Here’s the latest dividend forecast for Aviva shares through to 2026

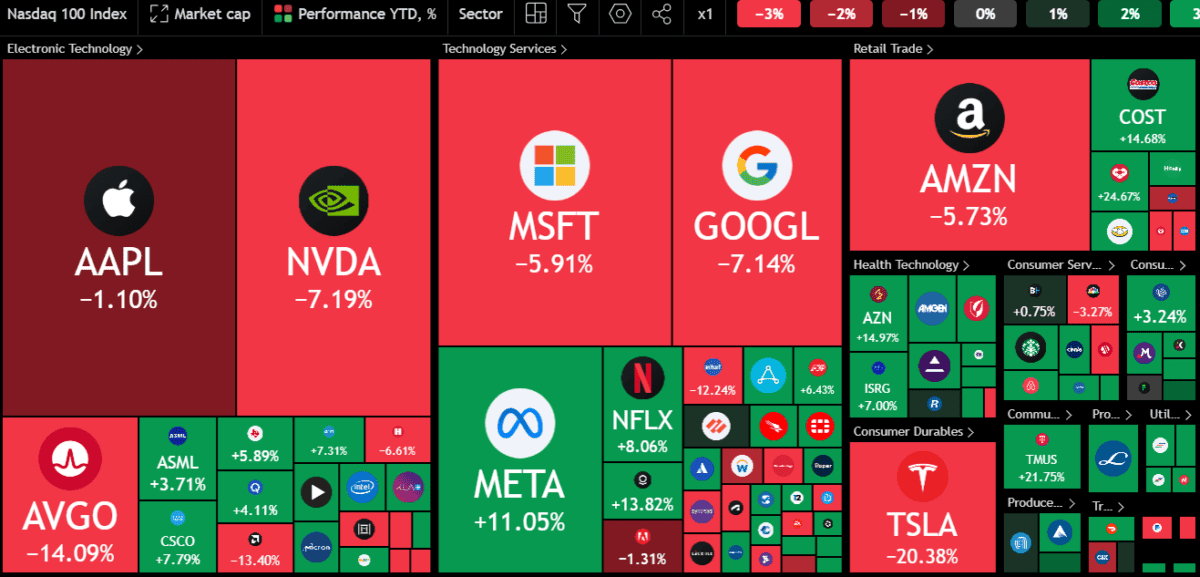

Aviva (LSE: AV.) shares are beating the FTSE 100 in 2025. As I write, the insurer’s up 10% versus a near-7% gain for the Footsie.

However, Aviva easily triumphs with its juicy dividend yield. Right now, that stands at around 6.8%, roughly double the FTSE 100’s 3.4%.

Indeed, things look even better when we consider the latest dividend forecast. They show some attractive income potential.

High-yield stock

For 2025, the market currently expects the company to dish out a dividend of 37.7p per share. That translates into a forward yield of 7.3%.

For 2026, the payout’s forecast to rise to 40.3p per share, which gives an eye-catching prospective yield of 7.8%.

Of course, no dividends are guaranteed, as Aviva proved during the pandemic when it slashed its payout. But as one of its shareholders, I’m optimistic on the income growth prospects here.

Management is sounding an optimistic tone too. In the Q3 trading update, CEO Amanda Blanc said: “Aviva is financially strong, trading well each quarter and has significant opportunities for further growth. We are confident about the outlook for the rest of 2024 and beyond, growing the dividend and achieving the Group’s financial targets.”

| Year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| 2024 | 35.3p | 5.7% | 6.8% |

| 2025 | 37.7p | 6.7% | 7.3% |

| 2026 | 40.3p | 6.9% | 7.8% |

Now, it should be noted that the company’s £3.7bn takeover of Direct Line is expected to close by the middle of 2025. This combined group will command more than 20% of the UK motor insurance market.

This deal will increase the total number of Aviva shares outstanding. However, the firm anticipates that the acquisition will enhance its earnings capacity, leading to a projected mid-single-digit percentage increase in the dividend per share following completion.

However, it doesn’t expect to launch any share buybacks in 2025.

Solid business

In recent years, Aviva’s disposed of low-growth or non-core international operations. This has seen it focus on markets in Ireland, the UK, and Canada. Consequently, the business is much leaner and has been progressing nicely.

In Q3, general insurance premiums rose 15% to £9.1bn, with 18% growth in the UK and Ireland and 11% growth in Canada. Meanwhile, wealth net flows of £7.7bn were 21% higher.

Over the last four years, Aviva’s increased its customer numbers by 1.2m to 19.6m. It now has 5m customers in the UK with more than one policy. The ambition is to grow that to more than 21m customers by 2026, including 5.7m UK customers with two or more policies.

A dividend stock worth considering

One risk with this stock comes if the UK dips into a recession. And with the UK economy stagnating right now and inflation ticking up, that can’t be ruled out. In this scenario, consumers could choose not to renew certain insurance policies.

Nevertheless, I think Aviva’s worth considering for investors looking for a solid dividend stock. A forward yield in excess of 7% combined with a cheap valuation signals good value to me.

The share price has also broken through the £5 barrier for the first time in years. So it has good momentum on its side, and I’m hoping for further price gains this year.