How to Get a Personal Loan in 6 Steps

Shopping for a personal loan doesn’t have to be a complicated process. Knowing where to start and understanding how to compare offers can help you select the best personal loan.

Below are six steps to guide you through the process of shopping for and getting a personal loan.

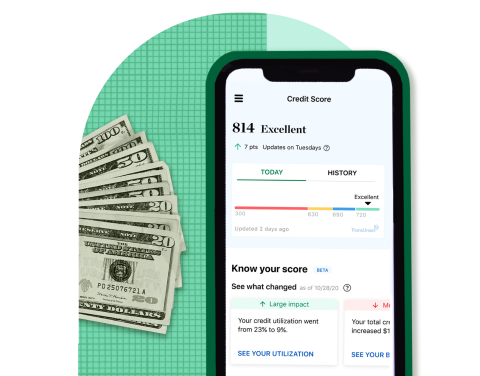

1. Check your credit score

A high credit score gives you a better chance of qualifying for a personal loan and getting a lower interest rate. Assess your creditworthiness by checking your score.

Credit scores typically fall into these categories.

-

720 and higher: Excellent credit.

-

690-719: Good credit.

-

630-689: Fair or average credit.

-

300-629: Bad credit.

Looking at a less-than-friendly score? Fix any errors that might be dragging it down. You can request your free credit report and dispute wrongly reported missed payments or other inaccuracies it may contain.

Be sure to make on-time payments toward credit card and other loan payments, and keep your credit utilization (the amount of credit you use relative to credit limits) low as these are the biggest factors affecting your score.

Be ready for any loan application

NerdWallet tracks your credit score and shows you ways to build it — for free.

2. Compare estimated rates

Knowing your credit score will give you a better idea of the annual percentage rate and payment amounts you might receive on a personal loan. Use the calculator below to see estimates based on your credit score and consider the impact of monthly payments on your budget.

3. Get pre-qualified for a loan

Pre-qualifying for a personal loan gives you a look at the offers you may receive from lenders. Many online lenders and some banks perform a soft credit check during pre-qualification that doesn’t affect your credit score.

During pre-qualification, you must typically provide some personal contact information, such as your name, date of birth, income and loan purpose.

Pre-qualifying with multiple lenders lets you compare estimated rates and payment amounts.

4. Compare lenders and shop

Compare the loan amounts, monthly payments and interest rates on your pre-qualified offers from various lenders. Online lenders, banks and credit unions offer safe unsecured loans.

|

Loan amount |

Get started |

||

|---|---|---|---|

|

5.94% – 35.47%. |

$1,000 – $50,000. |

at Upgrade |

|

|

4.99% – 19.63%. |

$5,000 – $100,000. |

||

|

8.93% – 35.43%. |

$1,500 – $50,000. |

at Universal Credit |

|

|

6.99% – 19.99%. |

$3,500 – $40,000. |

||

|

5.99% – 24.99%. |

$2,500 – $35,000. |

at Discover |

|

|

5.99% – 17.99%. |

$500 – $20,000. |

at NerdWallet |

|

|

Click “Check Rates” to pre-qualify on NerdWallet and receive personalized rates from multiple lenders. |

|||

If you have a fair or bad credit score, consider a secured loan or adding a co-signer or co-borrower to your loan application. These options can increase your chances of qualifying for a lower interest rate. However, note that both options have consequences for the collateral or co-applicant if you fail to repay.

5. Read the fine print

Before signing a loan, read the terms of the loan offers and get answers to your questions. In particular, watch for:

Prepayment penalties. A prepayment penalty — a fee for paying off the loan early — is rare. However, still be on the lookout for them in loan agreements.

Automatic withdrawals. If a lender automatically withdraws loan payments from your checking account, consider setting up a low-balance alert with your bank to avoid overdraft fees.

APR surprises. The total cost of your loan, including interest and any origination fees, should be clearly disclosed and figured into the APR.

Additionally, look for lenders that offer consumer-friendly features like reporting payments to the three major credit bureaus, allowing borrowers to change their payment date or sending borrowed funds directly to creditors on debt consolidation loans.

6. Application and approval

Once you’ve selected a lender that matches your needs, you’ll provide documentation to formally apply for the loan.

Application requirements may vary by lender, but you’ll likely need:

-

Identification: A passport, driver’s license, state ID or Social Security card.

-

Verification of address: Utility bills or lease agreement.

-

Proof of income: Pay stubs, bank statements or tax returns.

During the loan application process, you’ll need to provide documents that prove identification, verify your address and show proof of income.

The lender will run a hard credit check that may briefly decrease your credit scores by a few points and show up on credit reports for 24 months. Upon final approval, you’ll receive your funds according to the lender’s terms, typically within a week.