Despite total sales reaching record levels, the Apple (NASDAQ:AAPL) share price is down 2% after the company’s Q3 earnings report. Should investors be worried?

I don’t think so. While a 35% drop in net income looks alarming, I think the business is still in a very strong position.

Headlines

A feature of Apple’s recent reports has been strong revenue growth from its Services division. Since this has higher margins, the result has been overall profits growing faster than sales.

Half of that trend continued in Q3 – Services revenues grew 12%, compared to 4% growth in the Products division. But this didn’t translate into higher earnings.

While operating profits were up almost 10%, net income fell 35%. This was due to a $10bn tax payment the company made to settle a case dating back to 2016.

This looks like a one-off expense rather than a recurring cost. But investors should keep an eye on the attention Apple seems to attract from regulators in the EU and elsewhere.

Highlights

Over the last few months, there’s been a big question over how successful the launch of the new iPhone would be. And I thought there was quite a lot of pessimism around.

The iPhone 16’s the first artificial intelligence (AI) offer from Apple. And some analysts took the view that the new features wouldn’t be enough to generate significant interest.

Apple’s Products division has lower margins. But a big installed base of devices is key to generating strong revenue from the more profitable Services part of the business.

With that in mind, I think the 5.5% growth in iPhone revenues was an important highlight. And it indicates the company’s competitive position is as strong as ever.

Outlook

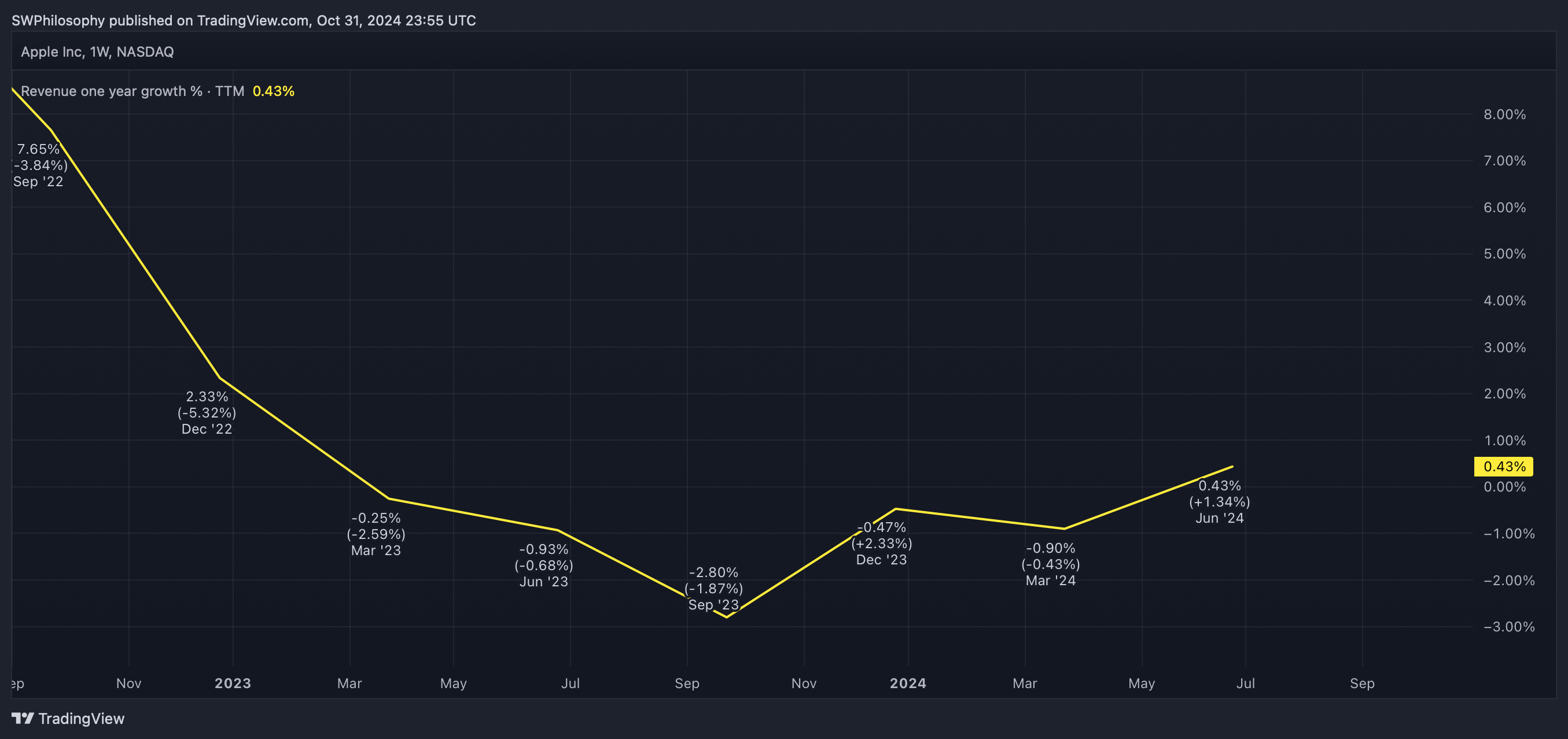

Overall revenue growth for Q3 came in at around 6%. That might not sound like much, but it’s the fastest the company’s sales have grown in the last couple of years.

Apple revenue growth September 2022- June 2024

Created at TradingView

CEO Tim Cook had forecast something largely similar for the final quarter of 2023. The hope is that some new Apple Intelligence features can keep the growth story going.

For obvious reasons, the December quarter’s typically a strong one for Apple products. So it will be interesting to see what the next set of results brings in terms of more record sales.

Shareholders should also know by now that not all revenue growth’s the same. If Q4’s growth is driven by the Services division, then profits might well come in more than 6% higher.

Why is the stock falling?

Apple’s report wasn’t all good news. Investors won’t have been pleased to see that $10bn tax hit and the company’s continued stagnation in China.

Overall though, I thought the update was very positive. Record sales and solid growth are signs the company’s competitive position’s still firmly intact.