3 FTSE 250 dividend stocks to consider for passive income in 2025

Dividend stocks have long been a preferred way for UK investors to generate passive income. As inflation puts pressure on the economic landscape, investors are increasingly drawn to the reliable income that such shares offer.

Yields on the FTSE 250 are currently higher than normal as its performance lags behind the FTSE 100. This could be an opportunity.

My top UK dividend picks today

I’ve identified three UK stocks with attractive yields, strong financials and long-term potential that I think are worthy of further research.

Dunelm Group

The homewares and household goods retailer Dunelm Group operates approximately 80 stores across the country. It has a solid track record of increasing dividends for almost 20 years, from 3.8p a share to 43.5p. It has also paid a special dividend for the past four years, meaning its 4.5% reported yield has been closer to 8%.

But recent price activity has been less impressive, with the stock down 18% in the past five years. Most of the losses occurred during the 2022 market downturn, revealing the business’s sensitivity to economic troubles. This is a significant risk to consider as US trade policies could further disrupt the global economy this year.

Still, I feel the excellent dividend track record makes it worth considering.

OSB Group

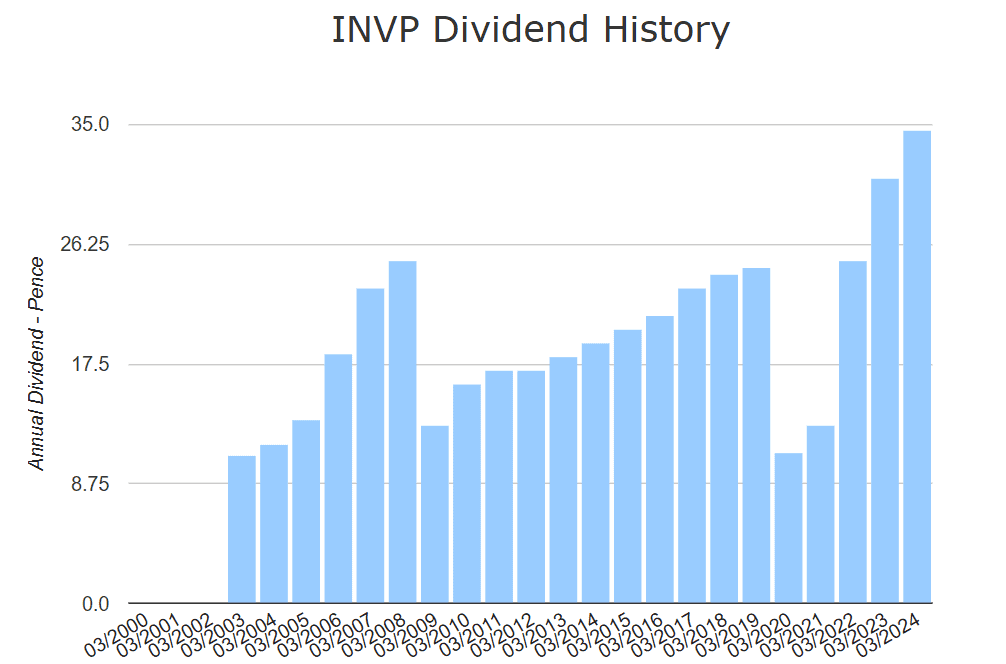

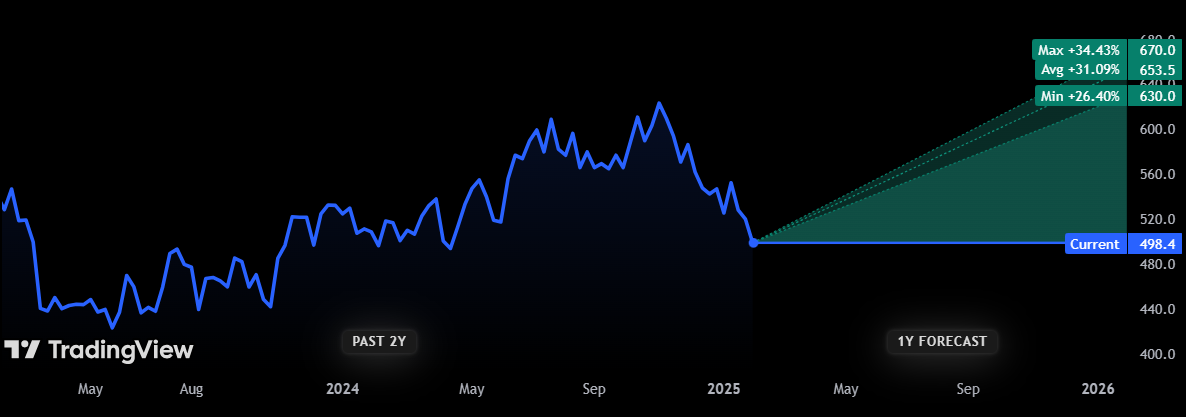

OSB Group (LSE: OSB) is a UK challenger bank based in Kent that offers specialised mortgage and loan products. It’s been paying dividends for 10 years, with a yield typically between 6% and 9.4%.

Currently, it appears to be undervalued, with a price-to-earnings (P/E) ratio of only 4.27 and a price-to-sales (P/S) ratio of 0.76. Those are both well below average, suggesting room for growth.

However, that could be difficult as it faces strong competition from the UK’s many large, established banks. In times of economic unrest, citizens tend to favour the perceived safety of brands they recognise. That’s a risk OSB must overcome if it hopes to continue growing.

Recent performance has been staggered, with the bank’s net margin falling to 7.8% in H1 2023 before recovering to 16.14% in H1 2024. The bank’s enterprise value lags, having fallen to £5.79bn in H1 2024 after peaking around £7.87bn in H1 2023.

As a shareholder, it has served me well and I believe investors would be smart to consider it.

Pets at Home

I’m not a pet owner but have long considered the potential of Pets at Home (LSE: PETS). Here’s why I think savvy investors should do likewise.

It operates through various segments, selling pet accessories, grooming and vet services. Over the past decade, it’s made several large dividend increases such as a near-50% jump in 2022. This affirms its dedication to shareholder returns.

But recent results underwhelmed shareholders, dragging the price down to a five-year low in November 2024. High inflation has forced consumers to cut down on expenses, threatening the company’s bottom line. There are signs it may drop this year but if it rises again, Pets could suffer further losses.

The full-year dividend has grown at a rate of 21.8% per year, from 5.4p in 2015 to 12.8p last year. As the price has fallen 50% since 2021, the yield has increased from 1.8% to 5.8%. This adds to the stock’s attractive valuation, with a P/E ratio of 11.7 and a P/S ratio of 0.72.