings date. It could skyrocket, especially if we see a strong earnings beat.