382 shares in this FTSE dividend gem could make investors £2,849 a year in passive income!

The FTSE 100’s Imperial Brands (LSE: IMB) remains one of my key passive income holdings.

Passive income is money made with minimal effort, as with stock dividends. And in 2024, the stock paid 153.42p a share, yielding 5.3% on the current £28.76 price.

Analysts forecast that the dividends will increase to 164p in 2025, 171.4p in 2026, and 176.2p in 2027. This will give respective yields based on present share price of 5.7%, 6%, and 6.1%.

How much can be made?

£11,000 is the average amount of savings in the UK, which would buy 382 shares in Imperial Brands.

So, investors considering such a holding would make £583 in dividends this year based on the 5.3% yield.

Over 10 years on the same basis – ignoring projected rises in return – this would increase to £5,830. And after 30 years on the same average yield, this would rise to £17,490.

This is a lot more than would be made from a standard UK savings account.

Supercharging the returns through compounding

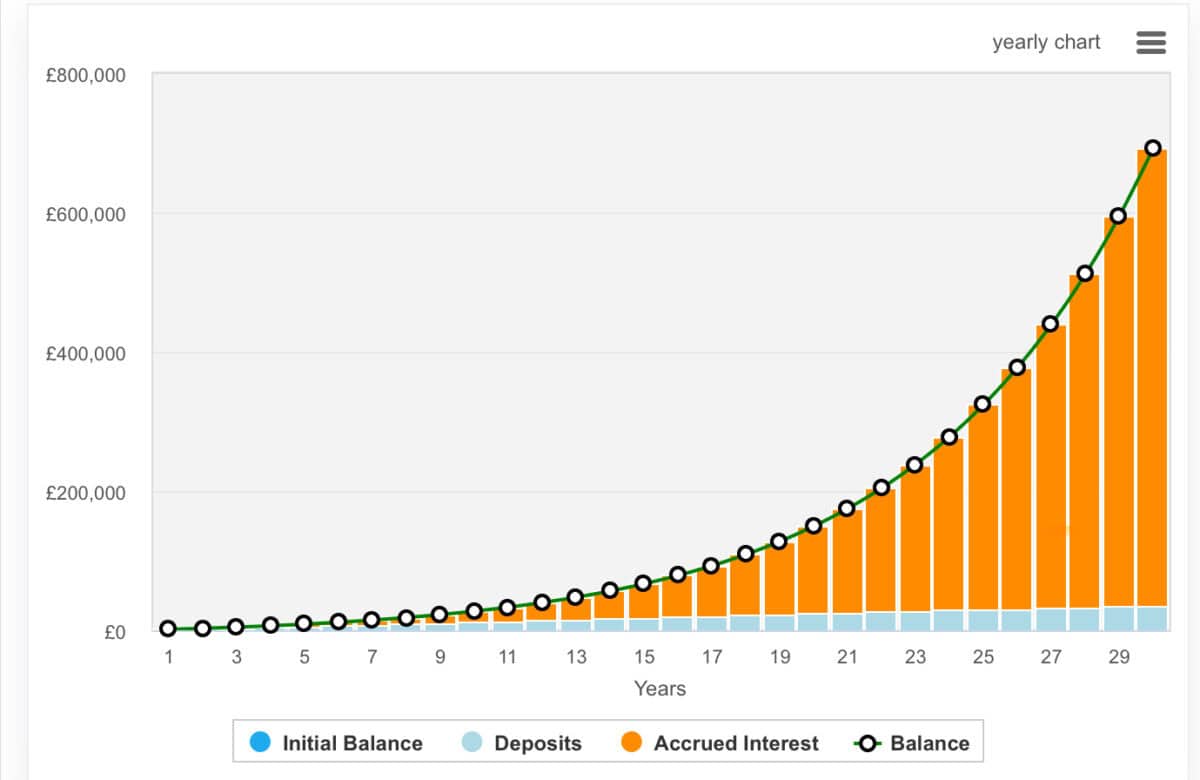

As good as these returns are, they could be vastly greater using the standard investment technique of ‘dividend compounding’.

This is similar to leaving interest in a savings account to gradually accrue over time. However, the effects of doing this with stock dividends can be extraordinary.

In Imperial Brands’ case, using this method on the same average 5.3% yield would generate £7,666 in dividends after 10 years, not £5,830.

After 30 years on the same basis, this would rise to £42,753 rather than £17,490.

Adding in the initial £11,000 investment, the holding would be worth £53,753. On the same 5.3% yield, this would pay £2,849 a year in passive income!

A potential share price bonus

When I bought Imperial Brands shares, they yielded much more than now. This is because a stock’s yield moves in opposite directions to its price. And this stock has risen 73% from its 5 March 12-month traded low of £16.62.

I think much of this has been down to ongoing share buybacks, which tend to support price gains. The firm has also posted some solid results over the past year.

Its 2024 numbers showed a 4.5% year-on-year rise in reported operating profit — to £3.55bn. Earnings per share jumped 19.1% to 300.7p.

That said, a stock can still have a lot of value in it despite such a price rise.

To find out if this is true with Imperial Brands, I ran a discounted cash flow analysis. Using other analysts’ future cashflow forecasts and my own, this shows the stock is 60% undervalued at £28.76.

Therefore, its fair value is technically £71.90, although market unpredictability might push it lower or higher.

Will I buy more of the stock?

A risk to the stock is cut-throat competition in the tobacco and nicotine replacements sector, which could squeeze its margins.

Nonetheless, the firm expects single-digit net revenue growth and mid-single-digit adjusted operating profit growth in 2025.

Additionally positive is the withdrawal of the US Food and Drug Administration’s planned ban on menthol cigarettes. These products comprise around 15% of Imperial Brands’ profits in the US.

Given their solid financial forecasts, strong yield and extreme undervaluation, I will be buying more of the stock very soon.