What’s gone wrong with the FTSE 100’s ‘King of Trainers’?

Since November 2024, the JD Sports (LSE:JD.) share price has been the worst performer on the FTSE 100.

After two profits warnings, nearly 25% has been wiped off the market cap of the sports fashion retailer. As a shareholder, I feel the pain.

However, I’ve no plans to sell my shares. I believe the stock currently offers tremendous value for money. And I’m expecting big things over the next few years.

I’m not alone. In January, the company’s chief executive bought £99,000 of the stock at an average price of 90p.

What’s going on?

The retailer’s recent problems have been blamed on a “volatile trading environment”. The UK economy’s struggling to grow and consumer confidence appears low.

To compound matters, the increase in employer’s National Insurance Contributions will have a significant impact on the company’s bottom line. Ironically, the chairman of JD Sports was one of 120 business leaders who signed a pre-election letter endorsing the Labour Party’s economic policies, and calling for a change of government. As they say, be careful what you wish for!

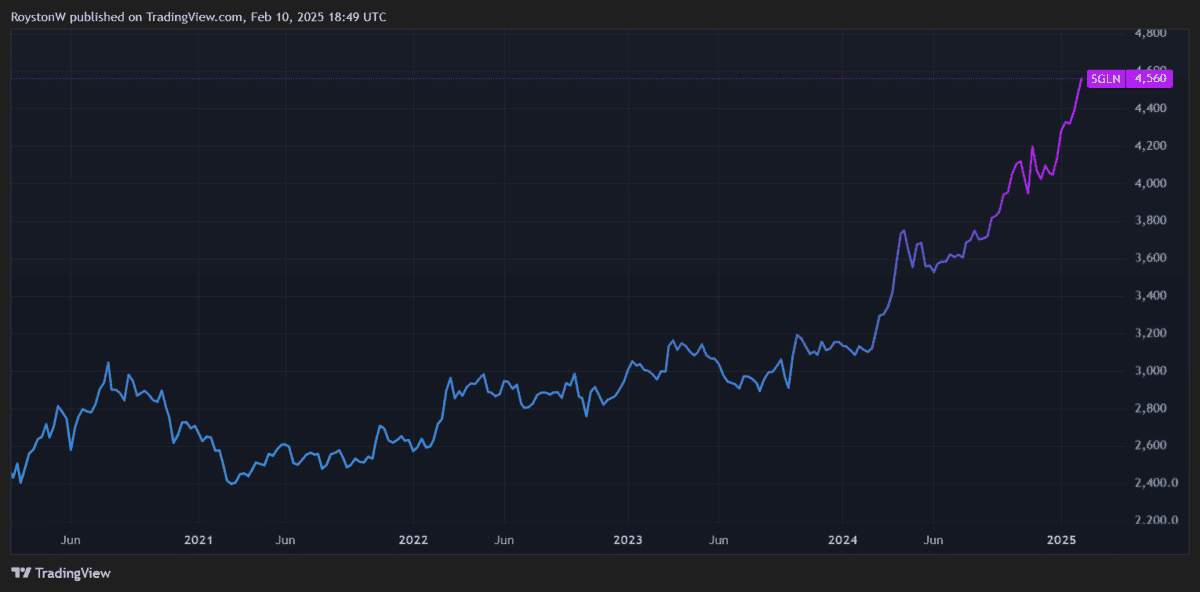

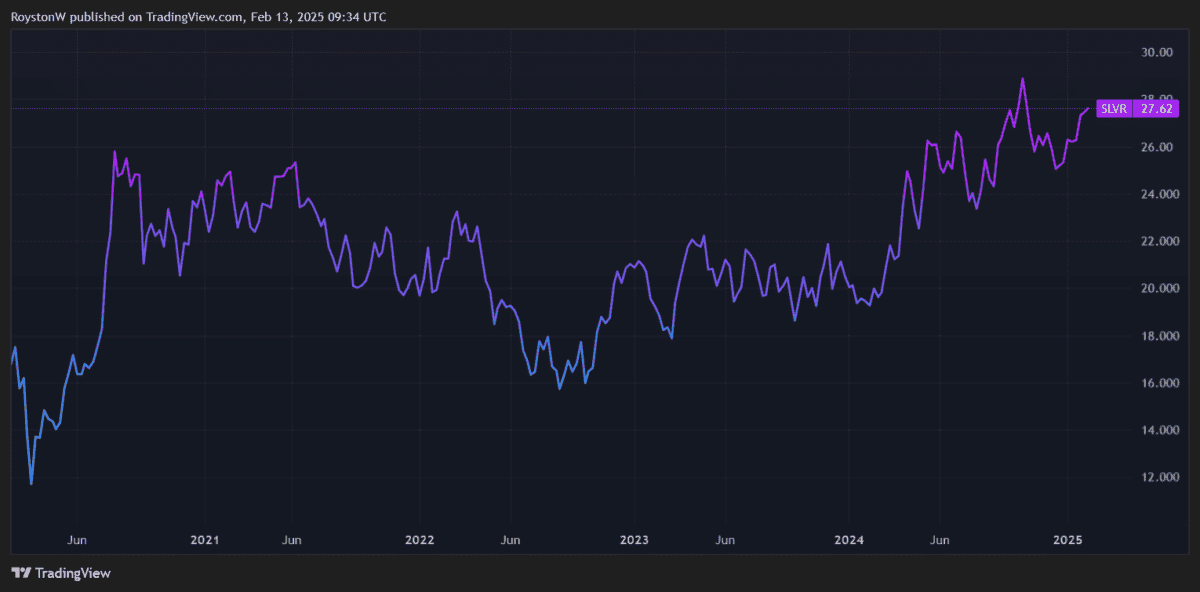

The stock also appears to have been caught in the crossfire resulting from problems at Nike (NYSE:NKE). As the chart below shows, movements in the share prices of the two companies appear to closely mirror one another.

It’s believed that around half of JD Sports revenue comes from the sale of the American sportswear giant’s products. But a failure to innovate — and a poor decision to try and sell more product directly to consumers — has caused Nike’s sales to fall.

However, I think the worst could be over for the American icon. Although its stock is down 31% over the past 12 months, it’s ‘only’ fallen 6% over the past six.

The British retailer has recently bought Hibbett (in the US) and Courir (in Europe), which means it now has 4,451 stores worldwide. This should help reduce its exposure to the sluggish UK economy.

Amazing value

But I’m optimistic.

The company sells other brands — including Adidas — that are doing well.

It also refused to engage in discounting during the Christmas trading period. This helped improve its margins.

Encouragingly, in December 2024 — the most recent period for which the company has disclosed any information — like-for-like sales were 1.5% higher than for the same period in 2023.

And with the fall in the JD Sports share price, I think it could be the best bargain on the FTSE 100.

For the year that ended 1 February 2025, the company has been forecasting an adjusted pre-tax profit of £915m-£935m. At the lower end of this range, earnings per share will be 12p.

This means the stock currently (14 February) trades on a forward price-to-earnings (P/E) ratio of 7.3. This is low by historical standards. Less than four years ago, it was over 18.

I find it hard to believe that the stock’s only 16% higher than its post-pandemic low, a period when it was forced to close its doors and its future was very uncertain.

The sports leisure market remains huge. It’s estimated to be worth $220bn, with younger people being a key demographic. According to JD Sports, 16 to 24-year-olds consider sportswear as their number one choice when it comes to spending their discretionary income.

For these reasons, I think it’s an attractive stock to consider for bargain-hunting value investors.