How much would an investor need in an ISA for a £999 monthly passive income?

Investors seeking passive income from FTSE 100 shares might wonder how much they need to secure a comfortable retirement. So let’s crunch the numbers.

Generating a second income target of £999 a month would deliver annual income of £11,988 a year. That would almost double the full new State Pension, so it’s well worth having.

The amount of capital required to generate that income would depend on the yield of the investor’s portfolio.

I believe it’s realistic to aim for an average yield of 6% from a diversified mix of FTSE 100 dividend shares. With that assumption, someone would need a total of £199,800 invested to hit their goal.

Building retirement on FTSE 100 shares

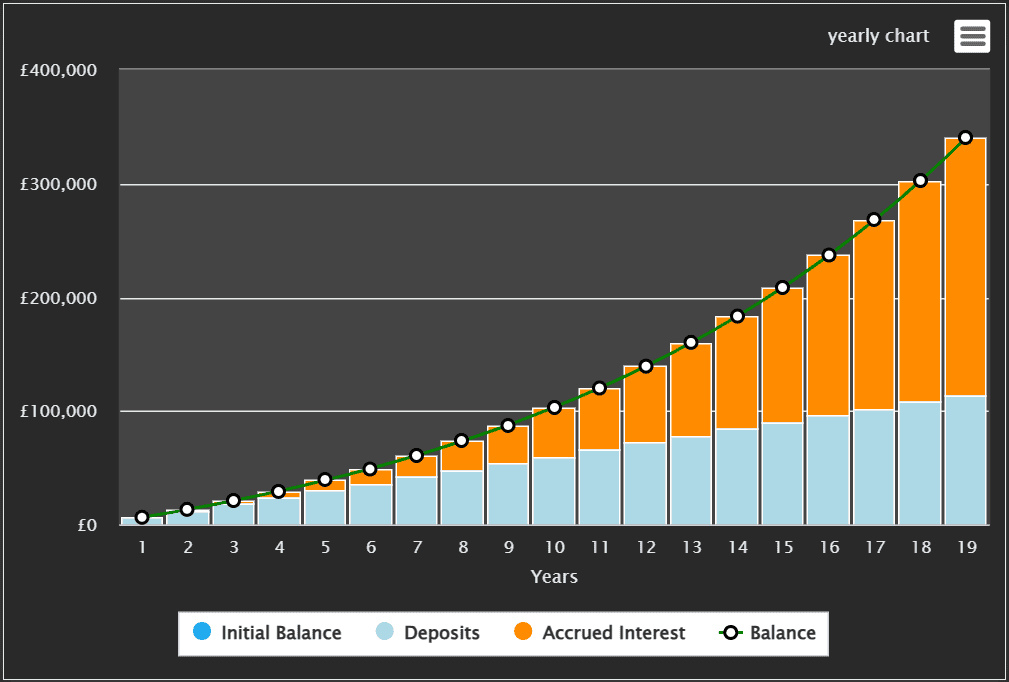

That’s a large sum, but it can be built up over time. Someone investing £250 a month could reach this milestone in 25 years, assuming an average total return of 7% per year. That’s roughly in line with the long-term FTSE 100 average total return, which combines both capital growth and dividend reinvestment.

To illustrate the kind of shares that could help build this income stream, let’s look at Aviva (LSE: AV.).

While some FTSE financials have struggled in recent years, as one of the UK’s largest insurers Aviva has delivered solid performance.

The stock has climbed 16% over the last year and is up a hugely impressive 63% over five years.

That’s just the share price growth. Investors have also received bags of dividends over that period, with the trailing yield currently an impressive 6.67%. The total return must be comfortably above 100% in that time.

Avvia shares now look a little expensive, with a price-to-earnings (P/E) ratio of 22.7. However, given the company’s impressive performance and growing profitability, markets believe it’s justified.

The Aviva share price may slow from here

That said, Aviva shares won’t always climb at this pace and dividends aren’t guaranteed. Today’s stock market volatility could potentially hit the value of the assets it holds to offset insurance risks, and hit inflows into its investing division. Once reflected in results, investor enthusiasm may cool.

However, I still think it has a valuable role to play in a well-structured portfolio.

While Aviva is a strong candidate to consider, relying on just one or two stocks is risky. Income seekers should look to hold around 15 to 20 dividend shares in total. Stocks from sectors like utilities, consumer goods and pharmaceuticals can help balance out market fluctuations.

By holding a mix of these types of businesses, investors can build a portfolio that generates reliable passive income while reducing exposure to the risks of individual stocks.

Generating £999 a month in passive income is achievable with a patient, long-term approach. With luck it should rise over time, as companies increase shareholder payouts.

Our investor shouldn’t just stick to tucking away £250 a month though. They should aim to increase that in time to reflect inflation, and throw in lump sums when they have cash to share.

The more they invest, the greater their potentail financial freedom in retirement. That’s the magic of compounding and the joy of passive income.