£20k invested in a Stocks and Shares ISA 10 years ago is now worth…

Few investing vehicles come close to delivering the advantages that Stocks and Shares ISAs provide. By eliminating income, capital gains, and dividend taxes from the equation, British investors have a serious upper hand on their wealth-building journey.

But how much money has this investment vehicle made for long-term investors over the last 10 years? The answer obviously depends on where capital’s allocated. So let’s explore just how much a £20,000 initial investment in 2015 could have grown to today.

Index investing returns

Let’s start with one of the most popular ways to invest – index funds. These types of investments essentially put the wealth-building journey on autopilot. While it becomes impossible to beat the market in terms of performance, that’s not always necessary to build a sizeable ISA.

| Index | Stocks and Shares ISA Value | Total Return |

| FTSE 100 | £36,842 | +84.2% |

| FTSE 250 | £31,175 | +55.9% |

| S&P 500 | £69,368 | +246.8% |

| Nasdaq 100 | £106,687 | +433.4% |

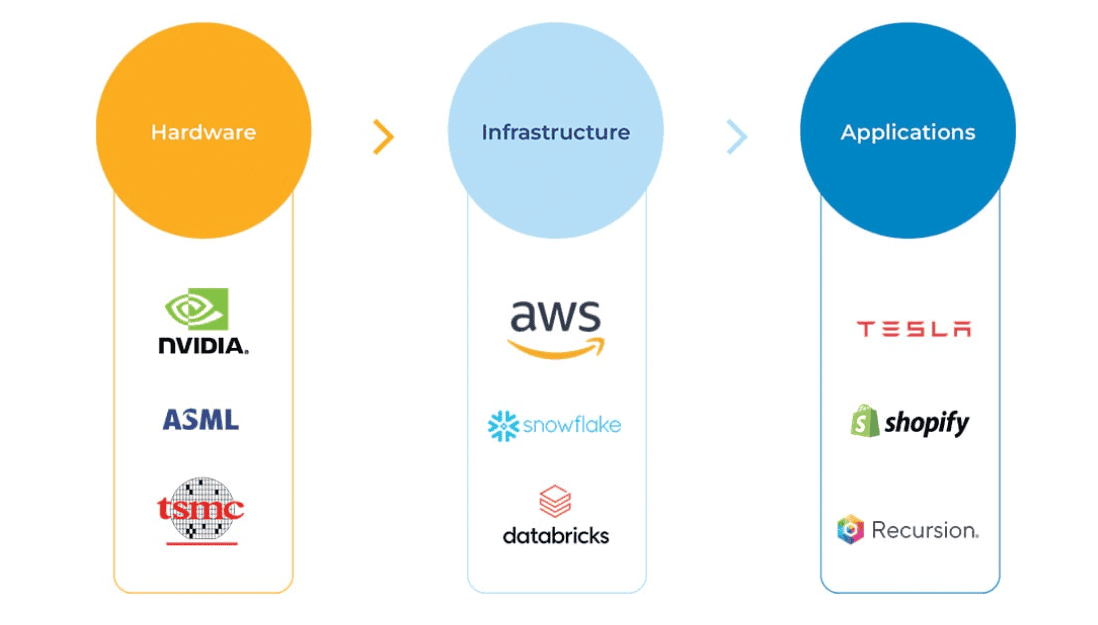

At a quick glance, it’s clear US technology stocks have been the best-performing investments of the last decade. At least that’s what the performance of the Nasdaq 100 suggests. Of course, such tremendous returns come at a cost. In this case, that cost is high volatility.

The Nasdaq 100 was also one of the worst-performing indices during the 2022 stock market correction, losing more than a third of its value in less than six months. By comparison, the FTSE 100 was actually up during this volatile period, highlighting its impressive resilience to adverse macroeconomic conditions.

What about stock pickers?

Clearly, given enough time, even volatile indices can help build significant wealth. But not everyone likes to rely on index funds. After all, some investors like pursuing market-beating returns. And when executed sucessfully, the rewards can be tremendous.

Take Shopify (NYSE:SHOP) as an example. The e-commerce giant had its IPO roughly 10 years ago and has since delivered a staggering 3,857% return since then. That means a £20k investment in 2015 would now be worth £771.5k today – all of which would be tax-free thanks to using a Stocks and Shares ISA!

With its latest quarterly results delivering 26% growth in gross merchandise value (GMV) to $94.46bn, 31% revenue growth, and higher operating margins, Shopify’s growth story seems far from over. Even more so, given that its international expansion continues to outpace its North American operations.

However, just like the Nasdaq 100, Shopify’s no stranger to volatility, falling by a jaw-dropping 85% between November 2021 and 2022. The stock’s inching closer to a full recovery and I’ve been using the depressed valuation as an opportunity to top up my existing position.

Sadly, not all US growth stocks have enjoyed such a robust bounceback. Another US tech firm from my portfolio is Teladoc Health, which is still down 95% since its 2021 highs as it struggles to respark its growth engine.

This goes to show that stock picking doesn’t always end in success. And depending on the decisions made, a relatively small ISA can end up being worth a fortune, or lose a significant chunk of its value.