Owning blue-chip shares that pay dividends is one way to generate a second income without having to work for it.

That is what I am planning to do next year. By following the plan below, I reckon I could realistically aim to generate more than £2,400 of passive income streams next year – and hopefully each year beyond.

Step one: choosing an investment vehicle

My first move is to decide what vehicle I will use to invest.

That can involve picking the Stocks and Shares ISA or share-dealing account that best suits my own circumstances and needs (everyone is different).

Although the standard annual ISA allowance is £20k, I can use that allowance until the first week of April and then another year’s allowance kicks in. So that could give me a £40k allowance in the next calendar year, alongside any existing funds I have invested. Also, I am not limited to investing through an ISA – even if I max out my allowance, I could buy shares in a dealing account, though without the potential ISA tax advantages.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

I will target a 7% average yield. This means I will need to invest £35k to aim for my £2,400+ second income target.

Step two: choosing the shares

That £35k is ample to spread over multiple shares.

Diversifying in that way means that if one share turns out to disappoint me – for example, by cancelling its dividend – then all my eggs are not in one basket. No dividend is ever guaranteed to last, though plenty do.

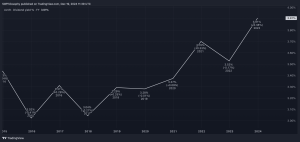

The sort of income share I like to own (and in fact do own) is FTSE 100 financial services provider Legal & General (LSE: LGEN).

As it unveiled at an investor event this week, its cash generation potential is so strong it is weighing the possibility of increasing its share buybacks. That comes on top of a progressive dividend policy that has seen the dividend per share increase every year since the financial crisis, bar one (when it was held flat).

With its juicy yield of 8.6%, I see it as potentially being a strong contributor to my second income. Legal & General has a proven business model, large customer base, strong brand, and a focus on the retirement market that is large and likely to stay that way.

One risk I see is a sudden stock market correction leading to a loss, as investments are revalued and policyholders potentially cash out. As a long-term investor, though, Legal & General is the sort of passive income machine I am happy to hold.

Step three: earning without working

Will I keep holding?

Companies can suddenly, or gradually, evolve in ways that affect the investment case for better or worse.

So, although I am an investor rather than a trader, that does not mean I ignore my portfolio for years at a time. Instead, I will pay attention to see if anything happens that makes me decide to sell some shares or buy others.

Meanwhile, I will hopefully earn my second income of over £2,400 annually – starting next year!

This post was originally published on Motley Fool