It’s not often that hyper-growth stocks are mentioned in the same breath as Warren Buffett. The investment portfolio of his holding company, Berkshire Hathaway, tends to mainly buy mature blue-chips.

So it’s safe to say that Nu Holdings (NYSE: NU) is a bit of an outlier in Berkshire’s portfolio. The firm is a fast-growing digital disruptor shaking up the traditional banking system across Latin America.

Admittedly, this is a small holding and we can’t be sure that Buffett bought it himself. More likely, it was one of his two investing lieutenants, Todd Combs and Ted Weschler, who took a stake in the Brazilian neobank back in 2021.

Nevertheless, the stock has been on fire, rising 33% in 2025 and over 200% since the start of 2023. Yet I think it has a lot more growth in the tank and is therefore worth considering. Here’s why.

The rise of digital banking across Latin America

Nubank, as it’s known, is the largest digital bank in Latin America and one of the fastest-growing online platforms in the world. Its purple credit cards are ubiquitous in its native Brazil, where it has over 100m customers (more than half of the adult population).

Why are so many customers flocking to the firm? Well, the region’s traditional banks are notorious for their outrageous fees and terrible customer service. Even today, they often charge fees for nearly every transaction, including ATM withdrawals, online transfers, and even account inquiries.

This has created opportunities for fintech companies like Nubank, which offer easy-to-use online banking solutions with far lower fees and vastly superior customer service.

Indeed, founder and CEO David Vélez has said that the company chose to make its debit and credit cards purple because it wanted to be “the most anti-bank possible.”

While the firm’s offering services to lower-income populations in Brazil, Mexico and Colombia, it’s increasingly attracting higher-income customers from legacy banks.

Growth machine

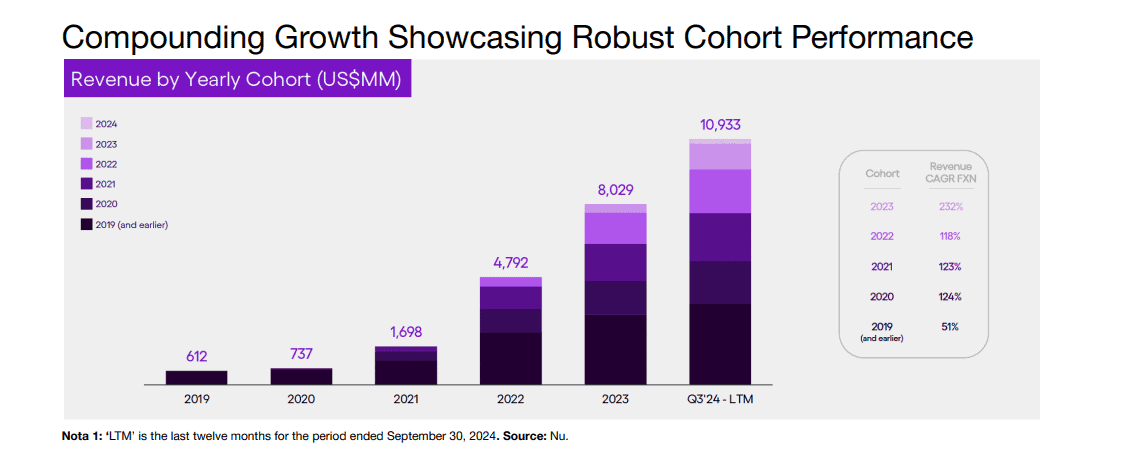

Revenue growth’s been nothing short of mind-blowing, rising from $612m in 2019 to an expected $11.8bn last year.

But this is no cash-incinerating start-up. Nu’s average revenue per active customer has grown from $3.50 at the beginning of 2021 to $11 by the end of September last year. And net income is expected to have surged 84% to $2.2bn in 2024.

Looking ahead, revenue is forecast to motor past $20bn by 2027, with earnings rising by an average of 48% in that time.

Attractive valuation

But how much to pay to invest in this high-growth stock? Not as much as might be suspected, with the stock sporting a price/earnings-to-growth (PEG) ratio of 0.7.

For context, a PEG ratio below one suggests that a stock might be undervalued relative to its earnings growth potential. I strongly believe that to be the case here, which is why I’m looking to buy more shares.

That said, I’ll be keeping an eye on Nu’s rising non-performing loans. In Q3, 90+ day delinquencies rose to 7.2% from 6.1% the year before, a trend that may lead to more loan loss provisions and lower earnings.

Longer term though, I’m very bullish here. Nu’s rapidly expanding digital ecosystem should result in lucrative cross-selling opportunities, while further expansion across Latin America and beyond looks very likely.