Does buying growth or income shares make more sense for a SIPP?

A Self-Invested Personal Pension (SIPP) can be something that matures over decades, making it ideal for the long-term approach to investing.

Some investors see that as an opportunity for dividends to pile up. Others think that a long timeframe can provide the perfect opportunity for small but promising companies to burst forth and show their true potential.

So when deciding what to do with a SIPP, ought an investor to consider growth shares, income shares or both?

Are growth shares different to income shares?

It helps recognise that a lot of shares in fact offer both growth and income opportunities. So sometimes the same share may have both growth and income potential.

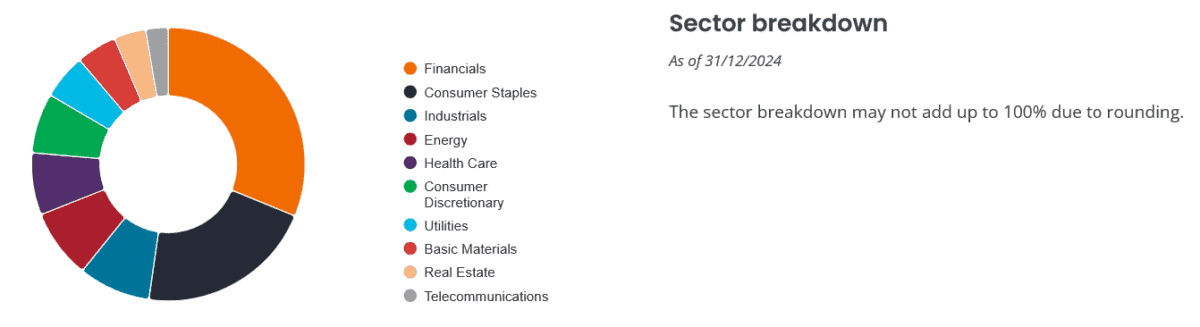

That said, tobacco producers are classic examples of what are seen as income shares by many investors. Mature businesses in fading markets may have limited opportunities to invest profits in growth, so share them out as dividends.

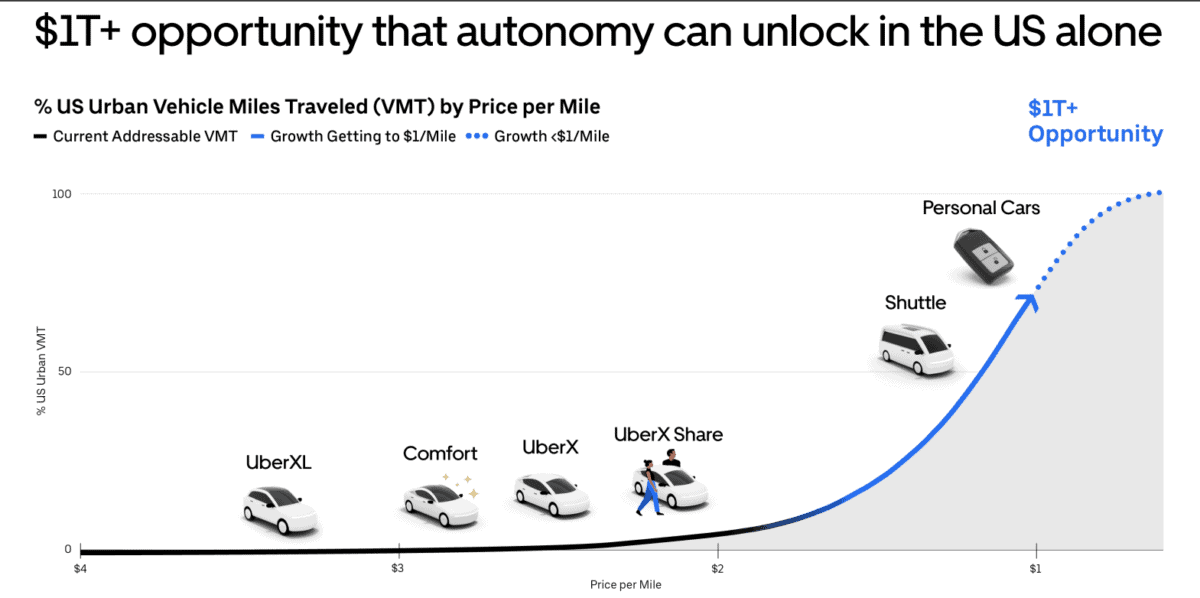

By contrast, a growing company like NIO continues to burn cash but is building a business that, if it grows in the right way, could end up being worth much more than it is now.

The thing is, it can be hard to know ahead of time just how well (or otherwise) a growth share might do. Some could be the next Amazon or Tesla. Many will not and may end up disappearing without trace down the line.

Setting objectives as an investor

In that sense then, it may not make too much sense to focus on an investor’s specific objectives when it comes to growth or income.

After all, the income withdrawal opportunities in a SIPP are different to, say, a Stocks and Shares ISA.

In short, the objective in a SIPP is basically to build total value over time.

Put like that, I think buying either growth or income shares – or a mixture of both – could be a suitable strategy in a SIPP.

Learning from billionaire pensioner Warren Buffett

I do see one big difference between many growth shares and some well-known high-yield income shares.

While some growth shares do spectacularly well — hello Nvidia (NASDAQ:NVDA) — many do not.

By contrast, income shares that have been paying dividends for decades already rarely crash to zero in a matter of months. It could happen, but more typically they slowly fizzle out, reducing dividends over the course of some years and perhaps finally cancelling them altogether.

So weighing risk and reward is essential in allocating a SIPP. To quote Warren Buffett, the first rule of investing is do not lose money and the second rule is not to forget the first one.

At the right price, incidentally, I would happily buy Nvidia for my SIPP. It is a growth share, sure. But it is throwing off huge amounts of cash. While its dividend yield now is tiny, I see plenty of scope for the payout to grow over time.

I also think business growth could continue thanks to the chipmaker’s proprietary technology, large client base and strong AI-related demand.

But rampant competition is a key risk – and I do not think the Nvidia share price today offers me any margin of safety.

If the price falls to the right level though, I will happily add it to my SIPP both for its proven growth prospects and, potentially, growing income streams.