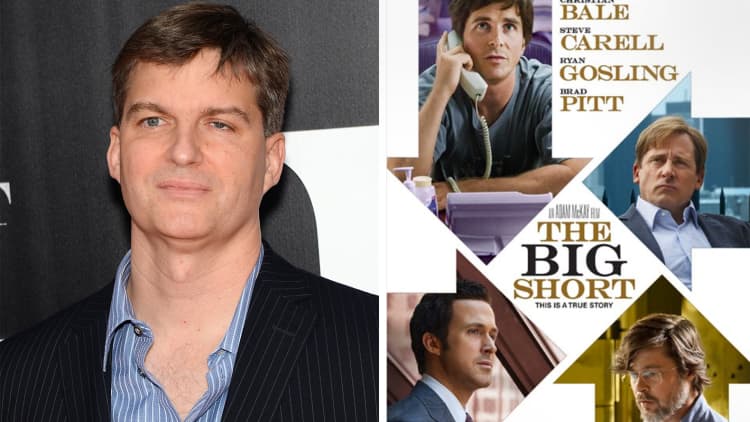

Michael Burry’s next ‘Big Short’: An inside look at his analysis showing AI is a bubble

Michael Burry — the investor known for predicting the housing meltdown ahead of 2008 — has turned his attention to one of the market’s most beloved themes: artificial intelligence.

Burry recently deregistered his hedge-fund firm, Scion Asset Management, removing it from routine regulatory disclosures. But he remains actively investing, and he is doubling down on what he sees as the next major mispricing in markets.

Central to that view is Phil Clifton, Scion’s former associate portfolio manager, whose research underpins the skepticism. Clifton argues that while generative AI adoption is accelerating, the economics behind the industry’s massive infrastructure buildout have yet to justify the cost.

In his farewell letter to Scion investors in late October, Burry called Clifton “the most prodigious thinker” he’s ever encountered. CNBC obtained several of Clifton’s research notes from earlier this year, written before he launched his own firm, Pomerium Capital, that help outline Scion’s bearish thesis on AI.

The investment world is “expecting far more economic importance out of this technology than is likely to be provided,” Clifton wrote. “Just because a technology is good for society or revolutionizes the world doesn’t mean that it’s a good business proposition.”

Low margins

On the surface, AI usage appears ubiquitous. More than 60% of U.S. adults say they interact with AI at least several times a week, according to Pew Research Center. Yet Clifton said the economics on the demand side are “surprisingly small.”

OpenAI — market leader and cultural phenomenon — is set to surpass $20 billion in annualized revenue this year, but that figure is tiny compared with the size of the AI build-out. Hyperscalers have quadrupled their capex spend in recent years to almost $400 billion annually, with expectations of $3 trillion over the next five years, according to Man Group.

“We assume other generative AI services in aggregate are insufficient to justify the sums being spent on infrastructure,” Clifton wrote.

History’s warnings

Scion sees a clear historical parallel with the early-2000s telecom boom, when heavy investment in fiber-optic networks far outpaced actual usage. U.S. capacity utilization fell to about 5%, and wholesale telecom pricing collapsed roughly 70% in a single year, Scion noted.

Clifton argues the cloud giants are now in a comparable race, expanding AI infrastructure on the assumption that future demand will catch up eventually. But if mass AI adoption takes longer than expected, the economics on these massive data center deals could become untenable.

Some Big Tech companies are starting to wobble on commitments already, he noted. Microsoft has canceled data center projects set to use 2 gigawatts of electricity in the U.S. and Europe, citing an oversupply. Alibaba’s chairman has warned a bubble is forming in AI infrastructure.

The Nvidia Exposure

No company has benefited more from AI spending than Nvidia. The stock has surged alongside unprecedented GPU orders from cloud providers. But Scion questions whether those customers will ever generate economic returns on that investment.

Stock chart icon

A key element here is depreciation policy. Tech giants have lengthened server lifespans on the books to six years. Yet Nvidia’s product cycles run every year now, making older chips functionally obsolete and less energy-efficient, long before they’ve been written down, Scion claims.

Nvidia has pushed back at this claim, saying its hardware remains productive far longer than critics say, thanks to efficiencies driven by the company’s CUDA software system.

Still, Burry and other critics are seizing on a contradiction. Nvidia says the newest chips are superior in performance, efficiency and capability, at the same time as it promises that older chips remain economically viable. One of those defenses, they say, has to give.

Burry has launched a new Substack newsletter to lay out his bearish thesis on AI. Whether generative AI ultimately proves to be a bubble remains to be seen, but for now, Burry is again positioning himself on the cautious side of a fast-moving story.