I asked ChatGPT to build the perfect passive income portfolio and here’s the result

Everyone has their own opinion on which are the best UK stocks to buy for a great passive income portfolio. The subjective nature of stock picking allows for a variety of choices. Further, some investors like to take on higher or lower risk than average, which impacts the potential yield on offer. I decided to get ChatGPT to objectively pick what it believes to be the ‘perfect’ portfolio, with some very interesting results!

Details of the bot’s choices

To begin with, the AI-powered bot told me that an investor should focus on high-yielding, resilient stocks across different sectors that are growing dividend payments. The main reason for this is that it ensures diversification, steady cash flow, and long-term sustainability. I regularly preach about these points, so I’m glad AI does too!

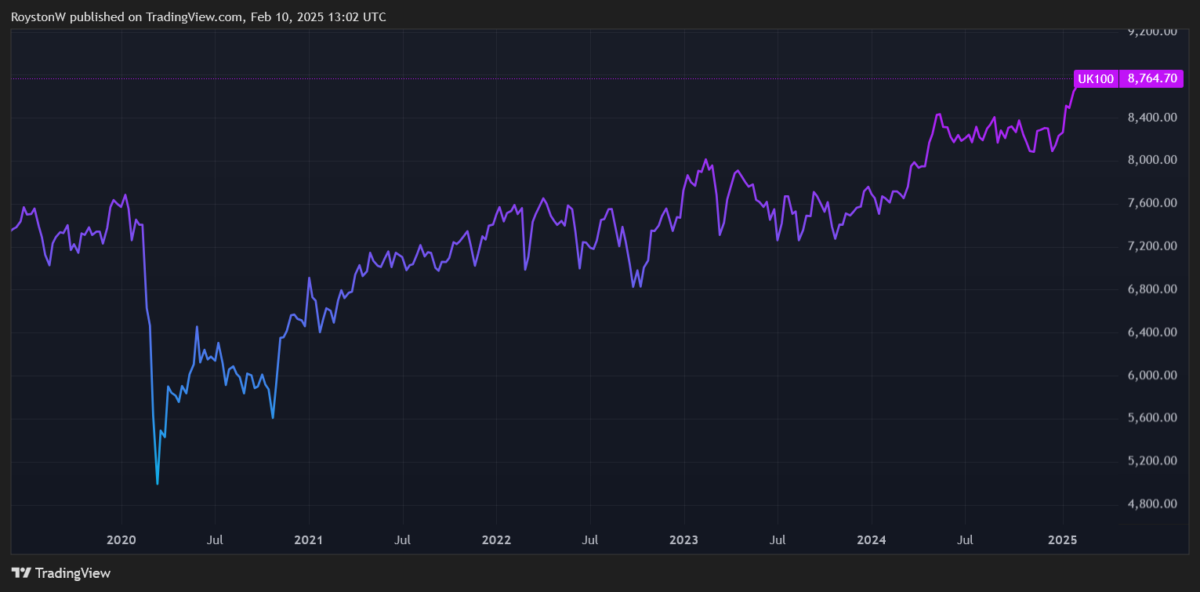

The portfolio provided aims to target an average dividend yield of 5%-6%. I thought this would be the case. The average dividend yield across the FTSE 100 is 3.46%. It makes sense that with some active stock picking, an investor could target an above-average yield. Yet at the same time, it’s not a super-high-risk goal. Some might want to target a yield of 7%-8% instead, being happy to buy some riskier stocks where the income maybe isn’t as stable.

Perhaps what impressed me the most was how ChatGPT split up the allocation into areas such as stability (suggesting National Grid and Unilever) and stocks with growth potential (BP, Legal & General and Tesco). It also suggested including some high-yield options selectively, such as Vodafone.

A stable inclusion

One suggestion it made was to consider buying Segro (LSE:SGRO) for long-term growth potential. The FTSE 100 real-estate logistics stock is down 17% over the past year. This is one factor that has pushed the dividend yield up to 4.01% right now.

The business owns and manages warehouses, distribution centres, and urban logistics hubs across the UK and Europe. The main way it makes money is via rental income from the leases. It has some large clients, such as Amazon, where long-term agreements provide a steady source of cash flow.

The share price should also reflect the property portfolio’s net asset value (NAV). Over time, the properties should appreciate in value, providing another source of potential profit.

As such, Segro could be considered a smart inclusion to a passive income portfolio, more on the steady but stable side. It hasn’t missed a dividend payment for over two decades!

However, there are risks involved. The latest half-year results showed that the valuation of the portfolio was flat, which isn’t great. Further, even though the company has no major debt maturities until 2026, the fact that interest rates could remain higher for longer is a concern for future financing needs.

The building blocks

In reality, there’s no such thing as a perfect income portfolio. After all, future dividends aren’t guaranteed. Yet based on my view of the stocks selected, ChatGPT did a surprisingly good job of picking ideas. Further, the principles of diversifying exposure and buying companies from different sectors was a key message it provided, which is exactly what I try to stick to with my investing. I still prefer to pick my own stocks though!