The US stock market has been all over the shop recently. In fact, the S&P 500‘s 4.6% drop in the first quarter of 2025 was the index’s largest quarterly loss since 2022.

Given this, I’ve been weighing up a few options for my Stocks and Shares ISA. Here are two stocks I’ve got my eye on.

Out-of-favour AI stock

The first — Nvidia (NASDAQ: NVDA) — needs no introductions. The chipmaker is the world’s third-largest firm and remains central to advancements in artificial intelligence (AI). Demand for its latest Blackwell AI chips is very strong, according to management.

Yet Nvidia’s share price has fallen 27% in less than three months. This puts the stock on a forward price-to-earnings (P/E) ratio of 24, which is an undemanding multiple for a top-notch growth company.

Investors seem to be worried about a few things here. First, there is uncertainty around tariffs, which admittedly may impact Nvidia’s operations. And the chance of a US recession has risen considerably, according to most economists. An economic downturn would be bad all round.

Meanwhile, some doubts have crept in about Nvidia’s position in the inference stage of generative AI. While its chips reign supreme in the training phase, the competition may be far stronger in inference (i.e., when a trained model spits out a Shakespearean sonnet on the fly).

While these concerns are warranted, I currently see no evidence that Nvidia won’t keep benefitting from rising AI infrastructure spending. The market still expects Nvidia to post strong double-digit growth over the next three years.

Indeed, the AI chip king’s revenue is forecast to top $300bn by 2028, up from $130bn last year. Net profit is tipped to exceed $155bn by then!

Of course, these forecasts could change. But as the stock moves closer to $100, I think the risk/reward setup is starting to look more favourable. As such, I’m very tempted to invest in some shares.

Transport disruptor

The second stock I’ve got my eye on is Joby Aviation (NYSE: JOBY). It’s fallen 41% to $6 in less than three months.

Joby Aviation is aiming to commercialise electric vertical take-off and landing aircraft (eVTOLs). In lay terms, flying electric taxis that take off vertically and travel without emissions in near silence.

Joby’s aircraft can currently do a 100-mile trip at speeds of up to 200mph. But it’s still working towards full certification, which means there is a lot of regulatory and operational risk here.

However, the company is making rapid progress and expects to start a commercial service in Dubai in late 2025 or early 2026. The first of four ‘vertiports’ is currently being built at Dubai International Airport. It aims to zip four passengers to Palm Jumeirah island in just 12 minutes rather than 45 minutes by car.

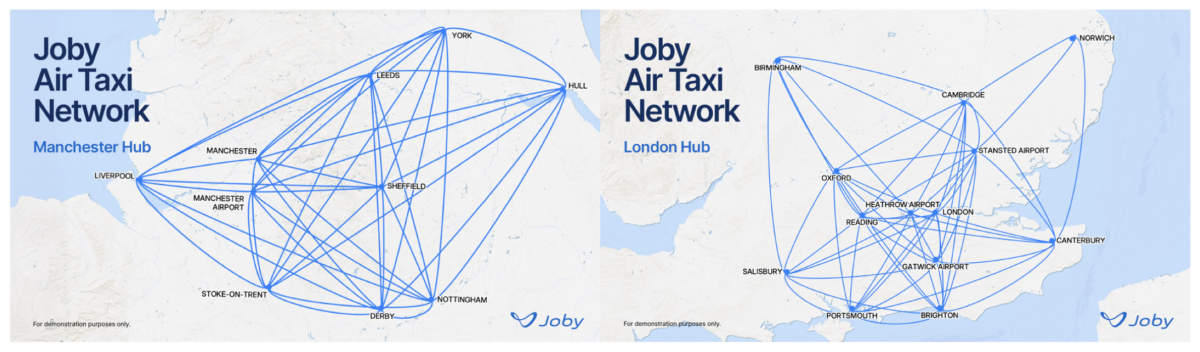

In the UK, Joby has partnered with Virgin Atlantic to roll out air taxis, starting with regional and city connections from the airline’s hubs at Heathrow and Manchester Airport.

Yesterday (31 March), China became the first country to approve commercial air taxis. So rather than being merely science fiction, this is a massive new emerging market.

Joby has over $1bn in cash to fund its commercial launch, but the stock is still very much in the high-risk, high-reward category.