Down 61%, is the Tullow Oil share price a potential bargain for contrarian investors?

The Tullow Oil (LSE:TLW) share price has fallen to just 14p as I write. That’s down from over £10 in the early part of the 2010s, and around £2 before the pandemic. Buy-and-hold investors over the past 15 years would have seen their investments reduced to almost nothing.

A different business model

Tullow Oil’s business model is distinct due to its focus on frontier hydrocarbon economies, largely in Africa. The company looked to leverage local skills and invest in their development, with hundreds of Ghanaian workers going on rotation to its Chiswick offices to gain more experience. The logic was that using local employees and suppliers was cheaper and gave back to the economy. I actually wrote my PhD on the topic and studied the company’s operations in Uganda.

Tullow had hoped to position itself as a nimble operator with a unique growth strategy tailored to emerging markets. However, things haven’t exactly gone to plan. Operating in frontier economies can be challenging, and taking Uganda as an example, progress toward first oil simply took too long. Uganda is expecting first oil this year, some 20 years after the discovery of commercial quantities of crude oil in the Albertine Graben basin. Tullow has since exited the market.

What’s happening now?

Tullow Oil made progress in 2024. The company returned to profitability with a $55m profit after tax, reversing a $110m loss in 2023. This turnaround was driven by strategic delivery, production optimisation, and debt reduction efforts. Revenue slightly declined to $1.54bn from $1.63bn, but adjusted EBITDAX remained stable at $1.15bn. Net debt was reduced to $1.45bn, lowering gearing to 1.3 times EBITDAX, while free cash flow reached $156m.

Operationally, Tullow optimised production at its Jubilee and TEN fields in Ghana, achieving 97% FPSO uptime — the time the FPSO was operational — and bringing five new wells onstream ahead of schedule and under budget. This represented a saving $88m. The company also resolved a $320m tax arbitration in Ghana and extended its revolving credit facility to mid-2025.

Clearly, lots of positives as the firm looks to bring its balance sheet under control and rationalise its operations. Looking ahead, Tullow plans to sell its Gabon assets for $300m and expects 2025 production to average 50,000–55,000 barrels per day.

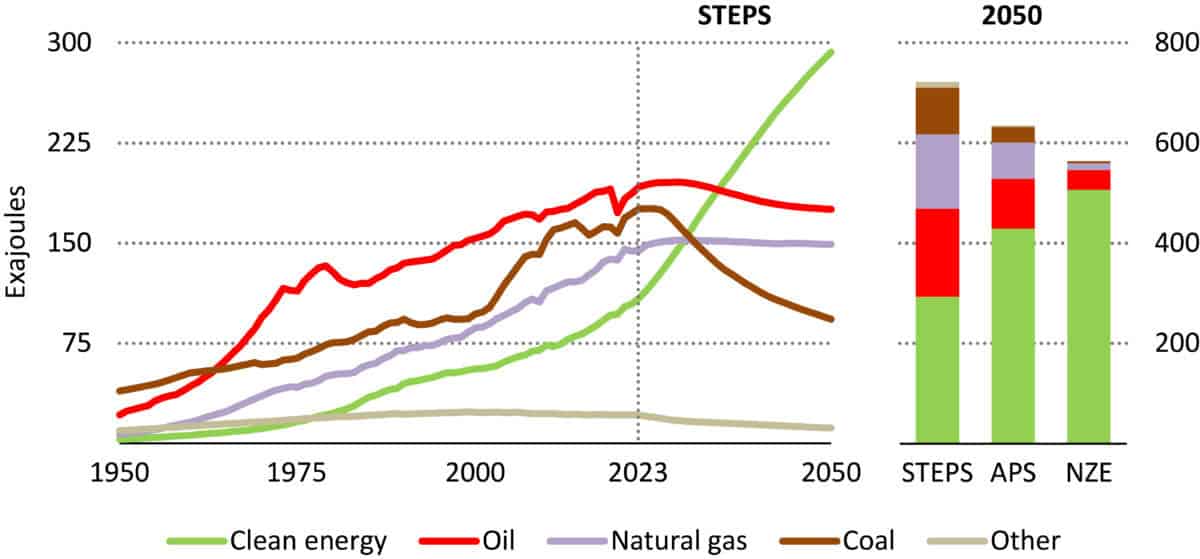

A slave to global markets

I’m not perfectly sure what Tullow’s breakeven point is in 2025. However, estimates I’ve found online put it around $45 per barrel. Regardless of the exact figure, we can’t ignore the general weakness in oil prices at the moment. President Trump’s trade policies have put downward pressure on oil, and this, if sustained, will likely feed through to earnings later in the year. This is makes me a little concerned when we consider Tullow’s huge net debt position.

Personally, I think there’s too much risk here. Trump has vowed to keep oil prices low throughout his presidency. This could hurt indebted producers like Tullow more than others. That’s why I’m not buying.