The stock market is processing the news that Donald Trump is going to be the next President of the USA. And the immediate response was very different across various sectors.

Financials, industrials, and energy shares climbed, while utilities, consumer staples, and property fell. There’s a clear theme here – and I think there’s a real opportunity.

Economic growth

In short, the stocks that have done well are the ones that are involved in US economic growth. Banks finance it, energy powers it, and industrials make it happen.

Norfolk Southern is a good example. As one of the six major US freight railroads, it stands to benefit from the need to transport materials and goods across the Eastern half of the country.

The stock climbed almost 10% following the election result, taking it to a 52-week high. That’s a clear sign investors think the election result is going to boost the industrial economy.

They may be right. But expectations are a lot higher now than they were before and that means there’s a much greater potential risk if things don’t turn out as anticipated.

Defensives

Not every company benefits from economic growth in the same way though. As GDP expands and contracts, demand for food, electricity, and real estate doesn’t change much.

These are the stocks that fared the worst. Shares in Colgate-Palmolive fell over 4%, mostly because its growth prospects aren’t particularly impressive in a growing economy.

In general, such shares that hold up best in a stock market crash. They’re typically resilient, meaning investors can look to them for stability when things go wrong.

When share prices start falling, it’s usually too late to buy these stocks. The time to be looking at them is when they’re out of fashion – and I think that’s now.

A potential buying opportunity

One stock that stands out to me right now is NextEra Energy (NYSE:NEE). The company is a regulated utilities business that’s the largest generator of renewable energy in the US.

The market sees this as a bad combination right now and it’s easy to see why. The company’s modest growth prospects and Trump’s focus on oil and gas over wind and solar are both risks.

From a long-term perspective though, I think things look very positive. If renewable energy is part of the long-term outlook for US energy, then NextEra is in a strong position.

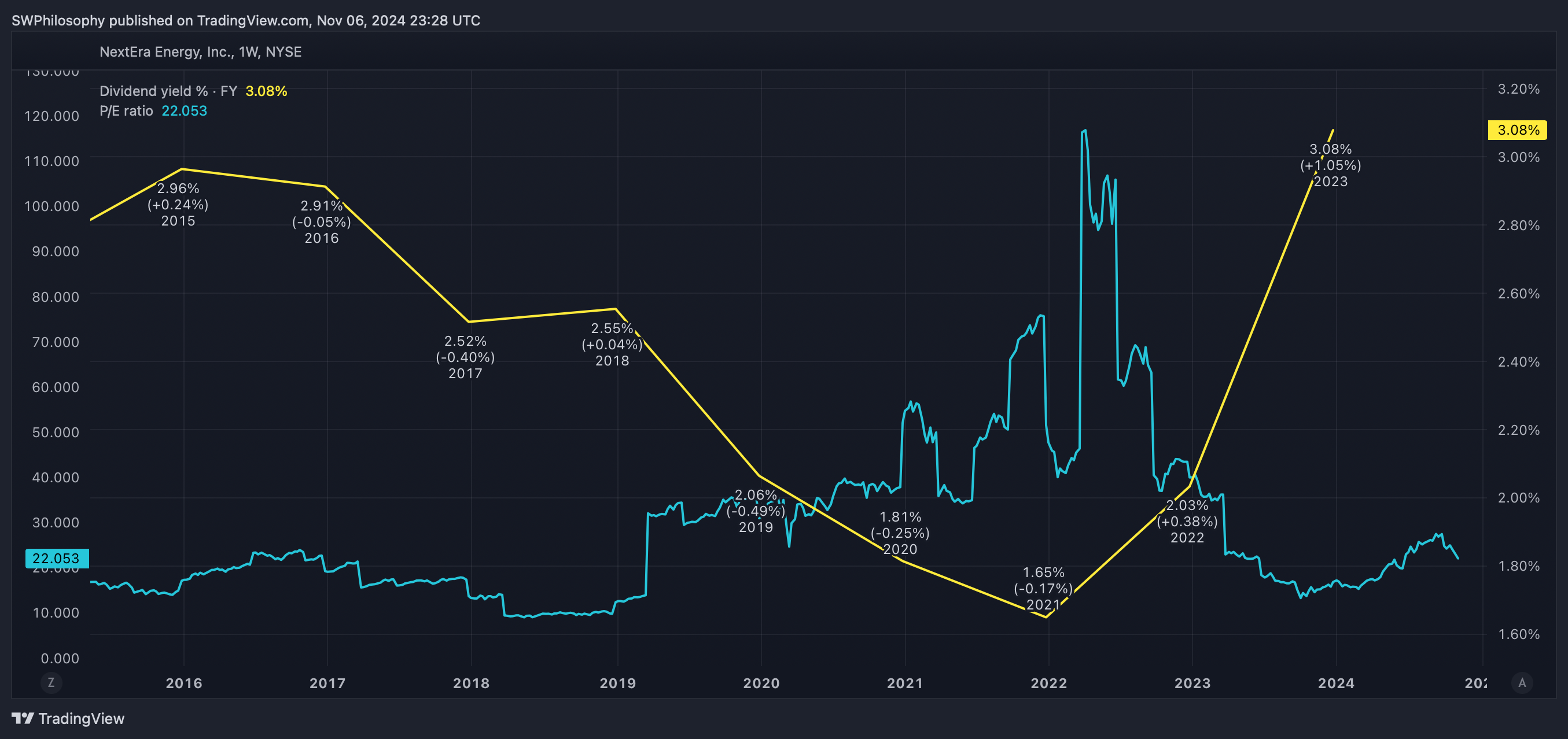

NextEra Energy P/E Ratio & Dividend Yield 2015-24

Created at TradingView

The firm owns some of the best sites for wind and solar generation. And after falling 5%, the stock trades at an unusually low price-to-earnings (P/E) multiple with a 3% dividend yield.

Will the market crash?

I’ve no doubt the stock market is going to crash… at some point. What I don’t know however, is exactly when that will be.

As an investor, I’d like to own stocks that will be resilient when share prices fall. But I want to buy them only when their valuations are attractive.

I think the US election result might be a chance to do this. And NextEra Energy is just one of the stocks that I’m going to be looking at very carefully over the next few days.