2025 is shaping up to be the year of the income stock. The FTSE 100 is packed with high-yielding dividend shares, and I’m banking on generating heaps of passive income from my portfolio.

Last year was disappointing for the UK’s blue-chip index. After a bright start, shares gave up most of their early gains as growth and confidence faded.

That’s frustrating in the short term but a massive opportunity when viewed over the long run. And let’s face it, that’s the only timeframe investors should consider.

Will Phoenix shares fly in 2025?

Top dividend income stocks are now trading at lower valuations and offering higher yields. Phoenix Group Holdings (LSE: PHNX) fits that description perfectly.

Phoenix is an intriguing company. With a 200-year history, it’s described as the UK’s largest savings and retirement business, yet few people can name it. The group’s brands, like Standard Life and SunLife, are more recognisable (although it’s keen to offload the latter).

Phoenix specialises in managing closed pension schemes, ones that no longer take new customers. This strategy has delivered steady profit growth. On 16 September, Phoenix reported a 15% rise in adjusted first-half operating profit to £360m.

However, it also posted a £646m post-tax loss, hit by “adverse economic variances from higher interest rates and global equities”. Management expects this volatility to ease as interest rates decline.

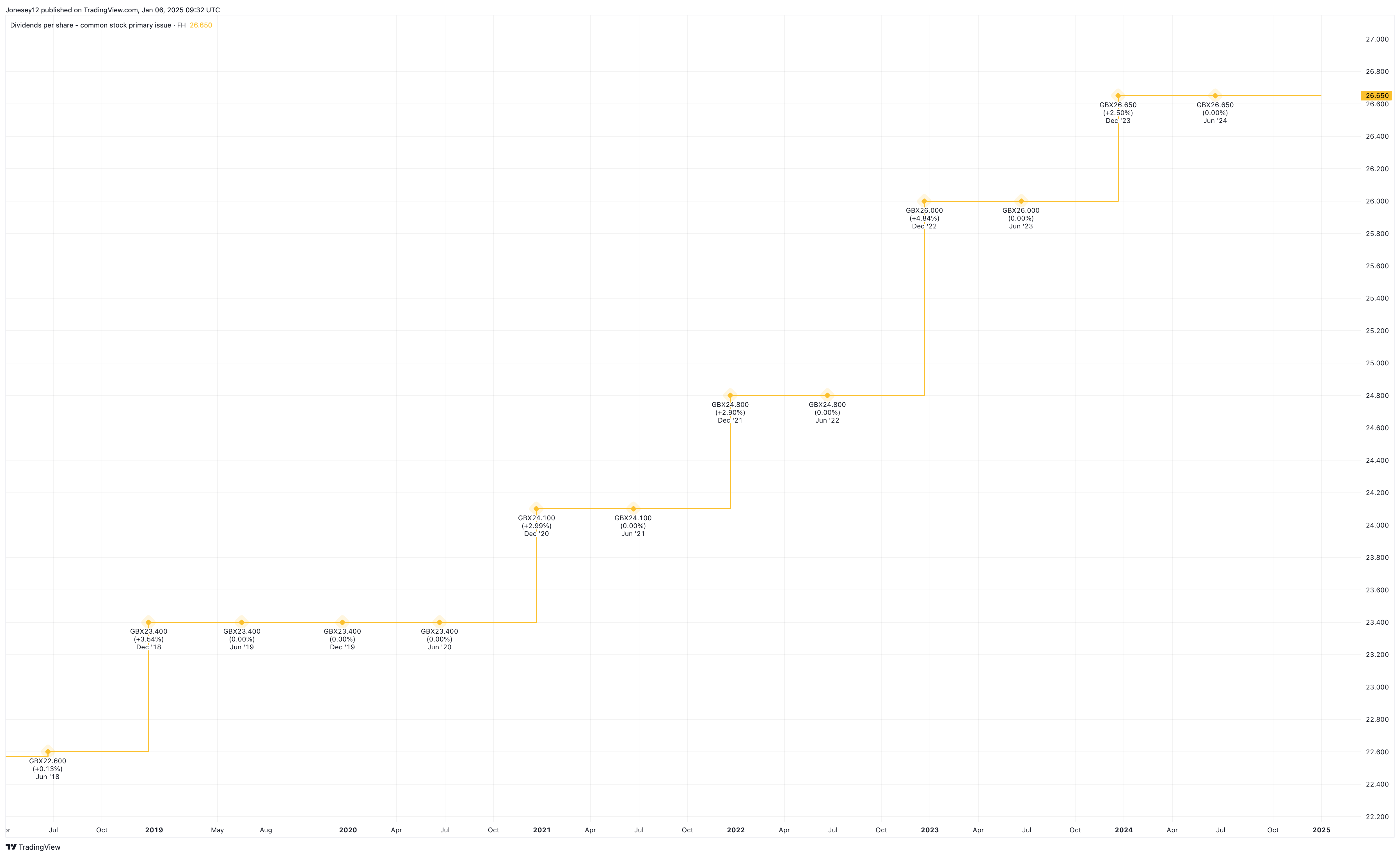

The dividend news was more encouraging. Phoenix’s board operates a “progressive and sustainable dividend policy” and the board seems confident of maintaining that. The trailing yield is a jaw-dropping 10.24%, the highest on the FTSE 100, and it’s forecast to hit 10.9% this year. Dividend growth has been solid, as this chart shows.

Chart by TradingView

Dividends are ideally covered twice by earnings. For Phoenix, they’re covered just once. The board supports this via its hedging approach, which is designed to protect surplus capital. Phoenix claims this makes the dividend “very secure”, and it felt confident enough to raise its half-year payout by 2.5%.

The dividend looks safe but no guarantees

The share price has struggled though. It fell 2% over the last 12 months and has slumped 32% over five years. Most FTSE 100 financials are in a similar boat.

The 12 brokers following Phoenix forecast a median price of 573p within a year, an 11% increase from today, if correct. Combined with the yield, this could give me a total return of almost 22% in 2025.

I’d be happy with that. I’m certainly not expecting Phoenix shares to go gangbusters this year. For that, we need a sharp fall in interest rates, and it doesn’t look like we’re going to get it. Eventually, rates will drop, and the outlook will brighten.

While I wait, I’ll reinvest every penny of that thunderous yield. The more income, the merrier. Nobody pays more than Phoenix – and I just can’t get enough of it. I’ll treat any share price growth as a bonus.