For me, the very best way to earn a second income is by putting money in an ISA and following a well-trodden investment strategy in order build wealth. Of course, the more money an investor has, the easier it is to generate a large passive income.

Sadly, most Britons still elect to build wealth through savings accounts, which with annualised returns typically below 3%, that money isn’t growing very quickly.

Stock markets typically perform better than savings

Investing in stock markets typically yields significantly higher returns compared to traditional savings accounts. Many individuals, particularly beginners, opt for index-tracking funds, which aim to replicate the performance of major market indexes. Historical data underscores the long-term growth potential of such investments.

For instance, the FTSE 100 has delivered an average annual return of 6.3% over the past 20 years, with the FTSE 250 outperforming its large-cap counterpart. In the US, the S&P 500‘s averaged an impressive 10.5% annually since its inception in 1957, climbing to an even higher average of 13.3% in the decade leading up to 2024. Similarly, the Nasdaq posted an exceptional 19.8% average return over the past decade.

These figures starkly contrast with the comparatively modest interest rates offered by savings accounts, emphasising the advantage of stock market investments for building wealth over the long term.

Doing the maths

Personally, I prefer to pick individual stocks, trusts and specific funds, over index-tracking funds. That’s because I believe I can beat the market — after all, researching stocks is essentially what I do.

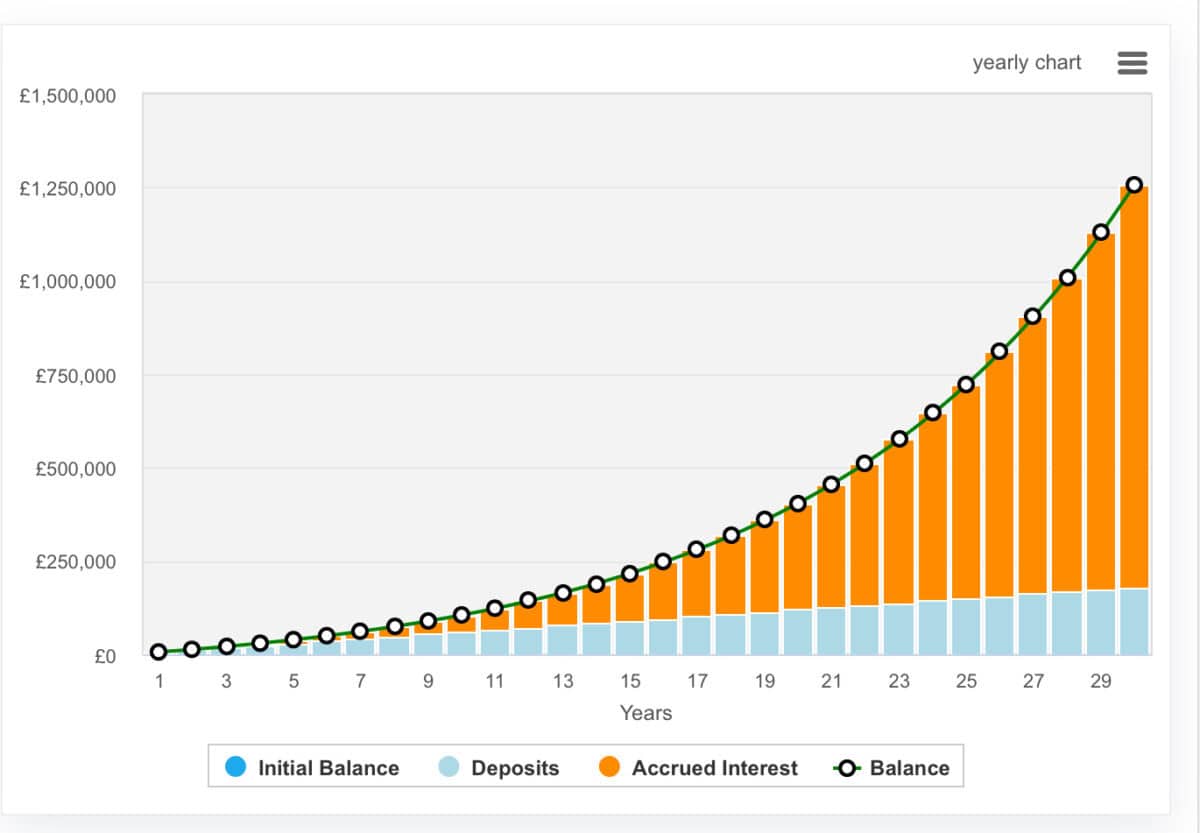

However, if an investor had chosen a tracker of any of the above major indexes over the last decade, they would have vastly surpassed the returns they could have achieved in a savings account. Let’s assume an investor puts £500 a month into an index tracker. Here’s how that money could perform in an S&P 500 tracker, based on the previously noted historical growth rates (but note, past performance is no guarantee of future success).

Why did I use the S&P 500 data? Well, because it quite conveniently works out to just over £1.2m over 30 years. Putting that money in stocks with an average dividend yield of 5% would generate £5,000 of monthly passive income — and tax-free. This is what I’m aiming to do, but by cherry-picking stocks, I’m hoping to grow my money faster.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

One to consider for the growth phase

While index trackers are a great way to start investing, investors may want to consider an exciting growth-oriented trust like Edinburgh Worldwide Investment Trust (LSE:EWI). It’s a Baillie Gifford-run fund — like the well-known Scottish Mortgage Investment Trust — and it’s a really interesting, albeit risky proposition. The fund aims to invest initially in entrepreneurial companies when they’re still nascent.

The trust’s largest investment is SpaceX, which represents a significant 12.3% of the portfolio. This is followed by PsiQuantum at 7.5% and Alnylam Pharmaceuticals. These are fairly high-risk investments, but given supportive trends in artificial intelligence (AI), space exploration, and even quantum computing, this could be the right time to take a diversified approach to emerging technologies.

However, some of its holdings aren’t publicly listed, and only listed companies are required to disclose earnings reports, which means crucial data on these private entities is scarce, heightening uncertainty for investors.