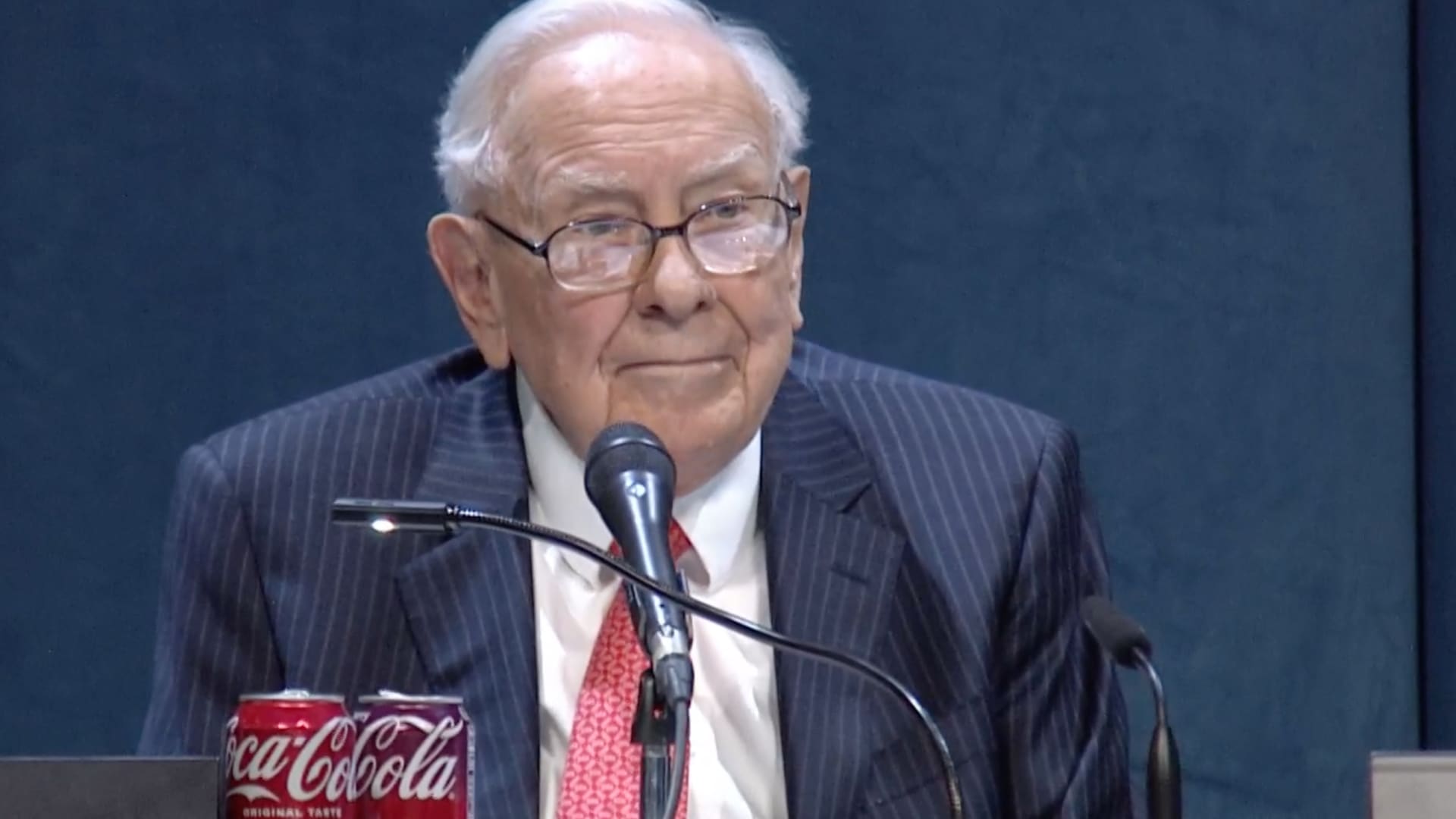

As Warren Buffett gets closer to stepping down as CEO at the end of next month, he told shareholders he will be “going quiet,” but only “sort of.”

More on his Thanksgiving letter, which looks like it could become a substantial annual tradition, below.

First:

A surprising stake

There was a notable surprise in Berkshire Hathaway’s end-of-Q3 equity portfolio snapshot, released after Friday’s closing bell.

Someone in Omaha purchased more than 17.8 million Class A shares of Google’s parent, Alphabet.

They are currently valued at $4.9 billion, making them the biggest Q3 addition in dollar terms.

The news sent the stock 3.5% higher in after-hours trading.

At this point, we don’t know who made the call.

Buffett has typically made purchases of this size, but it doesn’t feel like his kind of stock.

It is up 51.3% year-to-date, including a 37% climb in the third quarter.

Also, he has traditionally shied away from tech stocks. (He considers Apple a consumer products company.)

At the 2019 Berkshire meeting, Buffett and Charlie Munger lamented that they had “screwed up” by not buying Alphabet earlier because they “could see in our own operations how well that Google advertising was working. And we just sat there sucking our thumbs.”

On that day, the shares were going for around $59, and they gave no indication there were prepared to rectify their error.

Incoming CEO Greg Abel isn’t encumbered by that history, and Buffett has been handing over many of his duties to him.

Or it could be one or both of the portfolio managers, Ted Weschler and Todd Combs.

Stay tuned.

Not so surprising selling

Alphabet was by far the biggest Q3 addition at $4.3 billion, based on the September 30 price, well ahead of a $1.2 billion increase for Chubb.

The biggest decreases, Apple and Bank of America, had been foreshadowed by hints in Berkshire’s 10-Q almost two weeks ago.

(The Verisign reduction was disclosed in early August.)

Berkshire’s Apple position was cut by almost 15%, or $10.6 billion, to around 238 million shares.

It’s down 74% since Berkshire began selling two years ago.

But Apple remains Berkshire’s largest equity position at $64.9 billion, which is 21% of the portfolio’s current value.

The Bank of America reduction was smaller, just 6.1%, or around $1.9 billion.

The remaining 238 million shares are currently valued at $29.9 billion, Berkshire’s third largest position, making up almost 10% of the portfolio’s current value.

It’s been cut by 43% since early last year.

A complete listing of Berkshire’s Q3 13F appears below.

‘Sort of’

Many of the headlines on news stories about Warren Buffett’s Thanksgiving letter on Monday included this quotation: “I’m ‘going quiet.'”

But there was another phrase that followed that line near the top of the letter, getting its own paragraph: “Sort of.”

Starting next year, Greg Abel, “a great manager, a tireless worker and an honest communicator,” will be writing the annual meeting to shareholders and answering questions at the annual meeting. Buffett plans to sit on the arena floor with the other directors.

But he wrote, “I will continue talking to you and my children about Berkshire via my annual Thanksgiving message.”

This year’s letter ran a bit more than seven pages, compared to around three pages last year, and sounded a lot like the annual letters he’s been writing for decades, with sections on the importance of luck, getting old, his admiration for Berkshire shareholders, the many friends he has made over the years in Omaha, and his complete confidence in Abel’s ability to run the company.

He also revealed that while hospitalized as a child, he received a fingerprint kit and proceeded to take prints from the nuns caring for him, because “someday a nun would go bad, and the FBI would find that they had neglected to fingerprint nuns.”

(CNBC.com has this summary)

The newsiest bit was his plan to “step up the pace of lifetime gifts” to the three foundations run by his children, who, like Buffett, are getting older. (They are 72,70, and 67.)

He wants to “improve the probability that they will dispose of what will essentially be my entire estate before alternate trustees replace them.”

But he also “wants to keep a significant amount of ‘A’ shares until Berkshire shareholders develop the comfort with Greg that Charlie and I long enjoyed.”

The result, at least for this year, is an increase in the Class B shares (converted from Class A) going to each foundation to 400,000 shares from 300,000 shares last year.

Including a fourth unchanged donation to a foundation named after his late wife, the total as of the date of the gifts increased 17% to $1.3 billion.

Playing a more minor role: Class B shares are up 4% since last year’s gifts.

The entire U.S portfolio as of September 30

BUFFETT AROUND THE INTERNET

Some links may require a subscription:

BERKSHIRE STOCK WATCH

Four weeks

Twelve months

BERKSHIRE’S TOP U.S. HOLDINGS – Nov. 14, 2025

Berkshire’s top holdings of disclosed publicly traded stocks in the U.S., Japan, and Hong Kong, by market value, based on today’s closing prices.

Holdings are as of September 30, 2025 as reported in Berkshire Hathaway’s 13F filing on November 14, 2025, except for:

The full list of holdings and current market values is available from CNBC.com’s Berkshire Hathaway Portfolio Tracker.

QUESTIONS OR COMMENTS

Please send any questions or comments about the newsletter to me at alex.crippen@nbcuni.com. (Sorry, but we don’t forward questions or comments to Buffett himself.)

If you aren’t already subscribed to this newsletter, you can sign up here.

Also, Buffett’s annual letters to shareholders are highly recommended reading. There are collected here on Berkshire’s website.

— Alex Crippen, Editor, Warren Buffett Watch