Last month, BT (LSE: BT.A) shares briefly flirted with the 150p price level for the first time since May 2023. The shares have struggled to break above 150p since falling to 120p in September 2022. But before that, they spent almost an entire decade above 200p.

Can those days return? The past six months have been promising, with the shares up 37.5%.

Back in May, the company claimed it had passed the “peak capex on our full fibre broadband rollout“. For the past few years, it’s been haemorrhaging money into the digital upgrade and suffered many complications along the way. The implication now is that it could start funnelling revenue back into daily operations.

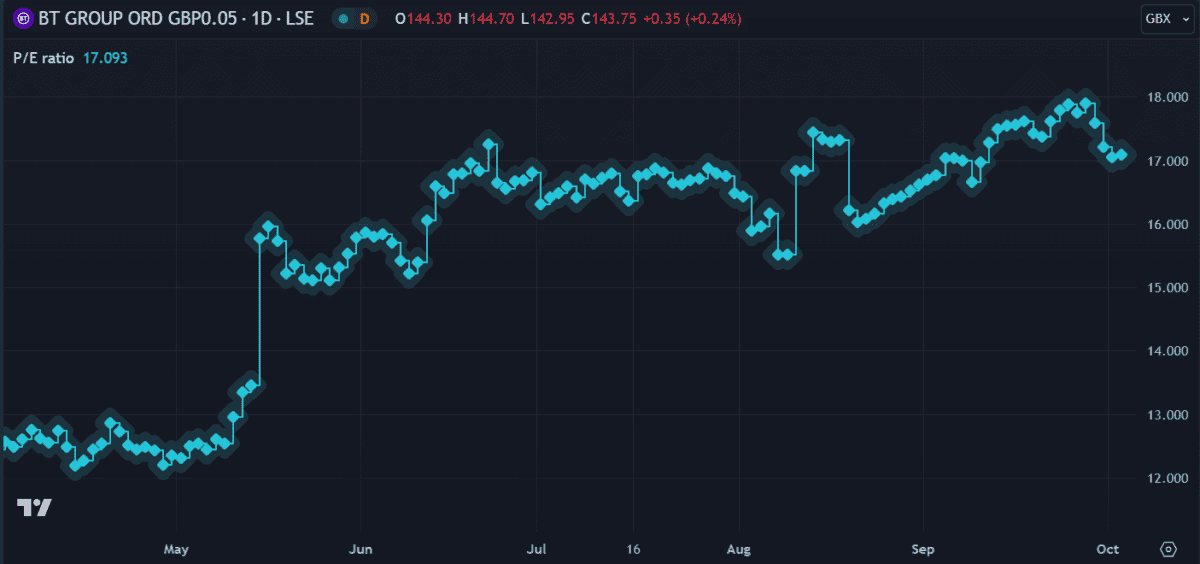

From the looks of things, that’s been happening. Performance is up and shareholders seem happy. Dividends remain consistent and a forward price-to-earnings (P/E) ratio of 17 suggests more room to grow.

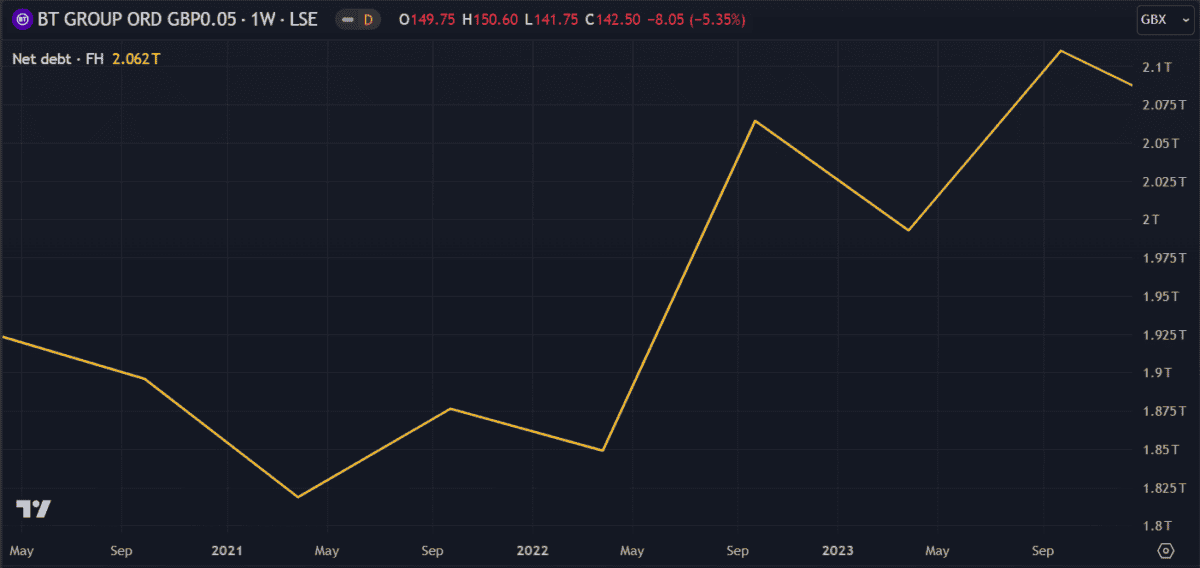

But the company’s debt remains the key sticking point for me. The full fibre broadband rollout has not been cheap, pushing debt up to almost £20bn over the past few years. That’s a lot for a company with only a £14.3bn market cap. It’s also considerably higher than its equity.

For me, this feels like a significant risk. What if the digital rollout backfires and customers start switching to another provider? Can it afford to cover those losses in the event of falling revenues? It may seem absurd to consider that a company as established as BT can fail, but nothing’s impossible.

So what to expect?

The real question is: are BT shares going to go up from here and if so, by how much? To figure that out, there are a few things to consider.

First things first, I must consider some core factors that lead many investors to fall into a value trap. The main one is short-term expectations but the other is analyst price targets.

While these targets can be telling, on their own, they can also be misleading. At best, they can be used to gauge the general sentiment around a stock. Occasionally, they can give a feel for how current events may guide longer-term trends.

Looking around a few reliable sources, I see an average 12-month price target of just under 200p. But consensus is weak, with some forecasts wavering by up to 100% in either direction. In other words, nobody actually knows where it’s headed.

My verdict

In my opinion, the likelihood of long-term growth from here outweighs the chance of significant losses. It may revisit the 120p level in the short term but an extended move below seems unlikely.

I’d say the dividends alone could make it a worthwhile investment for me. On top of that, any price growth makes it even better.

Are there stocks that I think could grow more in the next year? Yes. But are they as stable and reliable as the UK’s leading telecommunications company?

Probably not.

I sold a lot of shares in August but BT is probably my biggest regret. Now I think it’s time to accept my mistake and buy back in.